Comment calculer la rentabilité d’un projet ?

Dans une activité de vente de services professionnels, il est très important de suivre la rentabilité des projets. Cet indicateur est crucial pour faire grandir sa société, et s’assurer que l’activité dans son ensemble est profitable. Les sociétés de services qui vendent des projets doivent en effet être capables de suivre la rentabilité de chaque projet pour pouvoir prendre les bonnes décisions. Nous vous expliquons ici comment calculer la rentabilité d’un projet.

Comment calculer le chiffre d’affaires d’un projet ?

Théoriquement, le chiffre d’affaires est reconnu lorsque la propriété d’un bien est transférée ou lorsque le service est entièrement réalisé.

Toutefois, dans le cadre de projet qui peuvent durer plusieurs mois, voire plusieurs années, il est possible d’appliquer une autre méthodologie pour reconnaître du chiffre d’affaires au fur et à mesure de l’avancement du projet.

Le choix des méthodologies applicables dans votre cas doit être validé par votre expert-comptable ou vos auditeurs.

Le calcul du chiffre d’affaires d’un projet doit respecter les principes comptables en vigueur. Il existe plusieurs approches de reconnaissance du chiffre d’affaires, qui nécessite une bonne connaissance des indicateurs financiers utilisés en suivi de projet.

Reconnaissance du chiffre d’affaires par rapport à la facturation

Dans cette approche, le chiffre d’affaires est reconnu sur la base des montants facturés pendant la période, permis par un suivi des temps précis. Facturation = Chiffre d’affaires.

C’est généralement la méthode appliquée pour les projets en régie (facturés au temps passé).

Vos temps enregistrés se convertissent automatiquement en factures.

Reconnaissance du chiffre d’affaires à l’avancement

À la fin de chaque période comptable, un taux d’avancement du projet est calculé (ce taux doit aussi respecter une méthodologie acceptée comptablement).

Le chiffre d’affaires reconnu sur la période correspond au montant vendu multiplié par le taux d’avancement, duquel on déduit le montant de chiffre d’affaires reconnu sur la précédente période.

C’est une méthode souvent appliquée pour les projets au forfait.

Reconnaissance du chiffre d’affaires à l’achèvement

Pour les courts projets, la facturation à l’achèvement est la méthodologie la plus souvent retenue. Dans cette approche, le chiffre d’affaires est reconnu lorsque le projet est terminé. Pour entériner cette clôture, le client signe souvent un PV de réalisation ou un autre document permettant de justifier que le service a bien été rendu.

Stafiz est un ERP pour les professional services et sociétés de services. Découvrez comment mieux piloter vos projets, suivre leur avancement et faire progresser les marges.

Une fois votre chiffre d’affaires calculé, vous pouvez alors déterminer la rentabilité d’un projet.

Comment calculer la rentabilité d’un projet ?

Formule de calcul de la rentabilité d’un projet

Pour calculer la rentabilité de votre projet, il vous suffit de soustraire tous les coûts du projet au chiffre d’affaires qu’il a généré.

Rentabilité = Chiffre d’affaires – Coûts

Afin d’obtenir un résultat précis et fiable, assurez-vous d’avoir toute la visibilité nécessaire sur les dépenses liées au projet. Cela est d’autant plus important pour votre démarche de suivi budgétaire tout au long du projet : les coûts doivent systématiquement être remontés et pris en compte en temps réel.

Quels coûts prendre en compte dans le calcul de rentabilité d’un projet ?

Tous les coûts de projet qui ont été définis dans le budget doivent être suivis, sinon le périmètre d’analyse est différent entre le budget et le réalisé.

Voici donc les coûts qu’il est nécessaire de suivre, et la meilleure manière de le faire.

- Les coûts du temps passé par les collaborateurs : un outil de gestion de projet ou un ERP pour votre société de services vous permet de suivre les temps passés sur les tâches de projets et d’affecter des coûts associés à chacun des collaborateurs en fonction de leurs salaires.

- Les achats de sous-traitance : il faut prendre en compte les coûts de la sous-traitance sur le projet, soit grâce aux factures de sous-traitance, soit de nouveau grâce à l’ERP pour votre société de services. Un tel logiciel permet de suivre la sous-traitance, qu’elle soit liée au temps passé par un indépendant-freelance, ou qu’elle vous soit facturée au forfait.

Suivez la performance de vos collaborateurs externes

Dans Stafiz, vos externes sont inclus à collaborer directement depuis la plateforme par des accès spécifiques. La saisie des temps est simplifiée, et leurs factures peuvent directement vous être partagées.

- Les frais non re-facturables et autres achats : vous devez intégrer dans l’analyse de la rentabilité les frais associés à ce projet, comme les déplacements, la restauration, les achats de licences informatiques, etc. Dès lors que les frais ne sont pas re-facturables au réel, ils vont avoir un impact sur la marge et doivent donc être pris en compte

Comment analyser la rentabilité d’un projet?

Il est particulièrement important de connaître la rentabilité d’un projet dans une activité de services professionnels. Les sociétés de conseil, les agences, et toutes les activités qui vendent des projets doivent suivre les marges de leurs projets.

Cet indicateur de rentabilité permet de comprendre les éventuelles raisons qui pénalisent la rentabilité de l’activité dans son ensemble, et limitent la croissance.

Il est nécessaire d’analyser la rentabilité des projets sous plusieurs angles.

Comparer la rentabilité entre différents types de projets

Il faut pouvoir analyser la différence de rentabilité entre les projets vendus au forfait et les projets vendus au temps passé (en régie).

Généralement, les projets vendus en régie sont moins risqués du point de vue de la rentabilité puisqu’un prix de vente à l’heure ou au jour est déterminé et celui-ci doit théoriquement déjà intégrer une marge. Il arrive cependant que tous les jours ne soient pas facturés ou que des frais viennent pénaliser la marge.

Le suivi de la marge est encore plus important pour les projets vendus au forfait. Dans ce type de projet, le montant de vente du projet est fixé à l’avance et n’est pas censé changer. Si le travail pour réaliser le projet est sous-estimé, il y a un risque de dépassement des coûts. A l’inverse, en optimisant le temps passé sur le projet par rapport à ce qui a été vendu, il est possible de réaliser une marge beaucoup plus importante.

La rentabilité des projets selon les équipes

Il faut pouvoir grouper les projets et les rassembler en fonction des angles d’analyse qui peuvent vous intéresser : par équipe, par secteur, par business unit.

Il suffit pour cela que chaque projet ait un « tag » pour indiquer à quel équipe, secteur, business unit il est relié pour pouvoir ensuite consolider les données.

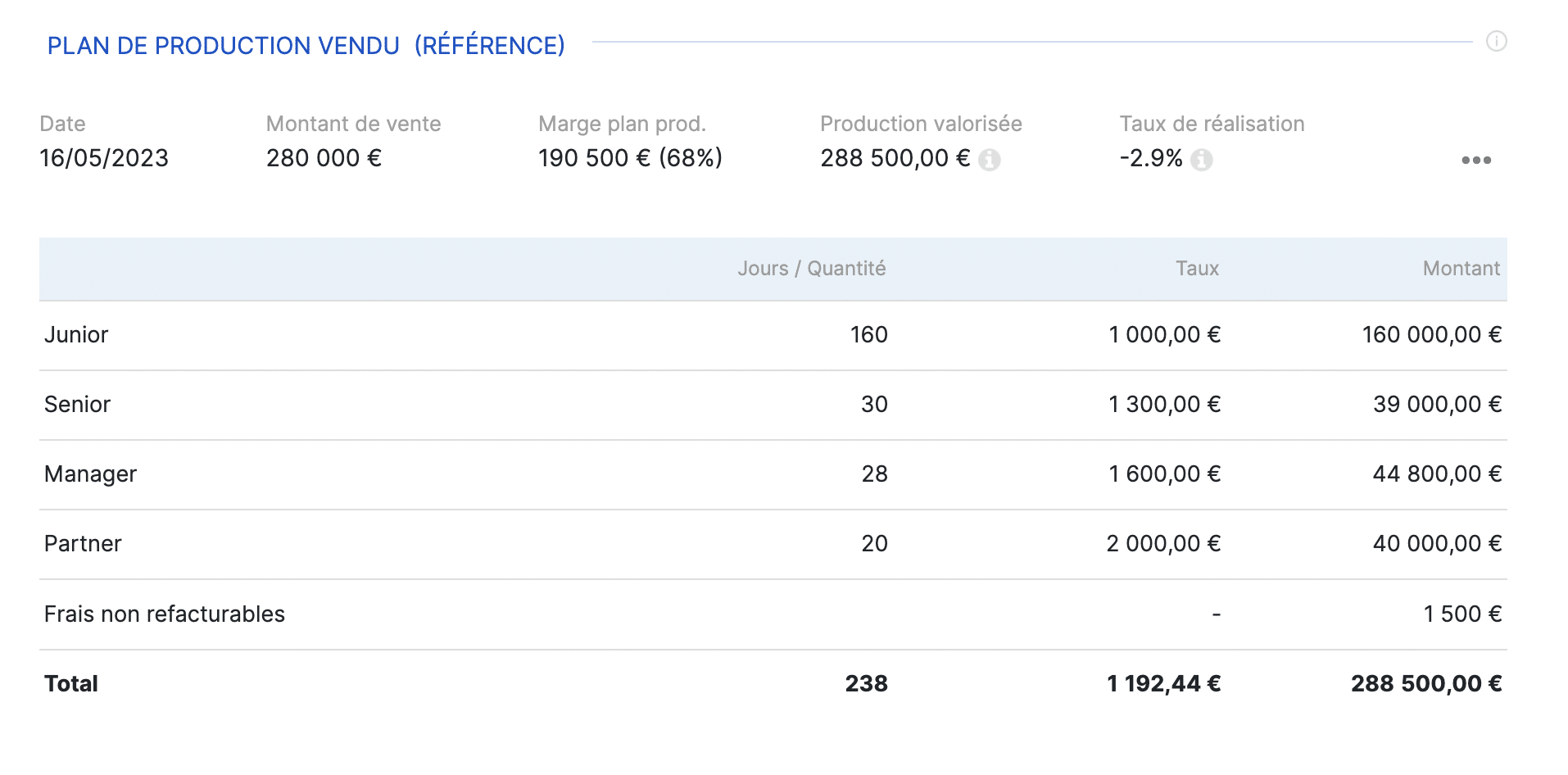

Comparer la rentabilité par rapport au budget initial

La rentabilité d’un projet se compare par rapport aux autres projets, mais aussi par rapport au budget initialement prévu.

La création d’un budget de projet au démarrage de celui-ci est une étape clé pour pouvoir suivre et améliorer la performance. C’est l’étalon de mesure qui permet, en cours de projet, de savoir si l’on dévie ou si le projet est en risque.

Pour construire le budget d’un projet, il est nécessaire d’estimer les éléments suivants :

- le temps que les collaborateurs auront à passer sur les différentes tâches du projet ;

- le coût associé à ce temps passé par les collaborateurs ;

- les achats de sous-traitance lorsqu’il y en a sur le projet ;

- les frais qui vont avoir un impact sur la marge (ceux qui ne sont pas refacturables au réel sur le projet) ;

- les éventuels achats de produits, ensuite utilisés ou revendus dans le cadre du projet. Par exemple des licences d’un logiciel.

Avec tous ces éléments, il est possible de calculer l’ensemble de coûts prévus pour le projet.

Ces coûts sont déduits du chiffre d’affaires prévisionnel du projet, ce qui permet de calculer la marge prévisionnelle du projet.

Vous n’utilisez pas de logiciel de comptabilité pour vos projets ? Découvrez leurs avantages et pourquoi vous en avez besoin.

Quels sont les indicateurs de rentabilité d’un projet ?

La marge brute projet

Indicateur clé pour le CFO ou le DAF, la marge brute aide à détecter les anomalies d’un projet, comme une sous-facturation ou encore un manque de cadrage.

Formule : Revenu facturé – Coût de production (internes + externes)

Le taux de marge

Cet indicateur permet de comparer plusieurs projets entre eux, et identifier quelle mission ou type de projet est le plus rentable. D’un point de vue stratégique, il permet d’orienter les décisions commerciales futures.

Un taux supérieur à 20% signale généralement un problème de pilotage projet, voire de pricing.

Formule : (Marge brute / Chiffre d’affaires du projet) × 100

Le taux de charge vendue

Il s’agit d’un indicateur phare pour les métiers de ventes de services comme les agences, les ESN ou encore les cabinets de conseil. Le taux de charge vendue permet en effet de détecter les pertes liées à des temps improductifs non facturés, tels que des réunions ou des révisions.

Formule : Heures facturables / Heures totales passées sur le projet

Le coût horaire moyen par profil

Il s’agit ici du coût moyen réel d’un consultant par heure, en prenant en compte :

- son salaire,

- les charges associées,

- les coûts indirects.

Comparé au TJM initialement vendu et facturé au client, il révèle la rentabilité brute des ressources mobilisées.

Stafiz aide les professional services à gagner en visibilité et mieux gérer leur avancement de projets grâce à des données temps réel, la prise en compte de tous les coûts et des KPIs financiers. Stafiz est un SaaS de gestion du staffing, pilotage de projet et de Business Intelligence. Ainsi, les budgets et les marges sont toujours respectées et vous prenez de meilleures décisions pour votre business.

Pour en savoir plus sur la plateforme Stafiz, demandez une démo.

Questions fréquentes :

Le seuil de rentabilité correspond au niveau de chiffre d’affaires nécessaire pour couvrir l’ensemble des coûts fixes et variables d’un projet. En dessous, le projet génère des pertes ; au-delà, il devient rentable. Il permet donc de définir à partir de quel volume d’activité ou de facturation un projet commence à créer de la valeur.

La VAN (Valeur Actuelle Nette) mesure la valeur créée par un projet après actualisation des flux financiers. Le TRI (Taux de Rentabilité Interne) indique le taux de rendement attendu, utile pour comparer plusieurs projets. L’Indice de Profitabilité exprime le ratio entre valeur actualisée et investissement initial, pratique pour hiérarchiser les projets lorsqu’il existe une contrainte budgétaire.

Le coût par tâche aide à contrôler la consommation de ressources par activité, évitant les surcharges non prévues. La marge projet (écart entre revenus et coûts totaux) mesure directement la performance financière. Enfin, la variance des coûts compare budget prévisionnel et coûts réels, permettant d’identifier rapidement les dérives et de corriger le pilotage en cours de projet.

L’indice de rentabilité d’un projet mesure le rapport entre la valeur actualisée des flux futurs d’un projet et son investissement initial. Il permet de comparer différents projets afin de les prioriser en fonction du meilleur ROI potentiel.

-

- S’il est inférieur à 1, le projet est rentable.

- S’il est égal à 1, il couvre ses coûts mais ne génère pas de profit.

- Supérieur à 1, l’indice de rentabilité indique un risque de pertes financières.

Un projet est rentable dès lors qu’il apporte un retour sur investissement, qu’il soit financier, stratégique ou organisationnel. Le suivi des bons indicateurs (marge, taux de charge vendue, écarts prévus/réalisés) permet alors d’en juger précisément.