Project Portfolio Management : le guide pratique (2025)

Toutes les sociétés de prestations de services le savent : le succès d’un projet n’est pas toujours synonyme de succès commercial.

Plus votre activité grandit, et plus les missions se multiplient. Et il peut vite devenir difficile de suivre votre rentabilité projet par projet, mais aussi au global.

C’est là qu’intervient la gestion de portefeuille de projet.

Qu’est-ce que le project portfolio management ?

PPM : définition

L’acronyme PPM vient de l’anglais Project Portfolio Management, ou gestion de portefeuille projet en français.

La gestion de portfolio de projet est à l’intersection des trois disciplines que sont :

- la gestion d’activité,

- le management généraliste,

- la gestion de projets et de programmes.

La gestion PPM est la dimension plus stratégique de la gestion de projet.

C’est le processus qui vise à évaluer, prioriser et sélectionner les projets les plus pertinents pour une entreprise, en tenant compte de leurs objectifs stratégiques, de leur capacité en ressources disponibles et de leurs contraintes.

La gestion de portefeuille de projet implique également le suivi et le contrôle des projets en cours, ainsi que l’évaluation de leur performance pour assurer leur alignement continu avec les objectifs stratégiques de l’entreprise.

Une bonne gestion de portefeuille de projet répond à des enjeux cruciaux et stratégiques.

Elle permet de fournir des réponses aux questions suivantes :

- Sur quoi travaille-t-on ?

- Sommes-nous en train de travailler sur les bons projets ?

- Comment sont investis notre argent et notre personnel ?

- Comment performons-nous ?

- A-t-on les capacités d’absorber les projets futurs ?

- Notre portefeuille de projet est-il optimisé ?

- Les résultats attendus des projets se sont-ils confirmés ?

- Peut-on concrètement et correctement délivrer les projets en cours ?

Quelle est la différence entre la gestion de projet et ppm ?

Bien qu’il s’agisse de deux disciplines appartenant à la gestion de projet, elles méritent bel et bien deux appellations différentes en raison de leur champ d’application.

La gestion de projet se concentre sur la planification, l’exécution et le suivi d’un seul projet. Les responsables veillent à ce qu’il soit livré à temps, dans les limites du budget accordé, et selon les spécifications données par le client.

Elle implique toutes les tâches nécessaires à la réalisation du dit projet, telles que la définition des objectifs, la gestion des ressources, la gestion des risques ansi que la bonne communication entre les parties prenantes.

Suivez le guide du suivi de projet optimal

La stratégie de portefeuille de projets quant à elle intervient sur un scope plus large, d’où sa dénomination de réelle stratégie à part entière.

Elle englobe la sélection de projets (et par conséquent, ses critères), l’optimisation et la gestion globale d’un ensemble de projets et de programmes au sein de l’organisation.

Elle applique aussi les méthodes de la gestion financière à la gestion de projet.

Cette approche permet un alignement stratégique des projets vendus avec différents objectifs stratégiques de l’entreprise comme par exemple :

- la maximisation du ROI,

- l’optimisation de l’allocation des ressources,

- les stratégies d’investissement,

- la gestion des risques,

- la croissance et la rentabilité,

- la diversification de l’activité.

En résumé, alors que la gestion de projet se concentre sur la réussite d’un projet spécifique, le project portfolio management assure la cohérence et la rentabilité de l’ensemble des projets d’une société.

Une gestion efficace de portefeuille de projet implique que l’entreprise prenne conscience de plusieurs postulats de base.

Postulat n°1 : les projets sont à la base de l’exécution de la stratégie d’une entreprise.

Postulat n°2 : il est nécessaire de prendre de la hauteur en sortant d’une vision projet par projet, pour adopter une vue globale du portefeuille de projets.

Postulat n°3 : chaque projet représente un investissement

Exemple de gestion de portefeuille de projets

Une société de conseil en marketing numérique dispose d’un portefeuille de projets avec différents clients. Chacun d’entre eux a ses propres objectifs, d’où découle le travail à effectuer pour les atteindre.

Cependant, les ressources dont dispose cette société de conseil peuvent être utilisées indistinctement pour plusieurs de ses clients.

Par exemple, une équipe de conception commune, peut produire des éléments graphiques pour des bannières commandées par plusieurs clients, avec des buts et des objectifs différents.

Imaginons maintenant que plusieurs projets visent à améliorer le classement Google de différents sites web.

Si la société de conseil investit dans un outil permettant de réaliser des audits de référencement, elle devra répartir le coût de l’outil proportionnellement à chacun des projets. Cette répartition est effectuée en fonction du positionnement dans le travail total du client.

Cette allocation des ressources et des coûts ne sera donc probablement pas proportionnelle. Cependant, sa répartition correcte en termes de dépenses sera essentielle pour mesurer la rentabilité réelle de chaque projet.

Une bonne gestion du portefeuille de projets permet d’optimiser à la fois les résultats individuels de chaque projet et l’activité globale de l’entreprise, d’où son importance.

Quels sont les avantages de la gestion de portefeuille de projet ?

La vision exhaustive d’un portefeuille de projet apporte une visibilité unique, qui permet d’améliorer la performance de l’entreprise grâce à quatre principaux avantages que cette méthodologie apporte, notamment :

- de meilleurs retours sur l’investissement des projets,

- moins de risque sur l’organisation des projets,

- une meilleure exécution des plans stratégiques,

- une gestion plus réaliste du capacitaire et de la charge des projets,

- une livraison plus rapide des projets,

- une satisfaction client plus importante.

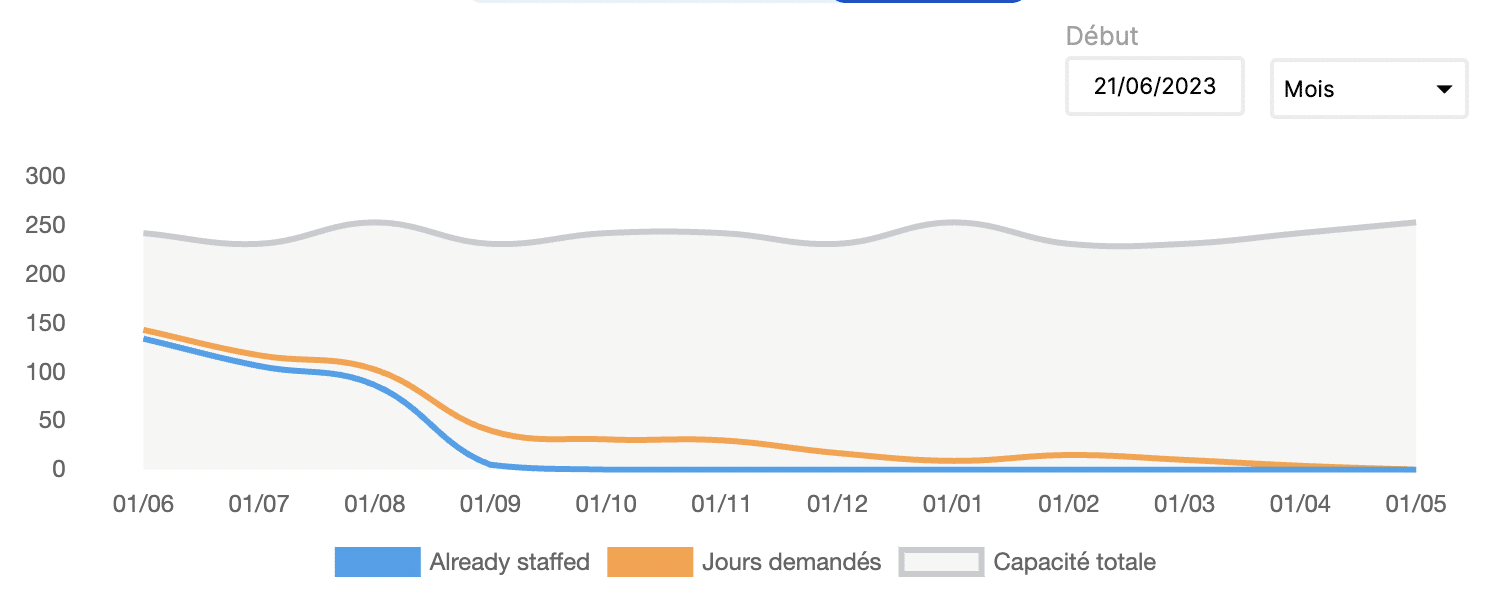

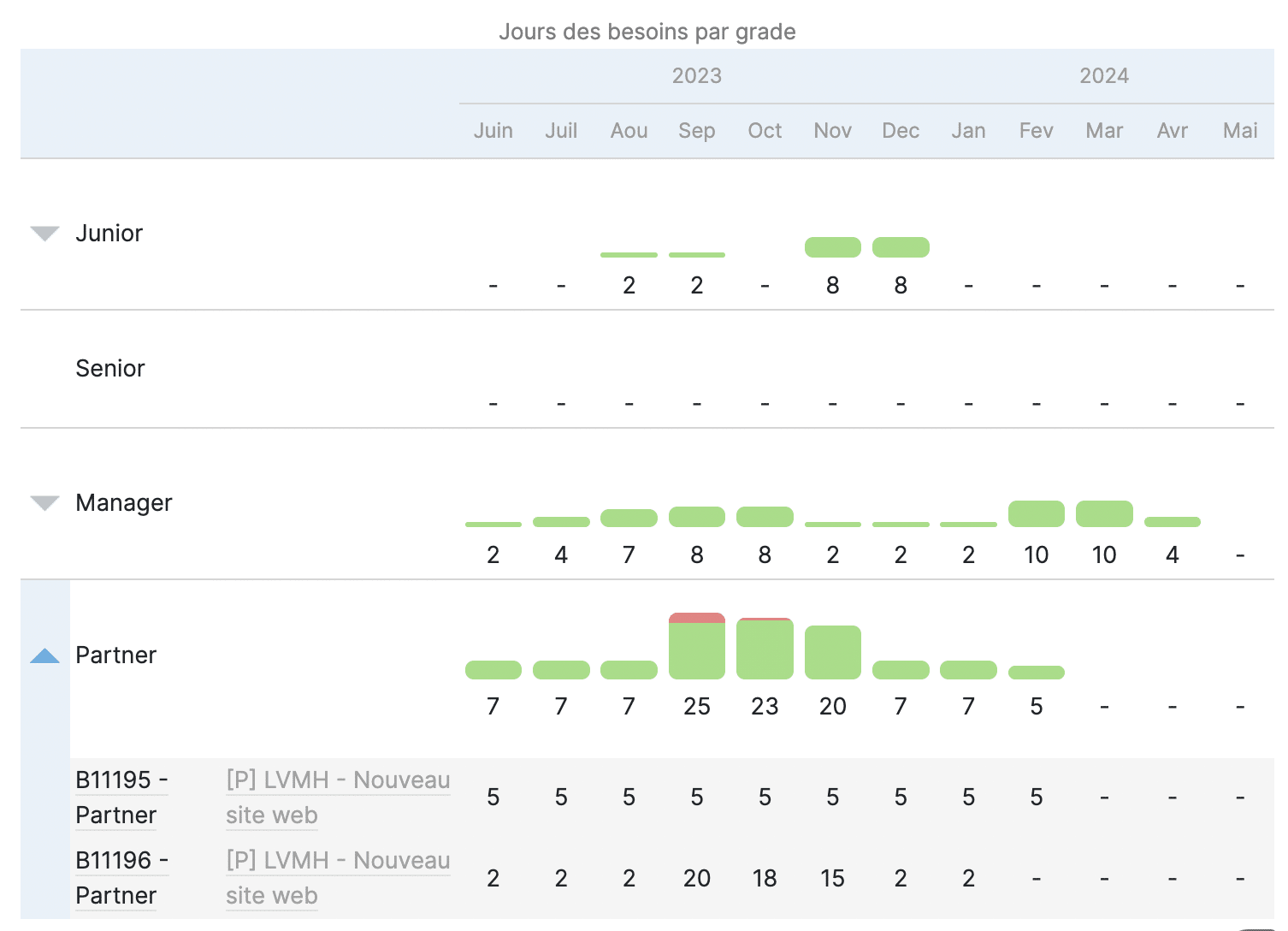

L’optimisation des ressources et du capacity planning

Les entreprises doivent croître avec des contraintes de capacités.

Les ressources, et notamment le personnel, est limité et la planification et l’optimisation du temps des collaborateurs sur les projets est donc un enjeu stratégique.

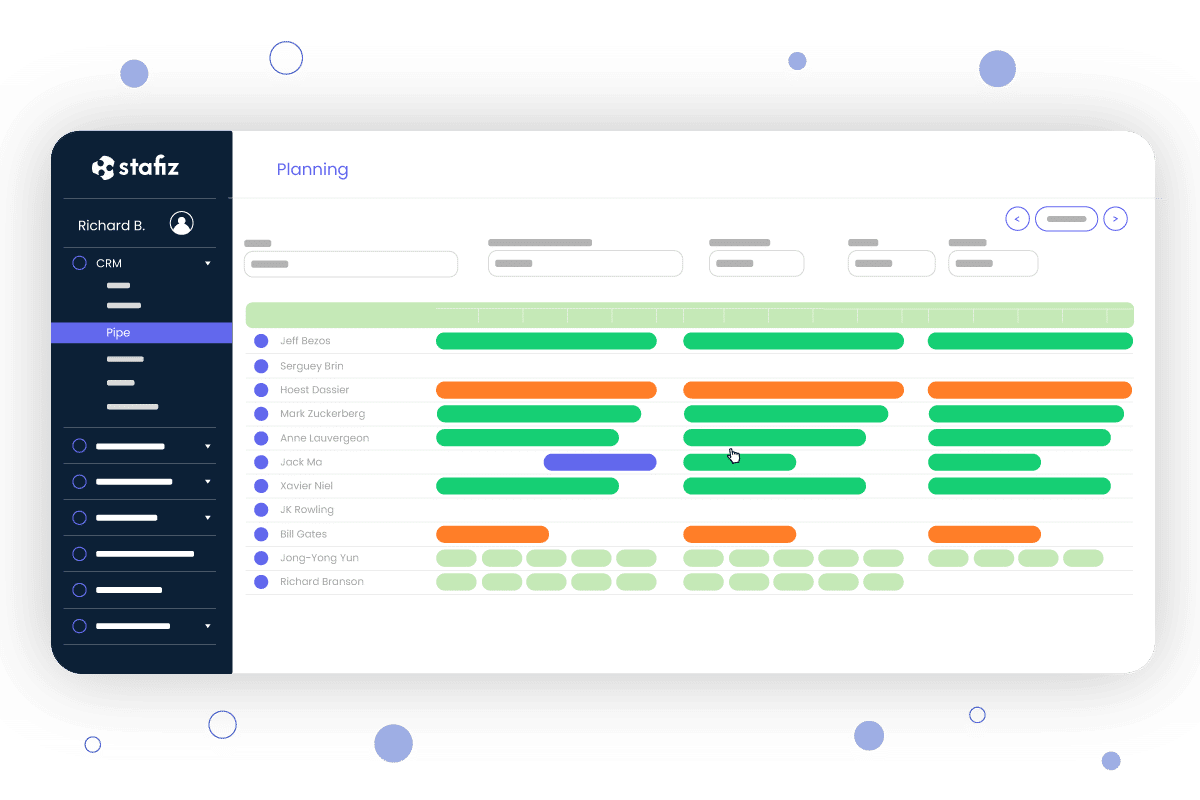

La gestion PPM permet d’avoir une vision globale des projets en cours dans une organisation, ce qui facilite la planification et l’allocation des ressources de manière plus efficace.

En identifiant les projets qui contribuent le plus aux objectifs stratégiques, la gestion de portefeuille permet de concentrer les ressources sur les initiatives les plus importantes.

Par ailleurs, elle favorise la collaboration et la coordination entre les équipes et les départements. Elle permet de mieux partager les ressources entre les départements et d’arbitrer de façon optimale en évitant les conflits de planification et en favorisant l’échange d’informations et de compétences.

Enfin, grâce à la visibilité sur l’avancement des différents projets, la prise en compte des projets futurs qui s’apprêtent à démarrer et les indicateurs dont bénéficient les gestionnaires de portefeuille de projets, ces derniers sont plus à même de prendre de meilleures décisions d’allocation des projets pour placer les ressources là où elles seront les plus stratégiques.

Cette visibilité globale permet aussi de déterminer quelles sont les compétences en sous-capacité dans l’organisation et pour lesquelles il est nécessaire de procéder à des formations, voire des recrutements.

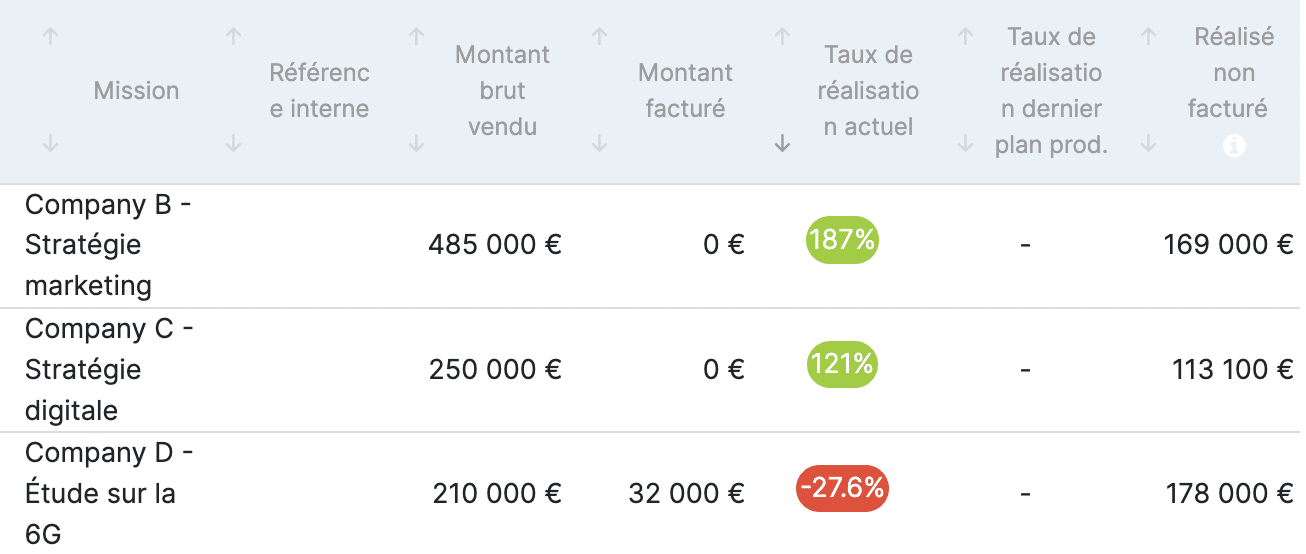

L’amélioration du suivi financier et de la performance des projets

La visibilité sur l’ensemble du portefeuille de projet permet de voir d’un coup d’œil la situation de l’ensemble des projets et d’identifier facilement ceux qui sont en train de dévier de leur budget ou qui prennent du retard. Il est plus facile d’identifier les bloquants et les raisons qui entraînent la sous-performance d’un projet.

Grâce à la vue sur l’ensemble du portefeuille, il est possible de prendre des décisions éclairées pour rétablir une erreur de trajectoire.

Par exemple, un gestionnaire de portefeuille de projet peut choisir de ré-allouer les ressources d’un projet qui montre de l’avance vers un projet en difficulté. Sans une vue globale de la situation des différents projets du portefeuille, il est impossible de rétablir la situation, car il manque de l’information.

La gestion de portefeuille de projet identifie et évalue les risques potentiels liés à chaque projet. Cela permet de mettre en place des stratégies de gestion des risques appropriées pour minimiser les impacts négatifs et maximiser les chances de succès.

En surveillant et en gérant les risques de manière proactive, la gestion de portefeuille contribue à une gestion des délais minutieuse, à éviter les dépassements de budget et l’échec des projets.

La gestion de portefeuille de projet fournit des indicateurs clés de performance pour évaluer la progression et les résultats des projets.

Cela permet d’identifier rapidement les projets en difficulté et de prendre des mesures correctives pour les remettre sur la bonne voie.

Le suivi de la performance facilite également l’apprentissage organisationnel en identifiant les bonnes pratiques et les leçons apprises à partager entre les projets.

Une prise de décision plus stratégique

La gestion de portefeuille de projet permet de comparer les projets entre eux en utilisant des critères stratégiques.

Elle fournit des outils et des méthodologies pour évaluer les avantages, les risques, les coûts et les impacts des projets sur les objectifs stratégiques.

Ces évaluations comparatives aident les décideurs à hiérarchiser les projets et à prendre des décisions éclairées.

Anticipation des opportunités et des risques

La gestion de portfolio de projet permet d’anticiper les opportunités et les risques liés à l’environnement externe.

Elle aide à identifier les tendances, les besoins du marché, les innovations et les menaces potentielles qui peuvent influencer la stratégie globale de l’entreprise.

Ces informations aident les décideurs à ajuster le portefeuille de projets pour saisir les opportunités stratégiques ou pour faire face aux risques émergents.

En pré-staffant vos ressources dès l’opportunité, vous limitez les erreurs de planification de projets futurs.

Réévaluation et ajustement continu

La gestion de portefeuille de projet favorise une approche itérative et adaptative dans la prise de décisions stratégiques.

Elle permet de suivre la performance des projets, l’analyse de rentabilité et donc d’évaluer les résultats par rapport aux objectifs stratégiques et d’apporter des ajustements si nécessaire.

Cela permet une prise de décision dynamique et évolutive en fonction des changements dans l’environnement et des nouvelles informations disponibles.

Comment gérer un portefeuille de projets ?

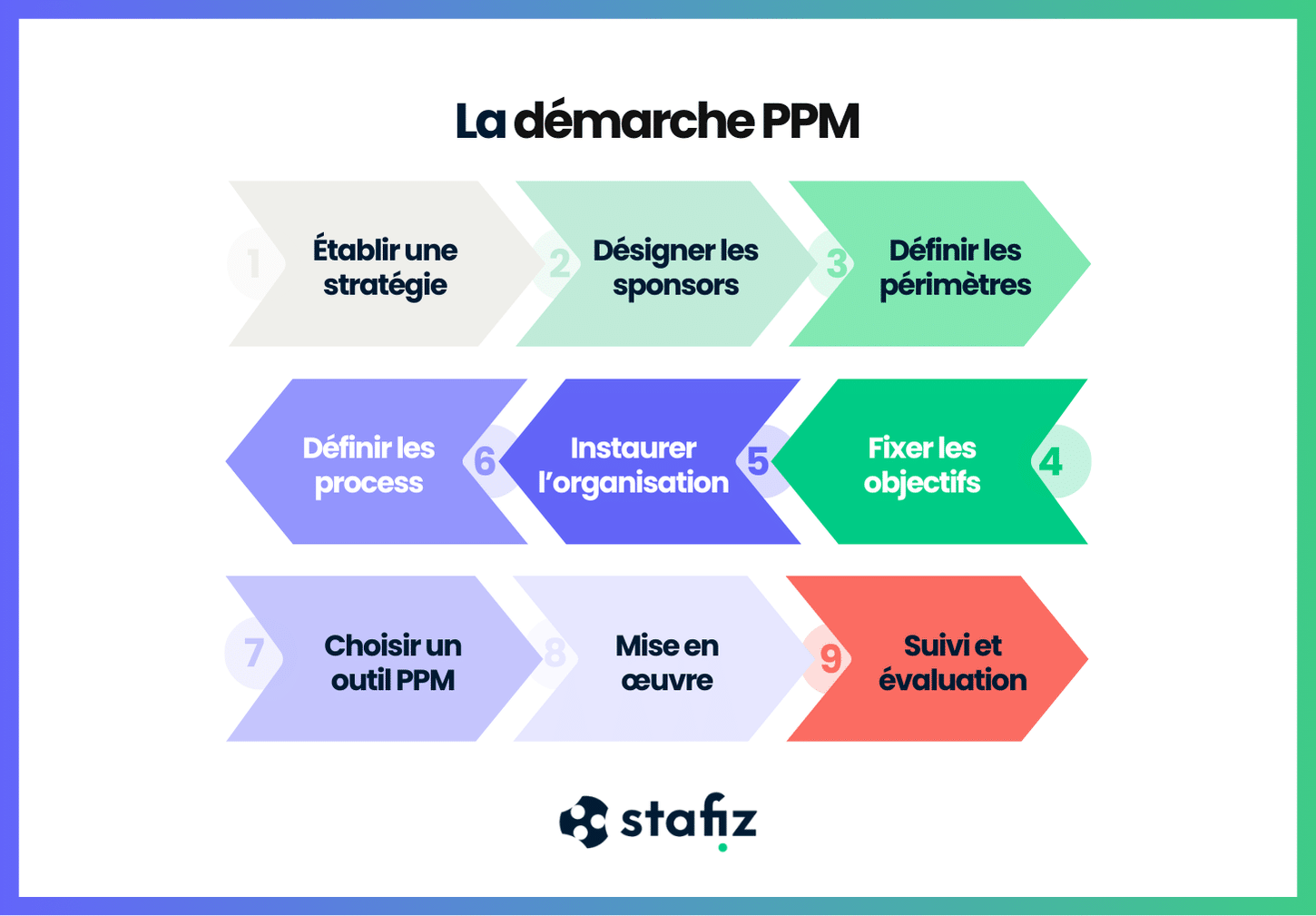

Les travaux de la CIGREF ont permit d’identifier une approche structurelle du project portfolio management en 9 grands axes.

Ces 9 axes clés permettent d’élaborer une stratégie d’organisation elle-même découpée en 4 étapes afin de faciliter votre mise en œuvre.

Étape 1 : sélectionnez les projets

Les critères de sélection des projets

Pour déterminer quels projets inclure dans les portefeuilles de projets à gérer, il est nécessaire de les analyser et les classer selon plusieurs critères.

- L’alignement stratégique : les projets doivent être cohérents avec les objectifs stratégiques de l’organisation.

- Les résultats attendus : les projets doivent avoir des objectifs clairs et mesurables. Ils doivent avoir suffisamment d’impact pour l’organisation.

- La faisabilité : la faisabilité technique, opérationnelle et économique du projet doit être évaluée dans un POC.

- Le retour sur investissement : les projets doivent être évalués en fonction de leur potentiel de rentabilité et de génération de valeur pour l’organisation.

- Les risques et autres incertitudes : les projets doivent être classés en fonction des risques et des incertitudes associées.

La méthode d’évaluation des projets

Il faut ensuite évaluer les projets pour leur donner une notation en face de chacun des critères ci-dessus.

Il existe différentes méthodes d’évaluation de projet qui aident à prendre des décisions éclairées sur quels projets inclure dans le portefeuille. Voici quelques-unes des méthodes couramment utilisées.

- Analyse coût-bénéfice (ACB) : Cette méthode consiste à comparer les coûts prévus d’un projet avec les avantages attendus. Elle quantifie les coûts et les avantages en termes financiers, puis calcule le rapport coût-bénéfice pour déterminer la rentabilité du projet.

- Analyse du retour sur investissement (ROI) : Le ROI évalue le rendement financier attendu d’un projet en comparant les gains financiers prévus avec les investissements nécessaires. Il est généralement exprimé en pourcentage et permet de hiérarchiser les projets en fonction de leur potentiel de rentabilité.

- Méthode d’évaluation multicritère (MEC) : Cette approche prend en compte plusieurs critères, tels que le retour financier, l’impact stratégique, la faisabilité technique, l’alignement avec les objectifs de l’organisation, etc. Les projets sont évalués et notés selon ces critères, puis une analyse comparative est effectuée pour déterminer les projets prioritaires.

- Analyse de sensibilité : Cette méthode consiste à évaluer l’impact des variations des paramètres clés d’un projet, tels que les coûts, les revenus, les délais, sur les résultats financiers. Cela aide à identifier les projets les plus sensibles aux changements et à évaluer leur robustesse.

Il est important de noter qu’il n’y a pas de méthode unique qui convient à tous les cas. Choisissez d’utiliser une méthode ou une combinaison de méthodes en fonction de vos besoins et de la complexité des projets.

Etape 2 : priorisez vos projets

Une fois que les projets ont été évalués, vous êtes capable de leur attribuer un scoring.

Assignez des scores à chaque projet en fonction de critères prédéfinis tels que l’impact stratégique, la faisabilité, le retour sur investissement. Puis, calculez une note globale pour chaque projet et utilisez ces scores pour les hiérarchiser.

Nous vous recommandons de consulter les parties prenantes concernées pour obtenir leur avis et leur soutien lors de la prise de décision.

Etape 3 : allouez vos ressources sur les différents projets

L’optimisation des ressources

Pour allouer les ressources correctement dans le cadre d’une gestion de portefeuille de projet, il faut chercher à optimiser leur placements.

Les ressources doivent être allouées sur les projets en fonction de la situation du projet et de son niveau de priorité.

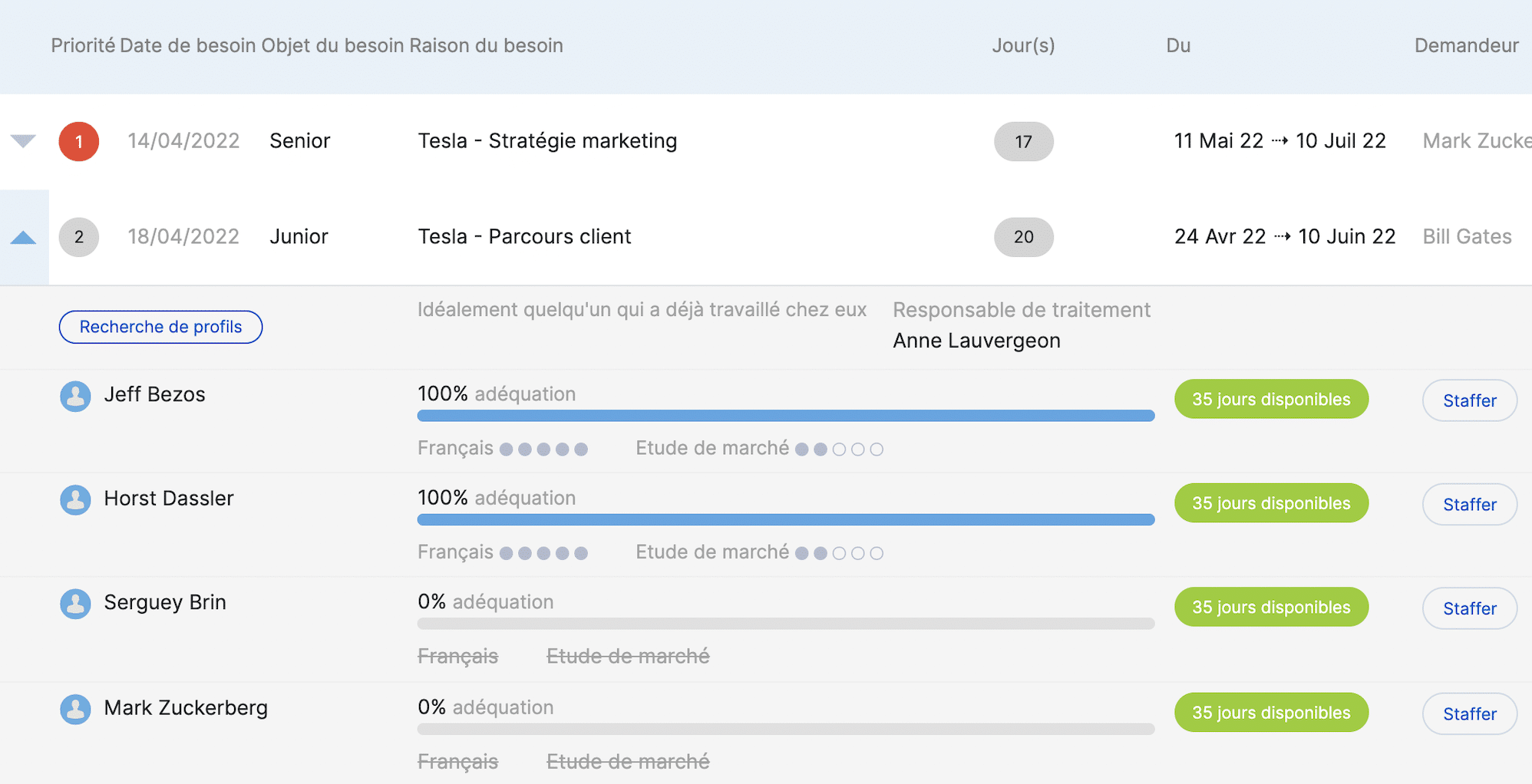

Découvrez comment Stafiz facilite l’allocation des ressources

Smart Matching® intelligent, recherche de profil par compétences, expériences, rôle ou encore disponibilité… Grâce à notre algorithme, plus besoin de courir après les talents !

Derrières les choix d’allocation des ressources, le gestionnaire cherche à obtenir deux résultats.

- Optimiser les ressources pour s’assurer que la charge est alignée au niveau optimal de la capacité.Le niveau optimal de la capacité dépend de chaque organisation. Dans certaines entreprises par exemple, la charge allouée sur les collaborateurs ne doit pas être au maximum de la capacité, car il faut réserver une partir du temps pour travailler sur d’autres activités internes.

- Mener les arbitrages pour obtenir les résultats attendus sur les projets.Si par exemple, un projet qui est en tête des priorités est en train de prendre un retard qui peut impacter défavorablement son résultat, le gestionnaire de projet doit chercher comment récupérer des ressources de projets moins prioritaires pour les allouer sur ce projet et rétablir la situation

Il faut donc constamment travailler à la ré-allocation des ressources et remettre en cause le statut quo pour améliorer l’optimisation des ressources.

La gestion des contraintes et des dépendances

Pour mener à bien la gestion du portefeuille de projet, le planning des capacités doit tenir compte d’un certain nombre de contraintes liées aux ressources, et au projet.

- Contraintes de disponibilités : les ressources spécifiques requises pour un projet peuvent être limitées ou indisponibles à certains moments. Par exemple, des experts spécialisés peuvent ne pas être disponibles pendant certaines périodes ou des équipements clés peuvent être réservés pour d’autres projets. Il est essentiel de tenir compte de ces contraintes de disponibilité lors de l’allocation des ressources.

- Contraintes de délais : les projets peuvent avoir des contraintes de calendrier strictes qui nécessitent une allocation spécifique des ressources pour respecter les délais. Il est important de tenir compte de ces contraintes temporelles.

- Contraintes budgétaires : les ressources financières disponibles peuvent être limitées, et il est essentiel de respecter les contraintes budgétaires lors de l’allocation des ressources aux projets. Une planification financière adéquate ansi qu’une bonne gestion des coûts est nécessaire pour garantir une utilisation efficace des ressources.

- Dépendances entre les projets : certains projets peuvent avoir des dépendances entre eux, ce qui signifie que la réalisation ou l’avancement d’un projet dépend de la disponibilité des résultats ou des ressources d’autres projets.

Ces contraintes et dépendances doivent être anticipées pour que le travail d’optimisation des ressources produise le meilleur résultat possible.

Etape 4 : suivez les projets et leurs résultats

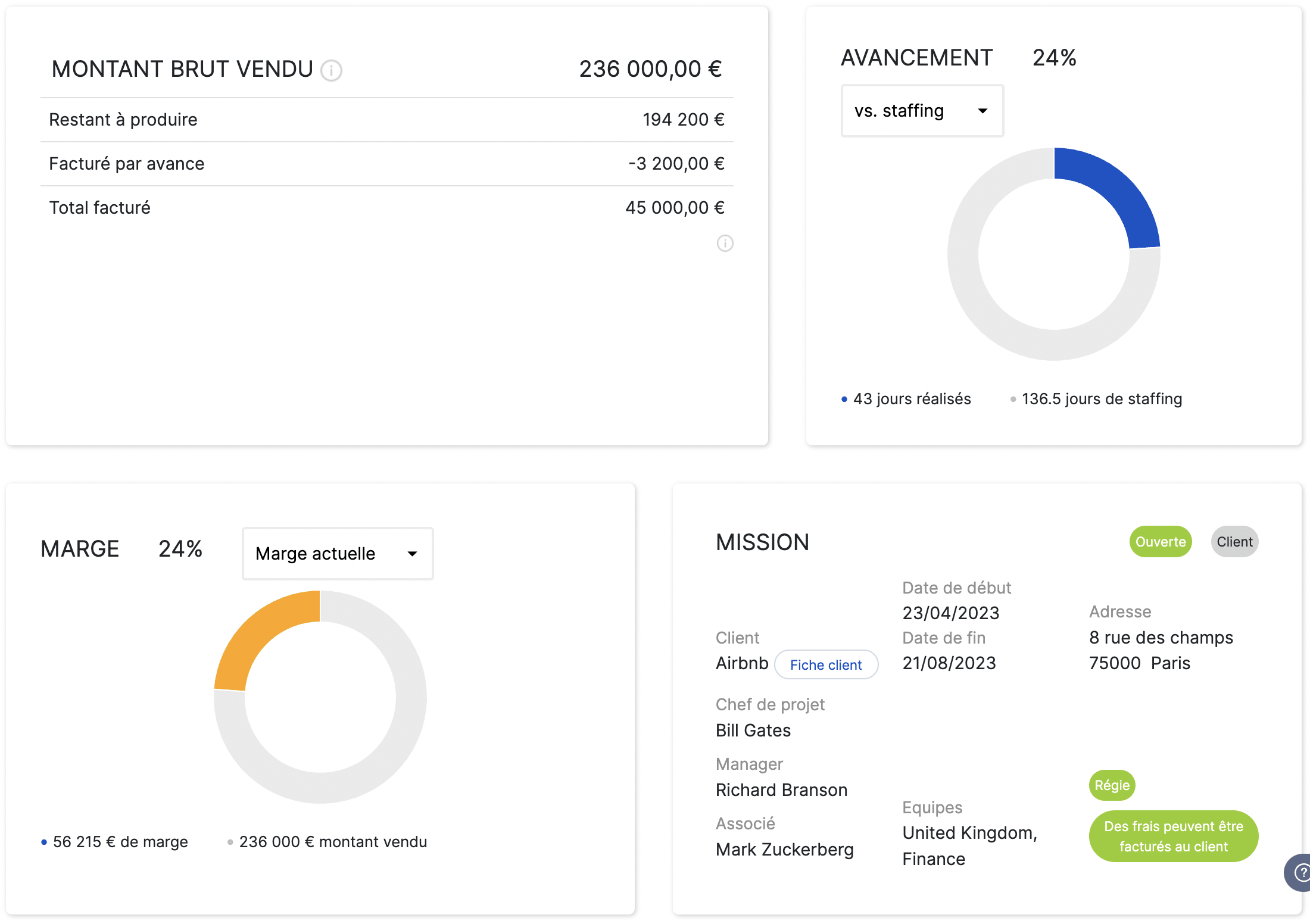

Le tableau de bord de suivi de projet

Pour gérer correctement un portefeuille de projets, il est nécessaire d’avoir une visibilité sur la performance de l’ensemble des projets du portefeuille. Cela implique de pouvoir consolider les tableaux de bord de tous les projets.

Le tableau de bord de projet est crucial pour bien gérer son portefeuille de projets. Il apporte de la visibilité sur la situation, la performance et la rentabilité des projets. Ce dashboard de suivi de projet apporte les différentes informations suivantes.

- Le suivi de l’avancement : il met en évidence les activités réalisées, les tâches en cours et celles à venir. Il offre une vision globale de l’avancement du projet et permet de détecter rapidement les écarts ou les retards.

- Les indicateurs de pilotage de projet : le tableau de bord projet fournit des indicateurs clés pour évaluer la performance du projet. Cela peut inclure des indicateurs tels que le respect des délais, des coûts et de la qualité, la satisfaction des parties prenantes, ou encore l’utilisation des ressources.

- La gestion des risques : le dashboard peut inclure des informations sur les risques identifiés et leur niveau de criticité. Cela permet de surveiller les risques et de prendre des mesures proactives pour atténuer leur impact sur le projet.

Les indicateurs de performance d’un projet

Les KPI d’un projet sont nombreux et il faut que chaque gestionnaire de portfolio de projet choisisse les indicateurs les plus importants pour rester aligner avec ses objectifs.

Il faut se concentrer sur les indicateurs qui ont un réel impact, et sur lesquels il est possible d’agir.

Pour mesurer un projet, les principaux indicateurs de performance sont toujours présents.

- L’avancement du projet : quelle est l’avancement en pourcentage ou en valeur par rapport à l’objectif. Cet avancement peut être détaillé par tâches ou regardé au global.

- Le temps passé par rapport à l’objectif : une autre mesure de performance est la capacité à rester dans l’objectif de temps budgété sur le projet, afin de rester aligner avec l’objectif.

- La marge du projet par rapport à la marge du budget : lorsqu’il est possible de calculer une marge du budget (il faut qu’il soit vendu et qu’il ait un chiffre d’affaires), il est intéressant de comparer la marge recalculée du projet à la marge initialement budgétée. La marge recalculée prend en compte les coûts passé et à venir sur le projet.

- Le taux de réalisation : il compare la valeur vendue du projet par rapport à la valeur des temps passé et futurs des collaborateurs sur le projet. Cela fournit une autre analyse sur la performance du projet et si le pricing de celui-ci était correctement réalisé.

La gestion de portefeuille de projet est donc un atout pour toutes les entreprises qui travaillent en mode projet.

Cette approche permet d’apporter davantage de performance aux projets en alignant la gestion des projets avec les objectifs stratégiques d’une entreprise.

Elle apporte une visibilité plus importante pour identifier les leviers d’amélioration et permet d’optimiser les ressources pour offrir de meilleurs résultats au global.

Pour se lancer dans une gestion de projet efficace, il convient d’identifier le bon logiciel de gestion de portefeuille de projet.

Le logiciel Stafiz permet de répondre à l’ensemble des besoins d’une gestion de portefeuilles de projet.