Should VAT be applied to rebillable expenses?

Sometimes, some projects involve your company advancing costs to your end customer. They will then be reimbursed, either in the form of disbursements or rebillable fees. The question then arises of VAT: should it be applied to rebillable expenses ? At what rate? How do I manage expenses for which VAT is not deductible ?

In this article, we offer you a guide on the steps to follow to re-invoice VAT on this type of fee. Indeed, they can sometimes have a heavy impact on your cash flow.

Can VAT Be Re-invoiced On Project Costs?

When a company is subject to VAT (we will see in the following paragraph the contexts where a provision of services does not take VAT into account), it can and must re-invoice VAT on rebillable expenses, as specified on the government tax website :

"In particular, all the costs incurred by a service provider liable for value added tax (VAT) for the performance of the service which he provides and for which he claims reimbursement from his customers, in addition to his fees or remuneration, must be included in his taxable amount."

The rebillable expenses must then account for VAT. There are therefore two scenarios.

- VAT is recoverable: the company invoices its customer excluding VAT and applies VAT on the overall service.

- VAT is not recoverable, the company invoices including VAT.

What Are The Costs Not Subject To VAT?

Disbursements

This is particularly the case for disbursements. They are not counted in the turnover of the company that acts as an intermediary. The invoice is directly in the name of the end customer, so he is the one who pays the VAT.

Certain exemptions by nature

In the law, certain activities are not subject to VAT, such as:

- medical operations such as consultations with doctors, dentists, physiotherapists, etc.

- approved training courses: school or university education or even certain vocational training,

- financial transactions such as credit, deposits, insurance,

- goods or services sold outside Canada.

Services invoiced by a self-employed person under certain conditions

The auto-entrepreneur status allows you to benefit from the basic exemption regime which exempts you from paying this tax. Thus, if the annual turnover does not exceed €37,500 (see detailed amounts on the tax website) to date in 2025, for a provision of services, the self-employed person does not charge VAT and does not recover it.

What VAT Rate Should Be Applied For a Re-invoicing of Expenses?

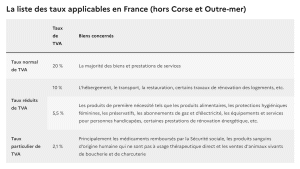

The VAT rate to be applied varies depending on the type of service or product.

According to the economie.gouv website, here is the list of rates applicable in France, excluding Corsica and Overseas, which apply different rates.

Source: economie.gouv

Thus, a meal in a restaurant during a mission will be subject to a rate of 10%, parking 20%, and a bottle of water, bought to take away or in the supermarket, considered a basic necessity, at 5.5%.

| Mileage expenses | / | Non-recoverable | No tax | 120€ TTC |

| Toll, taxi, fuel | 20% | Recoverable | 100€ excl. VAT | 120€ TTC |

| Train, plane | 10% | Non-recoverable | 110€ excl. VAT | 132€ TTC |

| Accommodation | 20% | Non-recoverable | 120€ excl. VAT | 142€ TTC |

| Meal | 10% | Recoverable | 100€ excl. VAT | 120€ TTC |

| Other | 20% | Recoverable | 100€ excl. VAT | 120€ TTC |

VAT rates according to the type of expenses

In the case of rebillable fees, the rate to be applied is that of the provision of services.

As part of a mission, a consultant advances a business lunch. This is then subject to a 10% VAT. However, as this lunch takes place as part of a mission, it will therefore be charged at the rate of the overall service provision , i.e. 20%.

How To Apply VAT When Re-invoicing Expenses To A Customer?

Here are the steps to follow to re-invoice a customer for fees by applying VAT.

Identify the type of charges

Are these really rebillable fees or disbursements? As a reminder, in the case of a disbursement, it is not possible to re-invoice by applying VAT.

Check the type of service

Does the expense concern a good or service subject to VAT ? If so, is this VAT deductible?

Indeed, VAT is not recoverable on certain types of expenses. This is the case for business meals, accommodation or accommodation expenses, among others. You can find the full list of non-deductible expenses on the public service website.

Calculate the price excluding tax

Calculate the price excluding VAT of the overall service. Let's take an example: as an agency, you charge €10,000 excluding tax for the creation of a website. You have paid €100 excl. VAT for the subscription to a tool that you have configured. The amount therefore amounts to €10,100 excluding tax.

Apply the corresponding VAT

You apply the VAT rate of the overall service, i.e. for the creation of a website: 20%. Your total amount will therefore amount to €10,100 + 20%, i.e.: €12,120. However, if the fee is not VAT deductible, it must be invoiced including VAT.

Let's say that an employee of an agency invites a customer to lunch and advances the amount of the bill, which amounts to €100 excluding tax. The amount including VAT is therefore €110 (€100 + 10% VAT). However, as VAT on business meals is not deductible, the agency will not be able to recover the €10. It invoices the customer for the bill including tax, i.e. €110.

Attach supporting documents

We recommend that you attach a sufficiently detailed and clear invoice to avoid any doubts. You can also attach the supporting documents, even if this is not legally mandatory at this time.

It should also be noted that it is legal to add a margin to the re-invoiced fees. This is sometimes justified because re-invoicing can involve administrative management or project management. However, we advise you to warn your customer beforehand to avoid any misunderstandings.

Best Practices To Follow For The Re-invoicing of Expenses

Be rigorous

To be compliant with tax rules, be as precise as possible in your invoices.

Two pieces of information are therefore essential and mandatory:

- your intra-community VAT number if your company is subject to VAT,

- the amount of VAT applied.

Anticipating reimbursement deadlines

Refunds usually take time because of processing times

invoices. Even if you try to get paid faster, it is common for weeks or even months to be needed. However, by advancing large amounts to your customers, on a regular basis, you can jeopardize your cash flow.

Negotiating with the customer

The re-invoicing of expenses involves time-consuming administrative and accounting procedures. When you can, and you don't make a margin on the re-invoicing of expenses, limit the advance of costs by negotiating that certain costs such as those related to transport or accommodation are covered by the customer or prepaid.

Automate your invoicing

Invoicing can quickly become a complex exercise, so automation will help you become more efficient and reliable. You can use a dedicated tool like Stafiz, an all-in-one solution designed for service professionals that offers automated invoicing.

VAT must therefore be applied to rebillable expenses. However, the rate taken into account is that of the overall benefit, generally 20% for the provision of services.

Re-invoicing is a time-consuming process that is best limited. This can jeopardize your cash flow because of the generally long repayment terms . In addition, re-invoicing requires rather cumbersome administrative and accounting management. However, these steps can be facilitated by using invoicing software that takes into account these use cases.

Questions:

French tax rule stipulates that re-invoiced fees are considered as an addition to your main service and must be subject to the same VAT rate as your main service. For example, if your service is at 20%, you apply this rate to all charges that are charged, even if their original purchase was subject to a different rate (for example, 10% for meals).

For expenses for which VAT is not recoverable (such as certain hotel expenses), you re-invoice the amount paid including VAT and add your VAT for the service.