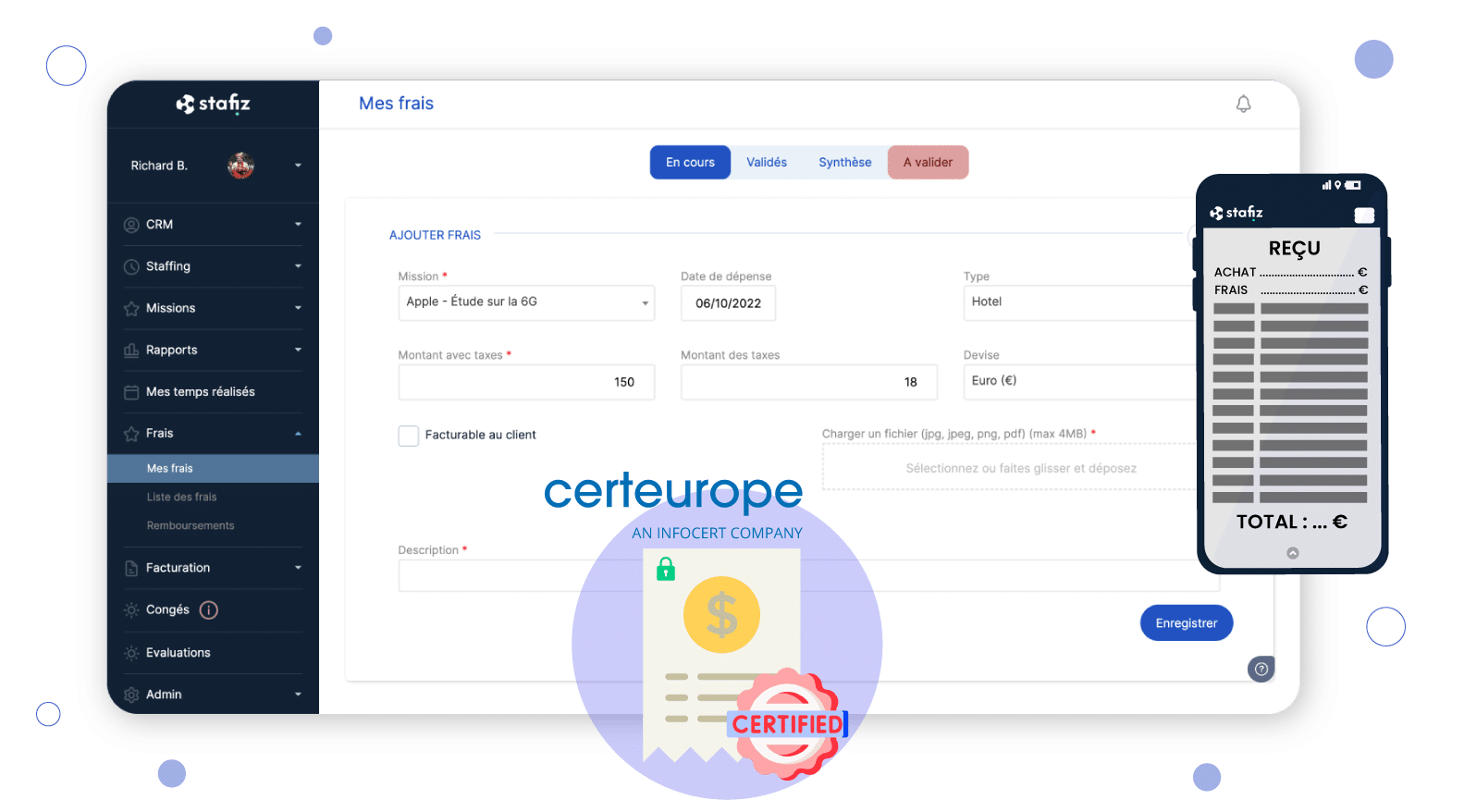

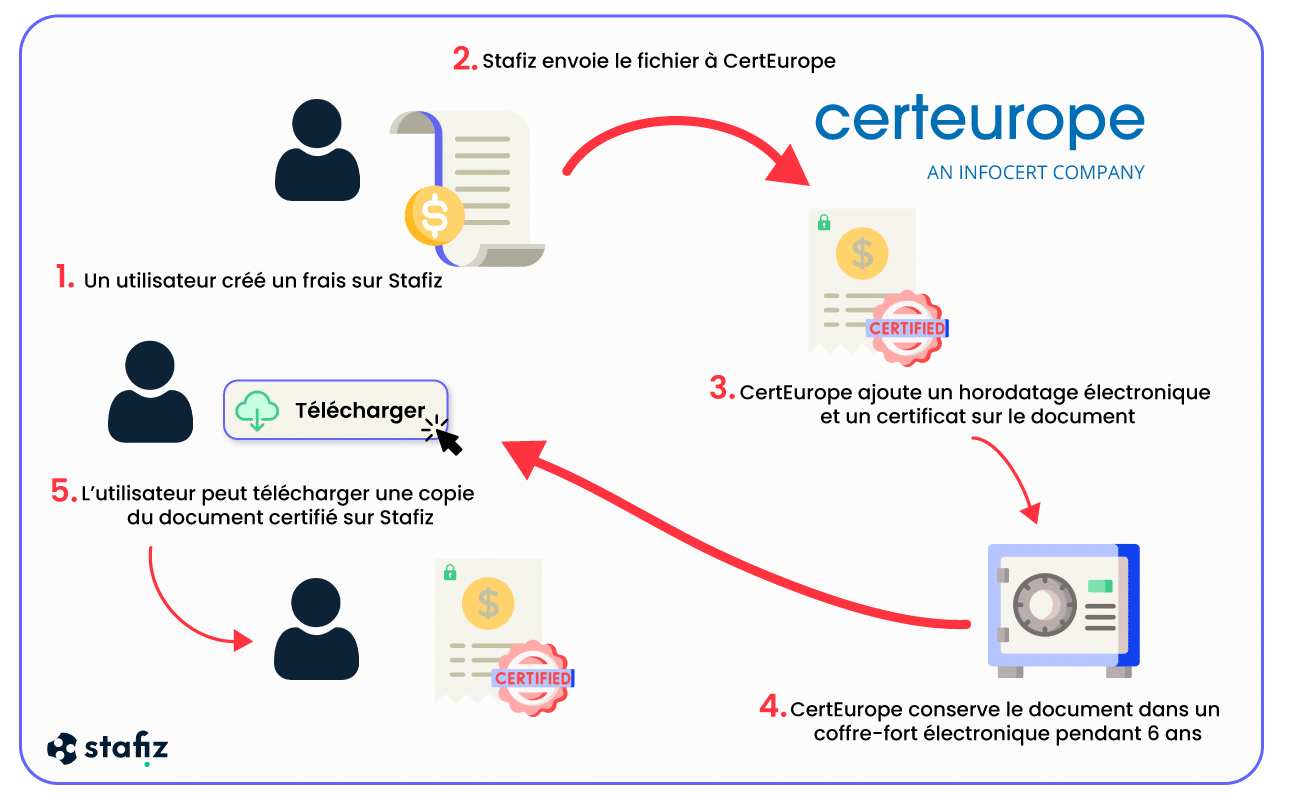

To dematerialize the management of expense reports, it is necessary to follow the following principles:

Legal framework: Article A102 B-2 of the Book of Tax Procedures which governs the digitisation of professional expenses.

- Identical reproduction of the original: the copy must conform to the original in image and content.

- Nothing should be altered, altered or modified.

- If the file is compressed to reduce its size, there should be no loss of information.

All documents must be scanned and stored in PDF format or in a PDF A/3 format (ISO 19005-3) in order to guarantee the interoperability of the systems and the sustainability of the data.

A security, compliance or time-stamping system corresponding to at least the one-star level general safety reference system (RGS) must be put in place, making it possible to record the dates of the various operations carried out.