Billable Expense Income in Project Management

The processing of costs and fees is an important part of the financial management of a project. Their reliability is based on rigorous monitoring, as well as the use of a tool capable of automating the consumption of budgets, thanks to easy entry and constantly updated data.

For this reason, rebillable expenses should be given special attention in your project accounting.

What Is Rebillable Expenses?

Rebillable Charges: Definition

Rebillable fees are expenses related to the sale of a project (or any other service or product). As these additional costs are not part of the fees for the service, they are then re-invoiced to the client, hence its name.

What is the difference between a disbursement and a re-invoicing of expenses?

Sometimes confused, re-invoicing and disbursement are two different accounting concepts.

Re-invoicing of fees

In the context of the re-invoicing of expenses, the expenses are incurred by the service provider on behalf of the customer. The invoice will then be sent to the service provider, who advances the amount. The invoice is then forwarded to the customer for reimbursement. It is therefore subject to VAT.

This method is more flexible and allows service providers who wish to do so to apply a margin on the re-invoicing of costs.

Disbursement

A disbursement is an expense incurred on behalf of the client, but this time on their behalf. The customer will then be the beneficiary of the invoice. The service provider always advances the sum, but acts as an intermediary here. This cash flow operation cannot be recognised as turnover, nor as an expense. The refund will be made without the application of VAT.

This is a more advantageous method for micro-entrepreneurs because the sums collected are exempt from contributions.

What Type of Expenses Can Be Re-invoiced?

There are 3 categories of expenses that can be reimbursed by the customer.

Transportation and housing

If your consultants have to go to the client's site, all travel expenses can be re-invoiced. This takes into account:

- transport tickets (train, plane, etc.),

- fuel, tolls and parking costs for the use of a personal vehicle (calculated according to a mileage scale),

- car rental,

- taxi or VTC costs,

- hotel nights or temporary accommodation during missions,

- meal expenses (lunches or dinners) incurred.

Purchases and equipment

The requirements of the specifications of a given project may require unusual operating methods for the service provider. Thus, all the material – physical as well as intangible – necessary for the production may be subject to a refund, such as:

- office supplies (prints, specialty papers, etc.),

- computer or other specialized equipment,

- any software licenses, subscriptions to online services or any other project-specific purchases,

- printing costs (brochures, presentation documents, etc.).

Subcontracting costs

Depending on the planning of the project and its evolution, the service provider may be required to collaborate with another service provider (company or freelancer) to maintain the proper execution of the project. This expense can also be re-invoiced to the customer, if the contractual clauses allow it, or failing that, an arrangement between the two companies.

How To Re-invoice Fees To A Client?

Several steps must be followed to re-invoice your costs to a customer while respecting accounting obligations.

Validation of rebillable expenses

In order to gain in efficiency and reliability, the implementation of a fee validation process is essential. This makes it possible to confirm the nature of the fee, and whether it is possible to re-invoice it to the customer to avoid wasting time in useless or even conflictual procedures. Ideally, this verification is carried out by a project manager or manager.

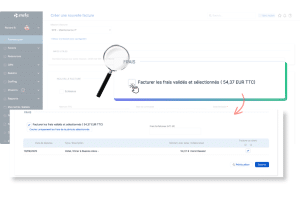

To industrialize this approach, the use of a tool is a real asset. In particular, Stafiz allows you to create validation workflows to shorten these administrative procedures for faster invoicing and collection.

Should billable expenses be considered income?

The fees re-invoiced to the customer are indeed integrated into the turnover, and are, as such, recognized as income.

However, they are to be excluded from the fees.

How do I account for the costs re-invoiced to the customer?

The fee is considered a sale of services or goods.

Expenses such as travel or rental are to be recorded in the accounts of class 6, while the income in a class 7 account.

Stafiz simplifies your re-invoicing of expenses, regardless of your sales method: fixed price or direct payment.

Integrated or separate invoicing: what to choose?

Integrated invoicing includes the costs to be re-invoiced directly on the main invoice of the service. Easier to process for the customer, it allows for faster processing and consistency. However, it lacks transparency on the details of the fees, since it is included among other elements of the invoice, thus leaving less room for it.

How To Rrganize The Re-invoicing of Expenses?

Integrated invoicing includes the costs to be re-invoiced directly on the main invoice of the service. Easier to process for the customer, it allows for faster processing and consistency. However, it lacks transparency on the details of the fees, since it is included among other elements of the invoice, thus leaving less room for it.

Separate invoicing, on the other hand, is an invoice specifically generated for the processing of rebilled charges. It is therefore added to the main bill for the service.

Separate invoicing is more advantageous for the customer, but also offers more transparency for the customer, but also more clarity. Internally, opting for this type of invoicing allows for better accounting traceability.

While the advantages of separate invoicing are interesting, they are nevertheless more administrative work due to the generation of multiple invoices.

What re-invoicing models should be adopted?

There are two ways to charge your customers a fee.

The model in reality

Fees are automatically added to invoicing thanks to real-time tracking of costs and progress. Your fees will then be recharged at their exact cost. The fee is then recognized as rebillable once it has been validated by the hierarchy.

The actual method is interesting since the costs are fully covered: you are guaranteed not to suffer any losses. On the other hand, it requires precise cost monitoring : be careful to keep any receipts or receipts, hence the interest in using an ERP such as Stafiz.

The flat-rate model

Opting for a flat-rate model means that you have to determine a fixed amount to be invoiced in advance, regardless of the actual cost, in order to cover the costs of the project. The charges are then added manually as flat lines on the invoice.

This method is administratively simpler. It establishes a certain predictability of costs, both for the customer and the company. However, it does require an accurate and reliable cost estimate, otherwise you risk a loss of income if the actual costs exceed the initial package.

How To Effectively Track Re-billable Expenses?

Even with the help of a tool, the re-invoicing of expenses requires special attention in its follow-up.

How to categorize re-invoiced fees in accounting?

Your accounting and financial solution must be able to segment the costs, so that your billable expenses are not mixed up with other expenses. This distinction helps you to make your income statements and financial reports more reliable. This categorization also carries a tax compliance issue.

You can then move on to the next step, aiming to use cost accounting to track these different costs at the level of a project, a client, or by type of expense. In the context of a flat-rate chargeback, this approach is ideal for optimising your future quotes.

What tools can be used to track and automate project expense chargebacks?

There is a lot of software available to automate the rebilling of your project costs to your customers. When making your choice, make sure that the solution can meet your specific needs, and offers an offer that is sufficiently adapted to your software environment: either modular, complete, or connectable.

Thus, a tool such as Excel can be quite suitable for starting an activity with less than 15 employees. Beyond that, it will be in your interest to opt for a financial project management solution like Stafiz to automate your expense management and gain in reliability.

Here is a list of criteria to consider during your search:

- OCR technology to quickly capture the information contained in your paper receipts,

- validation workflows to streamline the administrative process as much as possible, with customization options if possible,

- Integrations and synchronization with project accounting to speed up your administrative procedures,

- automated invoicing, which allows you to generate invoices that include your rebillable expenses, regardless of the processing method chosen,

- Accurate financial reporting, helping you to better understand your performance and optimize the management of your future projects.

Questions:

Re-invoicing is essential to recover the sums advanced or incurred on behalf of the client, thus ensuring the financial balance of the project. It ensures that the real cost of a service is borne by the end customer, rather than by the provider company.

You can re-invoice direct salary costs and professional expenses in the context of employee sharing between two companies. A margin may be allocated for management and administration fees. The amounts re-invoiced must be based on the time spent and governed by an agreement for the provision of staff or the provision of services.

No. In France, according to the Commercial Code (Article L441-9), it is illegal to charge "invoicing fees" or "administrative fees" without real consideration. Invoicing is a legal obligation for the company. However, you can re-invoice management fees or specific ancillary costs (shipping costs, bank fees), provided that they correspond to a real service provided to the customer.

You can invoice a customer as soon as the service is completed or the goods are delivered in accordance with the contract or purchase order. For long projects or subscriptions, it is common to use advance invoicing, interim invoicing (situation invoice) or periodic invoicing (monthly, quarterly).

Yes, it is possible to re-invoice fees without applying a margin, especially when you act as a simple intermediary. However, for re-invoiced costs that are not simple disbursements, invoicing without a margin means that the company bears the management and administrative costs related to this re-invoicing, which impacts its profitability. Only disbursements (advances made in the name of the customer) must be re-invoiced to the nearest euro, without a margin.