What Is Revenue Recognition In Project Management?

The revenue of a project corresponds to the part of the contractual income that can be recognised in accounting at a given date, depending on the actual progress of the project, regardless of invoicing or collection.

It is a key indicator for managing the profitability, margin and financial performance of projects.

For companies that sell projects — consulting firms, IT Services, agencies, service companies — project revenue is not limited to what has been invoiced. It reflects the value actually produced to date, in line with accounting standards (IFRS 15, PCG) and audit obligations.

However, determining when and how to recognize the turnover of a project is a complex exercise. It depends on:

- the type of contract (fixed price, management company, managed services, subscription, TMA),

- the method of calculating the promotion,

- the company's ability to make its production and cost data more reliable.

Poor methodology can lead to significant discrepancies in margin, profit and balance, with direct impacts during monthly closes or audits. Conversely, controlled recognition of project turnover allows for precise financial management, better anticipation of drifts and a reliable reading of actual performance.

This article details the methods for calculating and recognising project turnover, in accordance with accounting standards, and adapted to each type of project, in order to sustainably align finance, production and operational management.

What is the recognition of a project's revenue?

Definition: the recognition of a project's revenue

The revenue of a project corresponds to the revenue recognized in accounting on a given date, according to the actual progress of the project. It does not depend solely on invoicing, but on the value actually produced and delivered to the customer.

Recognition of revenue from a service contract is required for all billable projects.

Issues related to the recognition of a project's revenue

There are many constraints: accounting requirements (IFRS15, PCG), diversity of contract types (fixed-price projects, time-based projects, managed services projects, subscriptions, retainers, maintenance), pressure on profitability and the obligation to provide reliable reporting.

Knowing how to determine the right approaches to revenue recognition is therefore a complex challenge. However, this recognition of the turnover can have a profound impact on the margin, the balance sheet and even the perception of the market. Finance teams must rely on methods that are mastered and can be audited without risk of adjustment.

But the reality on the ground shows another difficulty: the necessary data (time spent, milestones delivered, remains to be done) are often scattered between excel and business tools. As a result, CFOs lack visibility, closures are too long, and the risk of deviations is significant.

When is the revenue recognition added into the income statement?

The answer to this question depends on several criteria: the type of project and the associated service.

To answer this question clearly and without any possible analytical bias, accounting standards have made it possible to clarify the subject. The international standard IFRS 15 first, then the application in local accounts.

What is the revenue recognition method under IFRS 15?

IFRS 15 – Revenue from Contracts with Customers defines a clear framework for recognising revenue. It presents a 5-step model, allowing the transfer of control of goods or services.

- When a contract exists with a customer: A contract that is approved by both parties exists with a customer.

- The performance obligation is identified: whether it is a transfer of property, a service, or a combination of these two options.

- The determination of a price.

- The price determined is then divided by type of obligation or service.

- The turnover is then recognised at the time of the transfer of control of the good or service.

IFRS 15 aims to standardize revenue recognition globally, provide greater consistency and transparency for investors, and reduce methodological discrepancies.

What is the accounting implication within European standards?

The European Union has officially adopted IFRS 15 via Regulation (EU) No. 2016/1905.

It is therefore mandatory for:

- companies listed on European markets,

- their consolidated financial statements prepared in accordance with IFRS.

However, each country can apply its local standards, which are not yet harmonised at European level. Local GAAP is then applied in each country.

💡 Local GAAP (Generally Accepted Accounting Principles) is the standard of generally accepted accounting principles that governs the specific rules applied in a given country.

However, local standards regarding revenue recognition are strongly influenced by the principles of IFRS 15.

What about the revenue recognition for consulting and IT Services ?

Consulting service models, whatever their nature, involve a project sale to clients.

It is necessary to apply the right methodology for recognising turnover according to the services. What for? Because this recognition of turnover has a major impact on the accounting results of consulting firms. Income statement data can be very different depending on the methodologies used. It is therefore one of the subjects that is very much watched by the CAC (Statutory Auditors) or during the audit of the accounts.

What is the difference between invoiced revenue, recognized revenue, and cashed revenue?

Three types of turnover can be distinguished.

Invoiced revenue

It is the total amount of billing generated. He adds up all the amounts of the invoices and deducts the credits. It is the total invoiced. Although it is an indicator of revenue, it does not correspond to accounting revenue, because not all the invoiced revenue can be recognized over the accounting period.

Recognized revenue

This is the part of the invoiced revenue that can be recognised over the accounting period and appear on the income statement. It excludes turnover which does not have to be recognised in accounting.

Cashed revenue

This is the part of the turnover recognised over the period that has already been paid to date. It is more of a cash flow monitoring indicator than a profit and loss account indicator.

How to Measure a Project's Revenue?

The on completion revenue recognetion method

Recognition on completion: definition

Recognition of revenue on completion consists of recognising the income only when the service is fully performed. This method is especially applicable to short projects or assignments where the value is only delivered at the end. As long as the project deliverable is not produced, validated and accepted by the client, no revenue is recognised.

💡 For example, services such as audits or pentests are usually accounted for using the completion method. Due to their short duration, usually over a few days, the start and end of the service often take place in a single accounting period (monthly).

On delivery, the total revenue is recorded in one go. The margin is then calculated on the basis of the costs actually incurred. This approach ensures prudent recognition and consistency between the actual delivery and the accounting recording of income.

Its advantages

This revenue recognition method has two notable advantages:

- its simplicity which reduces the risk of error. There is only one accounting record at the end of the project. There is no need to make intermediate estimates;

- His caution : no revenue is recognized until the project is completed. There is therefore no risk of overvaluation of revenue.

Its limits

But it also has some drawbacks, including:

- No progressive visibility: the revenue only appears at the end of the project. During the first part of the project, while the costs are taken into account, there is no revenue in front of it, which prevents the real performance of the project from being assessed;

- Risk of volatility : Revenue can be concentrated in a single month, creating artificial spikes.

The progress revenue recognition method

Recognition for advancement: definition

The method of recognizing revenue on progress is to recognize revenue as the project progresses. Revenue is no longer linked only to the final delivery, but to the value actually produced on a given date. Progress can be measured using several approaches: percentage of costs incurred, effort consumed against budget, or milestone validation.

Recognized Revenue = Total Project Price × Actual Completion Percentage

This method allows products and loads to be correctly attached. The costs incurred during the period are compared to the share of the service actually delivered, which offers a much more accurate view of performance. Thanks to this, the company can calculate the actual margin to date and no longer after the fact. The piloting becomes immediate: drifts are visible at the moment they occur, and not several months later.

The approach to advancement also ensures strict consistency between production, invoicing and accounting. The accounting reflects what was actually delivered, regardless of the billing rate or contractual terms.

Production, on the other hand, measures operational progress. Billing follows the payment plan. The progress method ensures that these three dimensions are aligned, making financial analysis safer and reducing interpretation gaps.

Without this approach, society remains in a post-mortem logic: it discovers its results at the end, when everything is consumed and it is no longer possible to correct. It observes, instead of piloting. With recognition for advancement, finance becomes a true partner of performance. Teams have reliable, up-to-date indicators and can make quick decisions to adjust loads, redefine priorities or react to drifts. Finance is no longer a spectator: it becomes a driving force.

Its advantages

The advancement revenue recognition method has certain advantages.

- The continuous visibility of the performance it brings: the revenue reflects the actual progress and therefore also facilitates the forecasting or even the planning of the revenue still to be recorded. Margins are also more precise with visibility to date of the project's profitability.

- Precise margin management, as the costs incurred and the recognized revenue evolve simultaneously. Accounting fluctuations are limited. This approach improves decision-making and strengthens collaboration between operational, finance, and business teams.

Its limits

And rightly so, it also has its share of disadvantages.

- Discipline of monitoring: this methodology involves making regular estimates to confirm progress. This means having robust processes and the right tools in place. A bad estimate can distort the image of the project.

- Expense reconciliation: for this approach to correctly account for profitability, it is important to master the cost monitoring, which is ideally exhaustive for the proper application of this method.

How to recognise revenue on times and materials projects?

In the case of advertising agencies, revenue and invoicing are based on the time spent on the project multiplied by an hourly or daily rate on which the seller and the customer have agreed. Recognition of revenue is therefore easier to follow for this type of project.

Theoretically, it is the valued production that serves as the basis for calculating revenue.

Formula = Number of days worked on the project x Daily rate (or even approach in hours)

In fact, it often happens that certain works are deducted from the invoice, which creates a gap between the valued production and the invoicing of the project.

Since this type of project is generally invoiced at the end of each month on the basis of the production carried out, and the invoice takes into account any one-off discounts, it is this data that is most widely used to recognise revenue. Indeed, it turns out to be even more accurate than a valued production that would not have included commercial discounts.

The linear recognition method of project turnover

In which cases is revenue recognised on a linear basis?

Some types of sales lead to a recognition of linear revenue. When the sales method is closer to a subscription, the linear recognition approach is the most appropriate.

In the case of subscriptions to products such as software licenses, but also for managed services projects, or for certain types of TMAs (maintenance services), the recognition of revenue must be linear.

It is also necessary to decouple invoicing from the recognition of revenue. Invoicing can be annual, quarterly or monthly, which has no impact on revenue. The difference between invoicing and revenue, on the other hand, leads to FAE (Invoices to be Established) or PCA (Deferred Revenue).

How does linear recognition work?

For example, let's imagine a managed service contracted over 3 years for €36,000:

The monthly revenue is 1000€ per month during the 36 months of the service.

Let's assume that on the 1st day, the invoice for year 1 is issued, i.e. 12000€. At that date, the PCA is €12,000 and will be reduced at each monthly closing by €1000 until it is at €0 at the end of the year. Then a new annual invoice will recreate a new PCA of €12,000

How to calculate revenue in the context of a project in progress?

The recognition of revenue at the time of progress provides a more precise monitoring of performance but requires a more rigorous approach. The process to be put in place varies depending on the approach to the revenue estimate chosen.

The different methods for calculating the progress of a project

The method of calculating the progress of revenue involves choosing a method of calculating the progress. Several approaches exist.

The percentage of progress by cost

This is the most recommended method because it is the most accurate. It involves calculating the total costs spent on the project to date (which must be as exhaustive as possible) and comparing it to the total costs of the project.

Formula = Project Costs to Date / Total Project Costs

It is important to define whether the total project costs in the denominator are based on the originally budgeted costs, or take into account the last estimate.

Ideally, for the calculation to be as accurate as possible, it should be possible to take into account the last estimate of the project costs in the denominator, i.e. the costs to date to which the most accurate estimate of the remaining costs to be spent on the project is added.

The cost-based approach is the most accurate way to calculate the progress of a project because it encompasses all the activity required to complete the project:

- the production of internal employees,

- costs associated with travel,

- subcontracting purchases,

- as well as all other purchases.

This exhaustiveness makes it more precise and more appreciated by auditors.

The percentage of progress by the production valued

Some companies prefer to estimate the project's progress by calculating the valued production to date and comparing it to the total valued production of the project.

This approach is accurate when projects are easily valueable, i.e. each stakeholder has an hourly or daily rate that can be applied to the time spent on the project.

Formula = Valued Production of the Project to Date / Total Valued Production of the Project

In this case too, the total valuation of the project must be known: this can be calculated on the basis of the budget, but ideally it is the last estimate that should be taken into account to provide a more accurate percentage of progress.

The percentage of completion per milestone

In some cases, the progress of the project can be measured by the milestones achieved. For this to work, the estimate must initially confirm the progress that each milestone brings. Each time a milestone is achieved, the estimate then confirms the increase in revenue.

Like manually reported progress, this means that a project manager must monitor the completion of milestones at the desired frequency. It is therefore a less infallible methodology than a calculation linked to costs or valued production. When it is impossible to update a forecast but at the same time the projects suffer from strong deviations from the initial forecasts, this is a methodology that may be preferred.

The percentage of manual completion

It is also possible to operate on the basis of the declaration. In this case, a person who is in charge of the project can indicate the progress at closing. Less rigorous, this method relies entirely on the human being and his knowledge of the project situation and the remains to be done.

What are the key indicators for measuring progress?

Depending on the methodology used, the indicators to be monitored are different. For advancement by costs: all costs related to the project must be taken into account.

The costs of internal collaborators working on the project

You need to be able to track the time spent on the project and convert this time spent into an associated cost. For each employee, a full cost must be attached, which must include:

- gross salary,

- the social security contributions paid by the company,

- any bonuses and bonuses.

Subcontracting costs

If the subcontracting service is sold on a fixed basis, the cost corresponds to the amount sold of the service. In the context of a progress calculation, it is important to specify when this cost must be recognized: confirming the date on which the service was performed therefore makes it possible to recognize the associated cost.

If the service is carried out by an external person who invoices by the hour or by the day, it is necessary to be able to track the time already spent on the project and to be able to confirm at the time of closure the time remaining to be spent by this external profile. This time is multiplied by the hourly or daily cost and allows you to enter into the situation of progress of the project costs.

Streamline your collaboration with your external parties

Stafiz allows you to include your subcontracting in order to update both project progress tracking and costs.

The different purchases

These are purchases of equipment, products or licenses. The purchase amount already committed and still to be committed must be monitored. If this amount changes, it must be updated.

Travel expenses

Some projects involve travel that can result in significant transportation costs. These costs must also be reported and possibly reestimated regularly to provide a correct picture of the total costs incurred in relation to the total projected costs.

Implementation of recognition of revenue at progress: how to go about it concretely

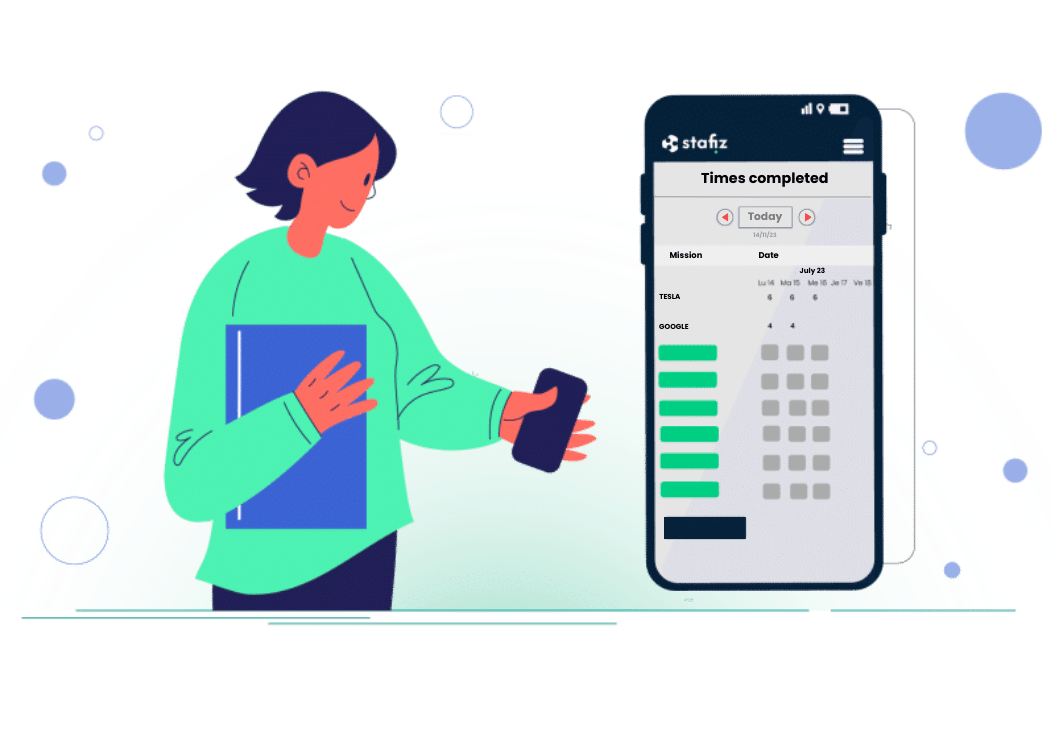

Tracking time spent on the project is the most accurate approach to calculating internal costs on projects. Employees must be equipped with a time entry tool.

Employees must be able to indicate the hours or percentage of days spent on the different projects, including the projects on which the percentage of completion is calculated. This software also makes it possible to assign a cost to resources and thus calculate the costs incurred on projects.

It is also imperative to be able to plan the remaining time to be achieved. Because the calculation of progress is ideally based on a final estimate: it must take into account the actual (or actual) as well as the forecast still to be made on the project.

A solution like Stafiz, for example, makes it possible to manage both the time achieved and the planning in the same software. The externals must also be able to track the time on the projects. The associated cost of the subcontractor on the project is defined and allows the progress of these subcontracting costs to be monitored.

- Subcontracting management: subcontracting costs must be able to be tracked, ideally in the same project management software. This monitoring must make it possible to know the valuation of the subcontracting costs incurred, and the total subcontracting costs planned to complete the project.

- Purchasing and product management: To complete the calculation of costs incurred on a project, other purchases must be added. The solution should be able to manage hardware and product purchases directly in the same software or retrieve these elements from another solution via API connector or flat file import.

- Expense management: In addition to recovering expenses, you need to be able to charge them to the right projects. It is also necessary to be able to indicate a still to be done so that the percentage of progress by costs is as precise as possible.

Best practices for tracking project revenue recognition at progress

In order for the recognition of revenue at the time of progress to be accurate, it is necessary to have processes in place at each close.

Validation of time, expenses and purchases

The cost elements on projects to date must be correct and up-to-date. There are several best practices for this:

- Implement validation workflows to confirm that time entry is complete and accurate

- Validate invoices for subcontractors and purchases: people who know the project can validate that the invoice corresponds to the reality of the service, and if there is a discrepancy, they can specify it so that only the costs actually incurred are accounted for in the calculation of progress.

Update Leftovers

It is usually the project manager who has a holistic vision of the project who can review the situation and plan for these remains to be done. The best practice is to carry out an analysis of the situation and update the remaining products at least once a month. Plan the remaining cost (this translates into future costs), confirm the progress of the subcontracting services (to recognize the costs incurred and those that remain to be incurred), check the consumption of the cost budget (and possibly readjust).

Check the completeness of updates

For the advancement calculation to be correct, it is imperative that all contributors follow the process, otherwise the analysis is distorted. Ideally, the tools make it possible to ensure that the time tracking has been carried out exhaustively, that the times have been validated, that the expenses have been submitted and that the project managers have updated the forecast.

Managing cut-offs

Once the progress calculations have been made, it is necessary to ensure that the period is closed so that any changes related to a previous period impact the open period. Without the management of cut-offs, the figures for previous periods change as soon as changes are made, which makes analysis impossible.

Questions:

The revenue of a project corresponds to the revenue recognized in accounting on a given date, according to the actual progress of the project. It does not depend solely on invoicing, but on the value actually produced and delivered to the customer.

Invoiced revenue is the invoices issued, while recognized project revenue is the revenue share that can be recognized over a period of time. A project can therefore generate revenue that is recognized before or after invoicing.

Project revenue is generally calculated from the progress of:

Recognized Revenue = Total Project Amount × Percent Complete

Progress can be measured using several methods: costs incurred, production valued or milestone validation.

For a fixed-price project, the turnover can be recognised:

- at completion, when the project is completed,

- or advancement, if the value is transferred gradually to the customer.

This recognition is carried out in accordance with IFRS 15 and the PCG.

Yes. The recognition of project revenue is independent of invoicing. This can generate invoices to be drawn up (FAE) or deferred revenue (PCA), depending on the time lag between the production carried out and the invoicing.

Project revenue makes it possible to monitor actual profitability to date, to anticipate margin drifts and to align finance, production and management. It is central to the management of long and complex projects, particularly in service companies.