Comment mettre en place une comptabilité projet efficace ?

Si la comptabilité touche parle à toutes les entreprises – obligations légales oblige, la comptabilité de projet s’adresse surtout aux activités de vente de projet : cabinets de conseils, ESN, agences créatives et publicitaires ou encore bureaux d’études.

Qu’est-ce que la comptabilité de projet ?

La comptabilité de projet s’intéresse à la façon dont les coûts d’un projet sont comptabilisés et suivis. Elle fournit une mesure précise de la performance financière d’un projet et permet aux responsables de projets de prendre des décisions éclairées concernant les actions à mener pour rester aligné sur les budgets.

La comptabilité projets peut également aider à identifier les risques potentiels et à évaluer les risques sur la marge d’un projet. En bref, elle constitue une composante essentielle de tout bon gestionnaire de projet. Avant de rentrer dans le détail des étapes à suivre, il est important de rappeler les principaux concepts.

Comptabilité projet et comptabilité générale : quelles différences ?

La comptabilité projet est une forme de comptabilité à l’échelle micro, tandis que la comptabilité générale observe un prisme macro pour suivre la santé financière de l’entreprise. En se focalisant sur un projet donné, la comptabilité de projet offre une meilleure gestion opérationnelle de vos budgets de projet. Sa durée dépend donc de celle de la mission, et ne dépend pas d’un calendrier comptable réglementaire, là où la comptabilité générale repose sur des échéances légales. Le calendrier de l’exercice comptable repose généralement sur 12 mois au cours desquels il faut réaliser les clôtures des comptes.

La comptabilité de projet n’est de ce fait pas une obligation légale, mais un procédé stratégique. Elle permet en effet de déterminer la rentabilité d’une mission, identifier les risques de déviations en temps réel et rectifier les dépenses avant que la marge ne se creuse. Elle est analytique.

La comptabilité générale, elle, est impérative pour des raisons légales. Elle permet une transparence pour les audits et le compte de résultat.

Une autre différence notable entre la comptabilité classique et la comptabilité de projet réside dans la classification des coûts. Ces derniers sont catégorisés par type en comptabilité générale, tandis qu’ils sont directement affectés à des tâches ou à des livrables dans le cadre d’un projet.

Pourquoi est-ce important pour les équipes de projet ?

Si la comptabilité classique est gérée par les comptables, la comptabilité projet est un outil de pilotage du quotidien pour les équipes projets.

Les équipes opérationnelles disposent de toutes les données financières de leurs projets, limitant les échanges parfois chronophages – et parfois interminables – avec les services dédiés. Cette accessibilité favorise une gestion proactive de la consommation des budgets. Avec une visibilité en temps réel, la prise de décision est facilitée, et les risques de déviations diminués par un suivi régulier. Du côté des ressources, il est également plus simple de repérer les points de frictions. La correction des écarts peut également se faire par une optimisation de l’allocation en ressources.

Comment fonctionne la comptabilité projet ?

Pour profiter au mieux des avantages stratégiques de la comptabilité de projet, il est important d’en comprendre le fonctionnement.

Le principe de la comptabilité de projet

Budget d’emblé et indicateurs clés

Toute comptabilité de projet implique d’établir un budget prévisionnel au démarrage de chaque mission. Ce budget doit intégrer l’ensemble des coûts qui sont à affecter au projet (temps passé par les collaborateurs, achats, frais de déplacement…). Il doit permettre d’anticiper une marge.

Tout au long du projet, le budget sera régulièrement revu, et le prévisionnel de marge re-calculé afin de s’assurer que la performance financière du projet est au rendez-vous.

Il est important de conserver les justificatifs des coûts passés sur le projet (feuilles de temps, justificatifs de frais, factures, etc.) ainsi que de pouvoir justifier des coûts prévisionnels (planning projet futur, etc.). Dans la mesure où ces coûts sont un élément central du calcul comptable, il est nécessaire de pouvoir prouver qu’ils respectent les règles comptables.

Codes de coûts et suivi rigoureux

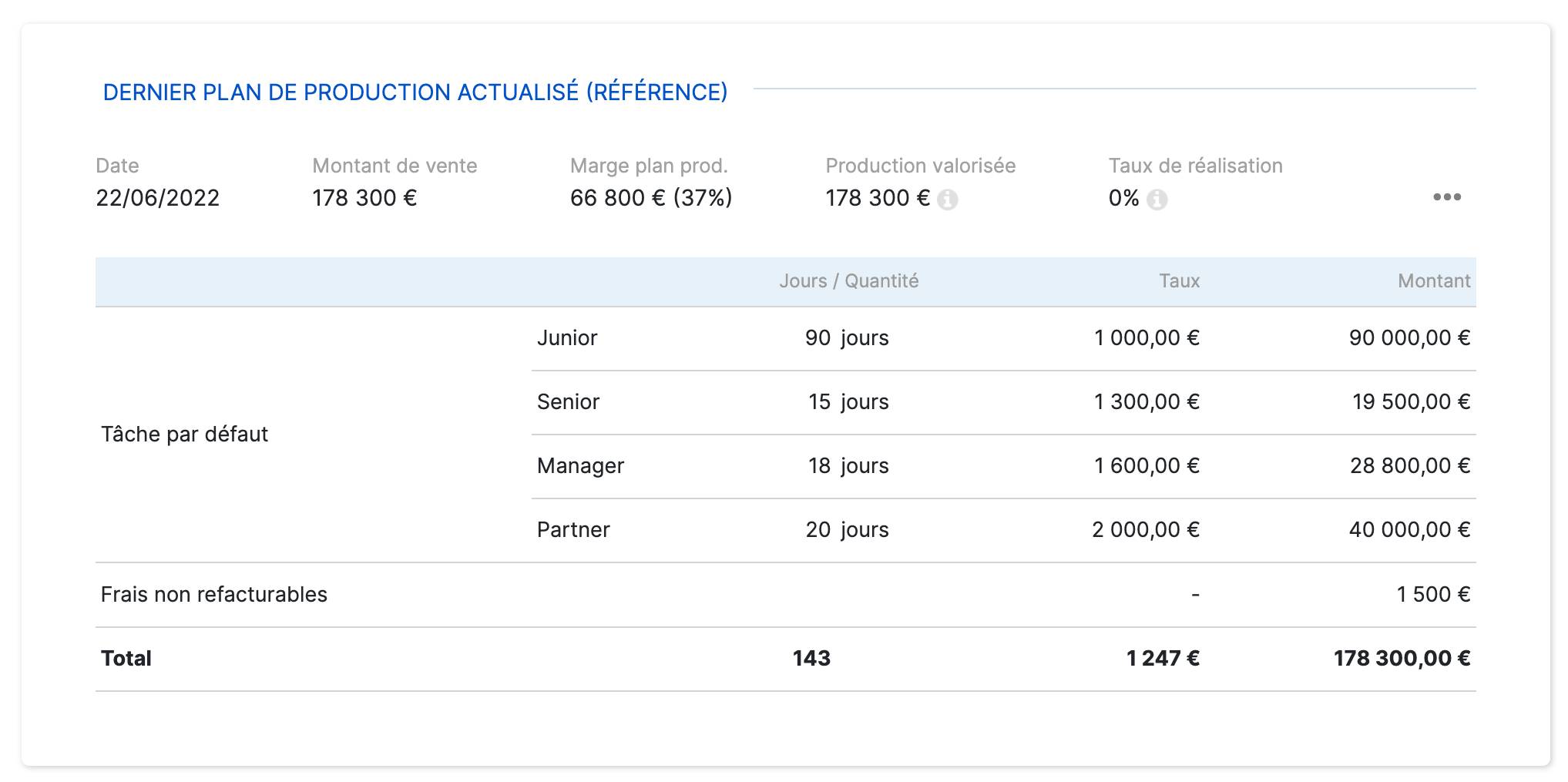

Lorsque le budget d’un projet est créé, il est important d’indiquer toutes les lignes de coûts. Il faut prendre en compte :

- le temps à passer par les ressources internes,

- les achats de prestations externes (des freelances par exemples),

- les frais de déplacement (même ceux qui seront refacturés),

- l’achat éventuel de produits qui seront revendus au cours du projet.

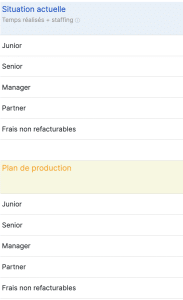

Comptabilité des projets – Écran d’un plan de production dans Stafiz

💡 Besoin d’optimiser vos dashboards ?

Stafiz propose un grand nombre de rapports à personnaliser selon vos besoins.

Comment suivre la comptabilité d’un projet : les étapes

Étape 1 : définir les besoins

En premier lieu, il est nécessaire de construire un cadre récapitulatif des besoins de manière à obtenir des calculs justes.

Commencez par déterminer votre granularité de suivi. Avez-vous besoin de suivre les coûts du projet à hauteur d’une phase de projet, ou de façon plus régulière avec un découpage par tâche ?

Ensuite, déterminez les KPI à inclure dans les calculs. On retrouve le plus souvent :

- le TJM des consultants,

- le taux de charge,

- le taux d’occupation,

- le budget prévisionnel,

- la marge brute,

- la marge nette.

Enfin, précisez le périmètre des dépenses à inclure comme un coût du projet, comme par exemple les salaires, les frais de déplacement ou de restauration s’il doit y en avoir, ou encore les coûts associés au matériel.

Étape 2 : choisir la bonne méthode de reconnaissance du CA

Il existe plusieurs méthodologies de reconnaissance du chiffre d’affaires dans la comptabilité projet :

-

- la méthode à l’achèvement, qui reconnaît le chiffre d’affaires généré seulement à la toute fin du projet ;

- la méthode à l’avancement, qui calcule l’avancement réalisé afin d’en reconnaître le chiffre d’affaires au prorata ;

- la méthode à la facturation, qui implique que le chiffre d’affaires est aligné avec la facturation afin de reconnaître le montant facturé.

Étape 3 : choisir un logiciel

Nous l’avons vu précédemment : la comptabilité de projet requiert des données fiables et des calculs parfois complexes pour une meilleure gestion en temps réel, et surtout, une reconnaissance juste du chiffre d’affaires.

Au fil de votre croissance, une fois les 8 à 10 collaborateurs atteints, il est donc nécessaire d’investir dans un outil de suivi comptable par projet.

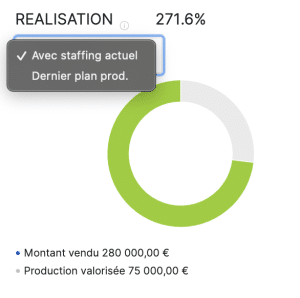

Stafiz vous aide notamment à suivre en temps réel les écarts entre le budget initial et les dépenses déjà réalisées.

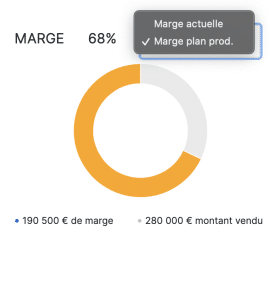

Le calcul de la marge et des coûts complets se met à jour, vous permettant d’automatiser la comptabilité de projet et d’en fiabiliser les données grâce à la centralisation des données des finances et du staffing, sans avoir à les saisir manuellement.

Si vous êtes déjà équipé d’un logiciel de comptabilité projet, vous pouvez toujours utiliser Stafiz pour piloter vos projets, et y connecter vos données comptables depuis votre outil grâce à nos intégrations.

Étape 4 : suivre les coûts et le réalisé

Une fois équipé d’un outil dédié pouvant relier comptabilité et gestion de projet, vos données sont récoltées et peuvent être affichées dans un ou plusieurs tableaux de bords.

Pour que les informations restent synchronisées et à jour, certains efforts sont de rigueur.

A commencer par la saisie des temps passés sur les tâches. Remplir des feuilles de temps n’est jamais une partie de plaisir pour vos équipes. Cependant, les maintenir à jour permet de déduire le nombre d’heures – ou de jours – accordés aux différentes tâches des projets, et ainsi comptabiliser le travail réalisé (si vous optez pour une autre méthode que l’achèvement).

💡Pensez automatisation !

Fatigués de courir après les feuilles de temps ? Grâce à Stafiz, créez des workflows de validation des temps, mais aussi de rappel de saisie.

Enfin, assurez-vous de toujours conserver vos factures et les justificatifs de notes de frais, et de les soumettre au plus tôt.

💡Pensez automatisation !

Stafiz est équipé de la technologie OCR. Plus besoin de saisir chaque détail manuellement : vos frais se remplissent automatiquement dans les champs correspondants !

Étape 5 : analyser les écarts

L’analyse des écarts en comptabilité de projet se réfère à la différence entre le budget initial et la situation réelle du budget. Les écarts de coûts sont évidemment le premier indice, mais les écarts de délais ou de production y sont étroitement liés.

Vous devez alors comprendre l’origine de ses écarts. Est-ce dû à une hausse de prix non anticipée sur un matériel ? S’agit-il d’une tâche qui prend plus de temps que prévu ? Pourquoi, est-ce une erreur de staffing ou une sous-estimation de durée ?

Le suivi budgétaire des projets, en prévisionnel

2 minutes pour voir Stafiz en action

Le plus grand atout de Stafiz est sa capacité à analyser le prévisionnel de charge, et par conséquent, l’impact financier de votre planification des ressources. Ainsi, vous pouvez repérer les écarts de marge bien avant qu’ils ne se produisent.

Suivez vos comptes de résultats à date et en prévisionnel dans Stafiz

Étape 6 : corriger et ajuster

Mettre en place votre comptabilité projet n’est pas suffisant. Elle vous offre un panorama de l’état des projets qu’il vous faudra activer comme un véritable outil de pilotage financier de projet.

Une fois les causes des déviations identifiées, vous pouvez prendre les arbitrages les plus adaptés à vos objectifs :

- procéder à une ré-allocation des ressources plus stratégique en priorisant des tâches urgentes ou en privilégiant un profil plus adapté ;

- renégocier avec le client en présentant les risques à venir – plus tôt les écarts seront identifiés, plus les négociations seront simples ;

- revoir le budget régulièrement et le confronter au reste à faire, pour limiter les mauvaises surprises et s’adapter aux aléas.

Stafiz est un ERP créé spécifiquement pour les professional services et sociétés de services. Plus de 40 000 utilisateurs dans 10 pays pilotent leurs projets dans Stafiz.

Quelles actions permettent d’améliorer les marges ?

La comptabilité de projet permet de définir les règles pour correctement piloter les projets. Mais chaque entreprise dispose d’un certain degré de liberté dans l’approche analytique.

Ainsi, les marges des projets peuvent être par exemple réparties en deux lignes pour affiner l’analyse de la performance. Un premier niveau de marge, qu’on appelle marge brute du projet, intègre les coûts dits externes (achats, frais, …). Ils n’intègrent pas de coûts salariaux de l’entreprise.

Découvrez comment faire décoller les marges de vos projets et améliorer votre performance financière dans notre livre blanc.

Pour passer de la marge brute à la marge nette, on ajoute dans les coûts le montant correspondant à la charge salariale pour l’entreprise du temps passé par les collaborateurs internes sur le projet. Un outil de suivi des temps sur les projets et les tâches est nécessaire pour que ce calcul soit précis. Voici les actions qui permettent d’améliorer les marges.

Suivre les marges

Et oui, ça paraît bête, mais on ne peut améliorer que ce que l’on suit. Or trop peu d’entreprises suivent les marges de leurs projets précisément. En installant un suivi précis et régulier des marges, la performance va indéniablement s’améliorer car le suivi donnera de la visibilité sur les problématiques qui viennent impacter les projets

Responsabiliser les chefs de projets

Ce sont eux qui doivent être responsables de leurs marges. En leur donnant les moyens de connaître automatiquement l’évolution de leur marge et les accès pour mettre à jour le reste à faire sur le projet, vous pouvez assurément compter sur eux pour tenir le budget.

Gagner en anticipation

Un logiciel qui vous permet de mieux gérer le prévisionnel de coûts et de l’associer au suivi des coûts réalisés vous donne une longueur d’avance. Stafiz par exemple, permet de piloter la charge des collaborateurs, les coûts à venir et notifie lorsque les marges dévient des projets

Vous vous posez des questions sur votre comptabilité projet et plus largement sur la gestion financière de projet ? N’hésitez pas à contacter nos experts qui pourront vous aider à mener les bons changements dans votre société !

Stafiz est un ERP pour les sociétés de services et vous permet de mieux gérer vos projets. Automatisez vos processus et gagnez du temps. Bénéficiez d’une visibilité globale sur la performance de vos projets !

Pour en savoir plus sur la plateforme Stafiz, demandez une démo.

Questions fréquentes :

On distingue trois grands types de comptabilité :

- La comptabilité générale : enregistre toutes les opérations financières de l’entreprise et produit les états légaux (bilan, compte de résultat).

- La comptabilité analytique : ventile les coûts et produits par activité, centre ou projet.

- La comptabilité budgétaire : compare les dépenses et recettes prévues avec les valeurs réelles pour piloter les écarts.

Les quatre principes fondamentaux de la comptabilité sont :

- La continuité d’exploitation : l’entreprise est présumée poursuivre son activité.

- L’indépendance des exercices : chaque exercice comptable est traité séparément.

- La permanence des méthodes : les règles comptables doivent rester constantes d’un exercice à l’autre.

- La prudence : ne pas anticiper les profits, mais enregistrer les pertes dès qu’elles sont probables.

La comptabilité générale donne une vision globale de l’entreprise pour répondre aux obligations légales. La comptabilité analytique détaille les coûts internes par activité ou centre de profit. La comptabilité projet, issue de l’analytique, va plus loin en suivant chaque projet individuellement — coûts, temps, facturation, marge — afin de mesurer la rentabilité réelle de chaque mission.

Mettre en place une comptabilité par projet permet de mieux piloter la rentabilité et la performance opérationnelle. Elle offre une visibilité précise sur les coûts engagés, les revenus générés et les écarts par rapport au budget. C’est un outil clé pour les sociétés de services (conseil, ESN, agences) qui doivent relier leur production à leurs résultats financiers.

Pour consolider plusieurs projets, il faut utiliser une structure analytique commune : mêmes codes de coûts, catégories de dépenses et règles d’imputation. Les données de chaque projet (temps, dépenses, factures) sont ensuite agrégées dans un tableau de bord global ou un outil intégré (ERP, Stafiz, etc.), afin d’obtenir une vision consolidée de la rentabilité par client, activité ou portefeuille.