The 8 Best Project Invoicing Software in 2025

The more assignments a company manages, the more complex the coordination between operational, financial and sales teams becomes. Traditional tools or Excel do not offer this synchronization, which leads to a lack of consistency between the work done and the value actually invoiced. SaaS project invoicing software provides a solution to this structural problem: it centralises data, automates flows and transforms the invoice into a real financial management tool, while facilitating e-invoicing in accordance with the Factur-X standard.

In this 2025 comparison, discover SaaS project invoicing software tested by our experts, according to your company size, your level of maturity and your invoicing models. Finally, we have listed the functional building blocks to consider when choosing your invoicing platform for projects and services.

Comparison of the Best Project Invoicing Software in 2025

Choosing the right invoicing platform for your SME or mid-sized company depends on the level of complexity of the assignments and the size of your company. Check out our 2025 comparison of the best software, both free and paid, and find the best tool for your business.

| Stafiz | SME to ETI | Consulting firms, IT Services, multi-project agencies | Complete project ↔ management, invoicing, profitability monitoring, integrated reporting | Initial configuration required, expert tool |

| Shine | Self-employed / VSEs | Freelancers, small agencies | Easy to use, all-in-one with a pro account | Not suitable for multi-users |

| Tiime | Construction / engineering | Project management, design offices | Free, e-bill compliant 2026 | Little project follow-up and profitability |

| Sellsy | VSEs / SMEs | Sales agencies, startups | CRM ↔ link invoicing, intuitive interface | Not very project management oriented |

| Facture.net | Independent | Self-employed entrepreneurs, consultants | Free, simple | Limited functions, no project management |

| QuickBooks | International VSEs / SMEs | Multi-Country Services & Startups | Stability, reporting | Limited FR Localization |

| FinancialForce / Certinia | Companies in Salesforce | Combining PSA and integrated CRM | Pipeline link → project → invoicing, global reporting | High cost and dependency on Salesforce |

| Workday PSA | International groups | HR firms, IT or multidisciplinary companies | HR + Finance + PSA, multi-entity consolidation | Very expensive, complex to deploy |

Each solution presented in this 2025 comparison responds to a specific degree of maturity.

- Shine and Facture.net are suitable for small structures (micro-enterprise, self-employed, freelancer, VSE) who want to invoice without worrying about a complex tool to set up. The objective is to save time with the administration without necessarily analysing the profitability of each mission.

- Tiime, Sellsy and QuickBooks target companies in the structuring phase. They want to automate invoicing, track payments and have a synthetic view of turnover, without going as far as the complete management of a portfolio of projects.

- Stafiz, FinancialForce and Workday PSA are aimed at organizations where the progress of projects directly determines invoicing. These tools link production data (time entered, deliverables, contractual milestones) to actual invoicing. The result: a detailed view of the margin to date, the remaining work to be done and the projected financial performance.

Shine, the reference tool for freelancers and small businesses

🏷️ Tool Type: Professional Online Banking with Integrated Invoicing

⚙️ Key features:

- Creation of quotes and invoices in accordance with legal obligations (mentions, VAT, numbering);

- Automatic payment monitoring and configurable chargeback reminders;

- Simplified accounting: bank synchronization, accounting export and automatic estimation of URSSAF contributions;

- E-invoicing included to anticipate the 2026 reform;

- Unified mobile and web app for business account, expense and invoice management.

Ideal for: Freelancers, freelancers, liberal professions, small agencies.

Taille d’entreprise cible : Indépendants, TPE (<10 personnes), agences

Benefits:

- Ultra-simple interface, accessible even to beginners;

- All-in-one solution;

- Recognized customer service, available 7 days a week, elected Customer Service of the Year 2025 ;

- Transparent pricing: free offer and plans with no hidden fees;

- VAT Anti-Fraud Act compliant tool and ready for mandatory e-invoicing in 2026.

Points of vigilance:

- Less suitable for managing complex or multi-user projects;

- No milestone billing automation or time tracking;

- Limited customization of invoice templates and financial reporting.

Shine stands out for its simplicity and all-in-one approach: invoicing, expense management, and payment tracking are done from the same business account. Each invoice is linked directly to the bank account: receipts are automatically recognized, which offers an instant view of the cash flow.

The user can activate automatic reminders of unpaid invoices, choose their frequency and track payments in real time, without manual reprocessing.

The tool does not allow multi-project management or direct invoicing, but perfectly meets the needs of freelancers and small structures who are looking for speed, compliance and serenity in their daily management.

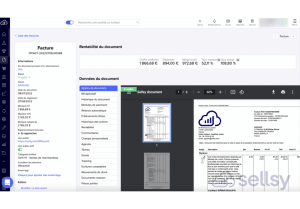

Stafiz, the integrated project invoicing solution

🏷️ Tool Type: SaaS ERP for service companies (agencies, consulting firms, IT Services, design offices).

⚙️Key features:

- Automatic invoicing from project monitoring, in direct or fixed price mode;

- Comprehensive and integrated project lifecycle management in a single environment;

- Invoicing monitoring and cash flow forecasting in real time;

- Native integration with leading accounting software;

- Multi-format and multi-software accounting export.

Ideal for: consulting firms, IT companies, multi-mission agencies, engineering firms.

Target company size: SMEs to mid-caps (from 10 to 2,000 employees).

Benefits:

- Complete centralization of the invoicing project ↔ process.

- A detailed view of profitability to date, and of projected profitability.

- Compatible with all billing models: control room, flat rate.

- Multi-entity and multi-country consolidation, suitable for SMEs and mid-caps organized in subsidiaries or with international teams.

Points of vigilance:

- Requires initial setup to fit your internal processes.

- More complete tool than traditional invoicing software, less suitable for small structures.

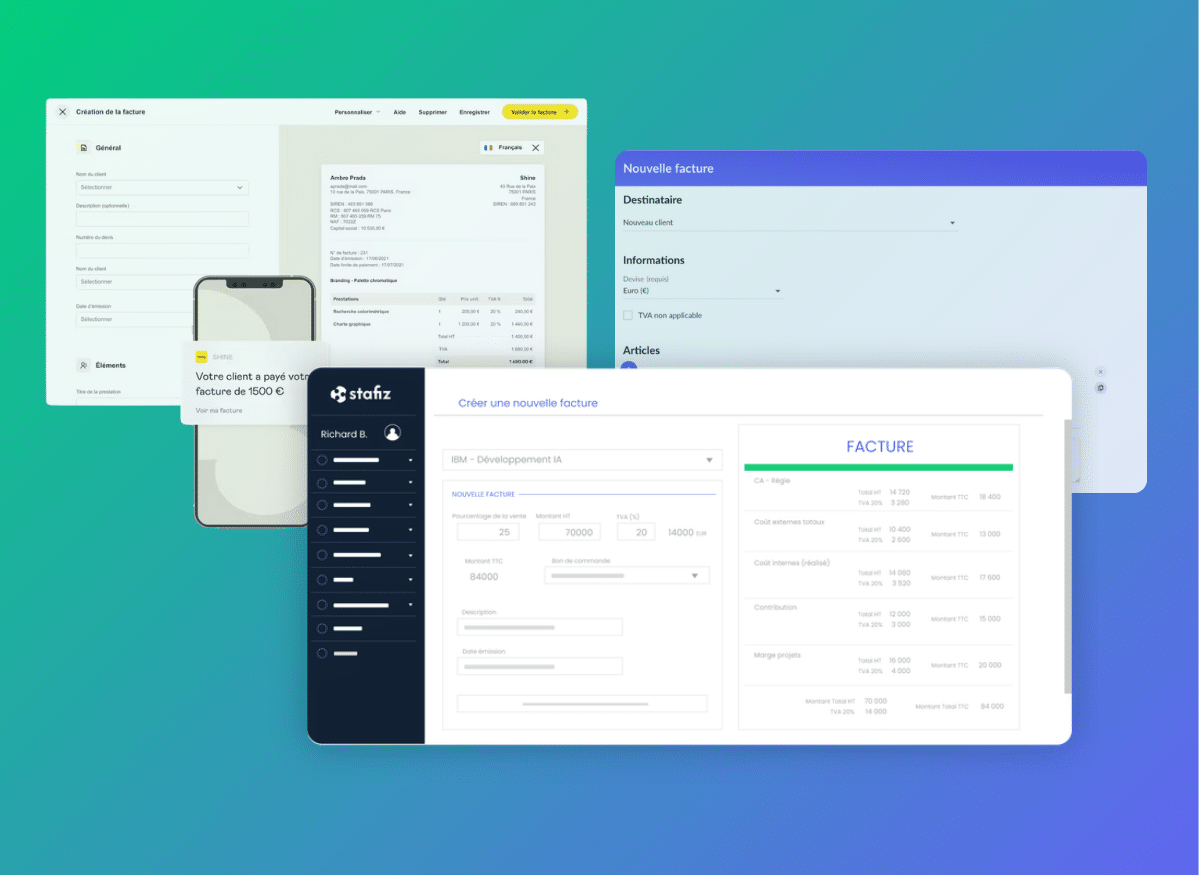

Automatic invoicing from project tracking

Invoicing in Stafiz is based directly on project tracking data. Each time entered, each milestone validated, each phase delivered automatically triggers the corresponding invoicing.

- In the time and expense department, the time entered and validated can be transformed into invoices instantly, without manual reprocessing. The validation workflow secures the invoicing process and avoids oversights.

- At a fixed rate, milestones are configured as soon as the mission is launched: each closed phase triggers the corresponding invoice. This way, you avoid the problems of reconciling and managing overdue invoices.

This automated invoicing significantly reduces cycle time and makes the end-to-end process more reliable.

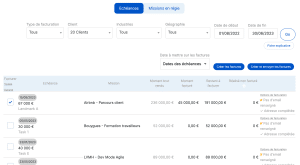

Stafiz centralizes and automates billing follow-up. Each line corresponds to a customer assignment and includes all the information necessary for the creation and management of invoices: due date, gross amount sold, amount already invoiced and remaining to be invoiced.

The objective is twofold: to reduce invoicing times and to secure cash flow by eliminating errors and oversights.

Comprehensive and integrated project lifecycle management

Stafiz is a SaaS solution designed for multi-project service companies, which covers the entire project lifecycle, from quote to financial close. It is also one of the best business-oriented ERPs for service companies.

Here are some additional features.

- Create quotes and sales opportunities directly in the tool, with the ability to pre-staff assets before signing.

- Follow-up of purchase orders.

- Management of rebillable expenses (fees, purchases, subcontracting).

- Monitoring of profitability, time, and miscellaneous expenses (fees, purchasing, subcontracting) taking into account direct and pre-sales costs.

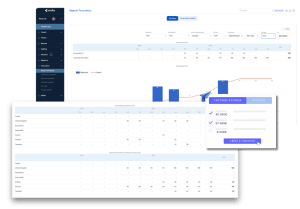

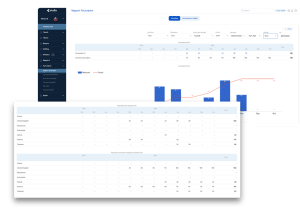

CFOs, operations managers, and project managers have a consolidated view of actual and projected margin, by customer, mission, or entity. This visibility allows them to adjust load, budgets or resource allocations in real time.

Stafiz makes it possible to calculate the real margin of a project by cross-referencing production costs and the associated revenues. The amounts are broken down by profile and by type of expenditure. This view allows you to link operational data (time, costs, resource planning) to economic performance.

Invoicing monitoring and cash flow projection

Finance managers have access to a view of the actual and projected invoicing forecast, which reduces the billing cycle time and improves your cash flow:

- Tracking issued, paid, and pending invoices

- visualization of Invoices to be Established (FAE), by project, customer or entity to know the remaining to be invoiced in real time;

- Mass invoicing and automated reminders to speed up collections;

- multi-country and multi-BU consolidation for a global reading of turnover.

Stafiz structures financial data around invoicing. Each entity, country or BU has its own KPIs (invoiced revenue, cumulative, margins). The summary table allows automatic consolidation at the group level.

Accounting integration and interoperability

Stafiz integrates naturally with the main accounting software (Sage, Cegid, Pennylane, QuickBooks, etc.). Accounting entries and expense journals can be automatically transmitted to your accounting tools, without manual reprocessing.

For more complex environments, Stafiz also offers:

- Native integration with your existing financial systems

- a multi-format accounting export (journals, entries, expenses, expenses) compatible with the majority of software on the market,

- and a complete REST API to automate data exchanges between departments (finance, HR, CRM, BI, etc.).

The objective: to make financial data more reliable and to streamline the transition between production, invoicing and accounting, while eliminating double entries.

Explore all Stafiz integrations

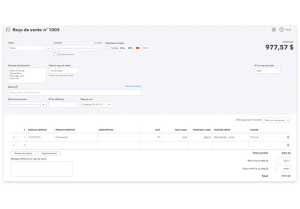

Sellsy, CRM and connected invoicing

🏷️ Type of tool: CRM suite + invoicing software VSE/SME + sales management.

⚙️ Key features:

- Unified view of the quotation pipeline→ order → invoice → reminder with traceability of customer exchanges;

- Management of subscriptions and recurring payments, integration of online payment solutions (Stripe, GoCardless, etc.);

- Integrated electronic signature to validate quotes and contracts without going through a third-party tool;

- Commercial reporting, margin monitoring, advance payment management and revenue forecasting from the pipeline;

- Synchronize contacts and business opportunities with invoicing, avoiding re-entry;

- Automation of customer reminders and centralized management of collections.

Best for: Communication agencies, commercial consulting firms, B2B startups.

Target business size: VSEs/SMEs (from 5 to 100 employees).

Benefits:

- Unified view of sales pipeline and invoicing, making it easy to convert opportunities into invoices.

- Modern, intuitive interface suitable for everyday use by non-technical sales teams.

- Complete CRM, quotes, and payments solution in one tool.

- Advanced automation of customer follow-up: reminders, subscriptions, revenue forecasts.

Points of vigilance:

- Not well suited to the management of complex missions: no time tracking, nor detailed management of internal costs.

- Limited analytical reporting on project profitability and production.

- Initial setup required to adapt automations to business processes.

Sellsy is primarily aimed at VSEs and SMEs looking for a unified sales management solution, without the complexity of an ERP.

Facture.net, a free invoicing tool

🏷️ Type of tool: 100% free invoicing software (by BIC / Cegid)

⚙️ Key features:

- Creation of quotes and invoices in accordance with legal standards (mandatory information, VAT, automatic numbering)

- Management of the customer base and sending of invoices directly from the platform;

- Follow-up of payments, simplified dashboard with payment indicators and automatic reminders;

- Compatibility announced with electronic invoicing and the Factur-X standard to anticipate the 2026 reform.

Ideal for: Self-employed people, freelancers, independent consultants, micro-enterprises, small structures without an accounting department.

Target company size: Freelancers and VSEs (1 to 10 people).

Benefits:

- Total free, with no subscriptions or hidden fees;

- Clear and intuitive interface, suitable for non-management specialists;

- Compliant solution hosted in France, guaranteeing data security and legal compliance.

Points of vigilance:

- Limited functionality: lack of project management, time tracking, or profitability;

- No advanced integration with external accounting or CRM tools, which restricts invoice automation;

- Basic reporting, without performance indicators or cash flow forecasts.

Facture.net is distinguished by its simplicity and gratuitousness, ideal

ale for freelancers, graphic designers or micro-entrepreneurs who want to invoice without going through a paid accounting tool. Although limited in terms of analytical functions and multi-project management, Facture.net remains an effective solution for launching a business or managing a micro-business.

QuickBooks, the international invoicing and accounting software

🏷️ Tool Type: Cloud-based accounting and invoicing software.

⚙️ Key features:

- Creation of customizable quotes and invoices, with automatic VAT calculation and compliant numbering;

- Automatic payment tracking and reminders, with configurable reminders and integrated bank synchronization;

- Analytical monitoring by customer, mission or product, allowing a segmented financial reading;

- Comprehensive financial reporting: consolidated profitability, expenses, margins and cash flows;

- Native integrations with third-party tools (PayPal, Stripe, Shopify, HubSpot, Zapier, etc.) make it easy to sync accounts and manage accounts receivable.

Ideal for: IT Services, agencies, growing startups and international structures.

Target company size: VSEs/SMEs, growing startups, international structures.

Benefits:

- Global reputation and technological stability, supported by more than 7 million active users worldwide;

- Modern interface with a user experience designed for non-experts;

- Excellent reporting and integration capabilities, particularly useful for multi-activity or multi-currency performance monitoring;

- Real-time bank synchronization, ensuring clear visibility into cash flow.

Points of vigilance:

- Partial French localization: some functionalities (e-invoicing, FEC export, legal notices) are not yet fully adapted to local requirements;

- Lack of fluidity for complex project templates ;

- Dependence on the internet connection and risk of performance loss in the event of a large multi-currency synchronization.

QuickBooks' strength lies in the centralization of financial operations: each invoice, expense or payment is automatically linked to the company's bank account, facilitating the monthly closing and the monitoring of cash flow. The tool combines automation and analytics, making it particularly suitable for businesses that want to track their financial performance without in-depth accounting.

Less suited to project management needs than ERPs such as Stafiz, QuickBooks remains a safe bet for international service companies looking for a cloud-based invoicing tool that can keep up with their growth.

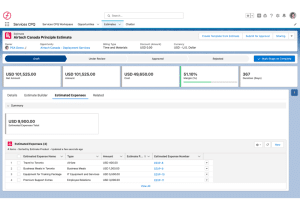

Certinia – formerly FinancialForce (Salesforce PSA)

🏷️ Tool Type: PSA (Professional Services Automation) fully integrated with the Salesforce ecosystem.

⚙️ Key features:

- Complete project tracking : resource planning, tracking of times and deliverables directly related to the Salesforce pipeline;

- Automatic billing based on the time entered, milestones reached or the packages provided for in the contract;

- Native link to Salesforce CRM, allowing you to instantly convert a sales opportunity into a mission with the associated budgets, resources, and deadlines;

- Tracking revenue, costs and margin per project, with multi-entity financial consolidation;

- Analytics dashboards built into Salesforce, showing real-time project progress, team load, and projected revenue in real time.

Ideal for: International consulting firms, IT Services, B2B agencies integrated with Salesforce.

Target company size: 100 to 2,000 Salesforce users, mainly in structures operating on an international scale.

Benefits:

- Unified view of the full cycle : pipeline → project → invoicing, without data breaks;

- Automate workflows between sales, production, and finance, reducing manual entries;

- Robust and modular tool, ideal for multi-entity and multi-currency management within international groups;

- Native integration with the Salesforce ecosystem: interconnected CRM, dashboard, resource management, and reporting.

Points of vigilance:

- Strong dependence on Salesforce : the tool cannot be used outside of this environment;

- High licensing cost, both for Salesforce and for the PSA module;

- Significant learning curve, requiring expert support for deployment and customization.

FinancialForce (now integrated under the Certinia PSA brand) is aimed at companies whose project management is closely linked to business performance. The major advantage of this solution lies in the continuity of the data: the information from the CRM (contracts, forecasts, opportunities) feeds directly into the monitoring of missions and accounting.

On the other hand, this technical power comes at a cost: FinancialForce is a premium tool, more suitable for mature organizations that already have a Salesforce infrastructure.

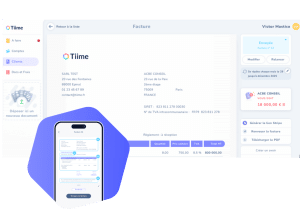

Tiime, the invoicing of technical professions

🏷️ Type of tool: SaaS invoicing and accounting management solution, designed for professionals in construction, engineering and technical professions

⚙️ Key features:

- Creation of unlimited quotes and invoices, fully customizable and compliant with legal obligations;

- Automatic payment tracking and customer reminders, with due date notifications and secure document archiving;

- Direct connection to Tiime Business, the accounting and cash management module, to centralize revenues, expenses and receipts;

- Dematerialization of invoices : sending, receiving and storing electronic invoices in accordance with the Factur-X standard, in compliance with the 2026 reform;

- VAT management and accounting export compatible with the main accounting software.

Ideal for: Design offices, project management, construction craftsmen, engineering.

Target company size: Self-employed, VSEs/SMEs in the construction or engineering sector.

Benefits:

- Free and easy-to-use tool, suitable for structures without an internal accounting department;

- Full compliance with the 2026 e-bill regulation, with legal archiving and automatic sending of electronic invoices;

- Invoicing adapted to technical projects, including site progress, intermediate situations and balance invoices;

- Native connection with Tiime Business, to track cash flow, bank flows and social security contributions in one place.

Points of vigilance:

- Limited management features: Tiime does not track loads, milestones, or time spent on projects;

- Invoicing-centric tool with no advanced profitability analysis or margin forecasting features;

- Restricted customization for multi-user structures or organizations with multiple entities.

Tiime is aimed at technical professions who are looking for a simple and compliant solution to invoice without complexity. Its free, ergonomic and native accounting integration make it a relevant choice for VSEs and freelancers wishing to centralize invoicing, treasury and accounting in the same space.

Workday Professional Services Automation for Multinational Enterprises

🏷️ Type of tool: Cloud ERP combining financial management, HR and project management (PSA), designed for large service companies operating internationally

⚙️ Key features:

- Full automation of invoicing with management of deposits and internal validation forms, based on contracts, milestones or time entered. Billable amounts are calculated automatically based on project progress, without manual reprocessing;

- Detailed cost, resource and margin tracking, covering all stages of project cost management : planning, expenditure tracking, budget reconciliation and analysis of variances between forecast and actual;

- Centralization of financial and HR data : each employee, mission or expense is linked to an analytical account for complete traceability;

Multi-entity and multi-currency consolidation, providing a consolidated view of revenue, margins and costs at group level; - Integrated reporting and analytics, with dynamic dashboards connecting HR, financial, and operational KPIs.

Best for: Global groups, consulting firms, IT companies, HR companies, and complex service organizations requiring global consolidation of their financial and HR data.

Target company size: Large companies and multinationals (from 500 employees).

Benefits:

- Native integration between HR, finance and invoicing, ensuring full data consistency;

- Particularly powerful tool for consolidated reporting, offering an instant reading of profitability by mission, entity or region;

- Suitable for multi-country and multi-currency environments, with unified data flows for global management;

- Real-time monitoring of costs and margins, useful for finance departments who want to anticipate budget variances.

Points of vigilance:

- High licensing and implementation costs, reserved for large accounts;

- Complexity of deployment, requiring a significant configuration and change management phase;

- Not very suitable for medium-sized structures.

Workday PSA is for large companies looking for an integrated view of financial and human performance. The tool is part of a global management logic, capable of consolidating data from several countries, currencies and entities. On the other hand, its functional richness and technical complexity make it an oversized solution for SMEs: for a more operational and agile management, Stafiz remains a better adapted alternative.

What challenges does project invoicing software address?

Every service company faces the same paradox: the more assignments there are, the more difficult it is to keep track of invoicing. As long as the company has fewer than 15 to 20 people, managers, CFOs and project managers juggle Excel files, manual entries and email reminders. Except that all it takes is a forgotten invoice, a rate error or an unreported milestone for visibility on turnover to collapse.

This situation is very revealing of the lack of link between production and invoicing. And it's not a question of individual rigour. In many organizations, financial tools live on one side, management tools on the other.

The result: scattered data, missing validations and a loss of confidence in the numbers.

The real challenges that invoicing software will meet comes from the fact that each business line manages in its own way:

- The CEO wants to drive growth through financial visibility. To do this, he must have a clear vision of turnover, margins and cash flow and margins;

- The Director of Operations (COO) struggles to synchronize the project and finance teams in order to streamline the production ↔ and invoicing cycle;

- The CFO wants to secure and make the turnover more reliable, which implies both a consolidation of all the data, the automation of processes, and compliance management – all while keeping an eye on the cash flow;

- The project manager (PMO) tries to match progress, milestones and invoices issued without losing visibility on the rest to be invoiced. He needs a tool capable of invoicing in multi-model, to follow the progress of invoicing in real time, while relying on reliable data;

- The management controller wants to ensure that the project is profitable. He must be able to rely on a tool that shows him the margins, the differences between forecast and actual, and the financial KPIs.

- Human resources need to connect workload with performance. The software must be able to indicate the availability of employees, their billable utilization rate, and make the link between the time entered and the invoicing;

- Consultants want an easy-to-use tool that directly transforms their time entry into invoiced value.

- The sales manager tries to connect pipeline and invoicing so that each closed opportunity translates into revenue.

Eight roles, eight expectations, and the same need: to find coherence between the work done and the value produced. In fact, this tool is not only used to issue invoices. It connects the entire cycle of a project, from the quote to the cash flow, and restores consistency to the data entered at each stage. It is this unified vision that gives companies the ability to manage their profitability in real time, without breaks between teams and without loss of information.

SaaS project invoicing software such as Stafiz responds precisely to these challenges by linking management, finance and production.

What features should I look for in a project invoicing tool?

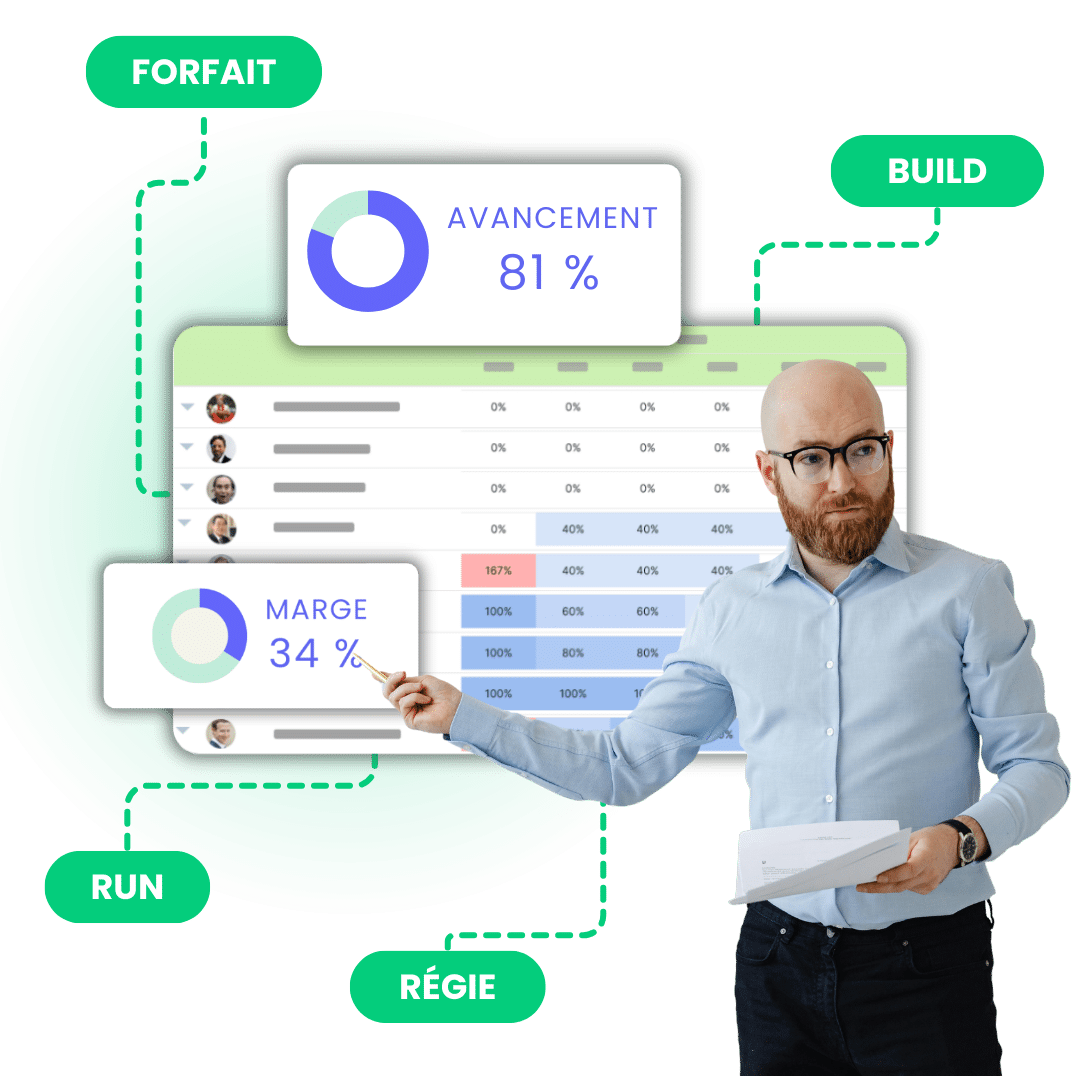

Multi-model billing management

Service companies and agencies often use several billing models depending on the nature of the assignment or contract:

- On-time: based on the time spent or the number of days sold. This model is particularly suitable for evolving support or consulting assignments.

- Fixed-price / deliverable: triggered when specific milestones or deliverables are reached. Ideal for projects with formal validation steps.

- Subscription-based: Used for support, maintenance, or support contracts, with regular payments.

- Mixed invoicing: combination of several methods on the same project, for example an initial flat rate supplemented by direct services.

Why it matters: Good project invoicing software should allow the model to be adapted to each contract, without having to recreate the entire invoicing structure or rules. This flexibility ensures consistent tracking and smooth invoicing, regardless of the complexity of the customer portfolio.

For example, Stafiz simultaneously manages projects on a time-based, fixed-price, milestone or subscription basis within the same interface.

Time, deliverables, and cost tracking

Accurate tracking of times, deliverables, and expenses is at the heart of profitability:

- Time entry by employee, mission and task, with a validation workflow by the project manager to avoid oversights or errors;

- Monitoring of rebillable expenses (travel, purchases, subcontracting) to ensure complete and compliant re-invoicing;

- Management of internal expenses (non-rebillable purchases, salary costs, pre-sales) related to each project to obtain a fair view of margins;

- Track deliverables and milestones that automatically trigger invoicing, ensuring consistency between production, progress, and revenue.

Why it matters: This level of granularity helps value every hour and expense at the right time. Ideally, the times entered and the deliverables validated should automatically trigger invoicing, reducing the risk of forgetting and cycle times.

Invoicing automation

Automation is an essential lever for saving time and securing your financial flows. Good software should allow:

- Automatic generation of invoices according to the rules specific to each contract (time management, package, milestones, subscriptions);

- Management of progress invoices to align invoicing and actual progress;

- Automated customer reminders and online payment support, to speed up collections;

- The automatic sending of electronic invoices (Factur-X, PDP, Chorus Pro formats) in accordance with the 2026 reform.

Why it matters: Automation significantly reduces errors, oversights, and administrative time, while improving cash flow.

For example, Stafiz and Tiime are two solutions that allow invoicing to be triggered directly from the project follow-up.

Liaison between operational management and invoicing

Invoicing can no longer be isolated from operational monitoring. The ideal tool should provide:

- A direct link between expenses, progress and invoicing, for seamless monitoring between production and finance;

- The possibility of invoicing from the realized or according to planned milestones, depending on the contractual model;

- The integration of the forecast (revenue forecast) into the financial pipeline, to anticipate future revenue.

Why it matters: This link ensures data consistency and helps turn operational monitoring into financial leverage.

The tools with this as their strength: Stafiz and FinancialForce

Multi-project and multi-client management

Service companies juggle several missions and contracts in parallel. A good tool should offer:

- A consolidated view of the entire portfolio;

- Dynamic filtering by customer, project manager, BU or type of activity;

- Automatic grouping of invoices for the same customer, even in the case of multiple projects;

- Overall monitoring of turnover and profitability by portfolio, entity or region;

Why it matters: This cross-functional vision allows management and PMOs to manage an entire portfolio, not an isolated mission, to effectively arbitrate priorities.

Profitability and Cash Flow Monitoring

Invoicing software becomes a real financial management tool when it integrates the right indicators:

- Automatic calculation of margins by mission, client or employee;

- Follow-up of issued, paid and unpaid invoices to anticipate cash flow tensions;

- Reporting of projected vs. actual revenue, updated in real time;

- Key indicators : billable utilization rate (Commercial and Economic Activity Rate), TMA, hourly profitability, and cash flow.

Why it matters: This is what transforms an invoicing tool into a financial management tool, capable of revealing the real performance of an activity.

The tools with this as their strength: Stafiz.

Collaboration and internal validation

Invoicing involves several actors: project managers, accountants, CFOs, management. The tool should facilitate coordination through:

- A validation workflow for time, expenses and invoices;

- Differentiated access rights according to roles (project manager, CFO, management);

- A complete and traceable history of approvals and changes;

- A customer portal for validating or viewing invoices.

Why it matters: Fluid, centralized validation reduces friction between project and finance teams, while ensuring process reliability.

Analytics features

A successful invoicing tool is not limited to generating invoices, it must provide a complete analysis of financial performance.

- Key indicators: projected turnover, margin, unpaid invoices, payment terms.

- Multi-level reporting (by project, client, consultant, entity).

- Automatic export to Power BI or Tableau, to go further in the analysis.

Why it matters: These features help drive profitability on an ongoing basis and anticipate HR or cash flow needs before they become critical.

Stafiz offers the most powerful project reporting tool on the market

Other criteria to be provided for

The different types of integrations

These integrations eliminate double entries and ensure data consistency across the entire finance project ↔ cycle.

- Automatic export to accounting software (Sage, Pennylane, QuickBooks, etc.).

- Synchronization with CRM (HubSpot, Salesforce).

- APIs or connectors with HR, reporting, BI tools.

Legal Compliance and E-Invoicing

This compliance is now a legal obligation with the 2026 reform and concerns:

- Automatic generation of invoices in accordance with the Factur-X standard ;

- transmission via PDP (Partner Dematerialization Platform);

- secure legal archiving (10 years minimum);

- numbering and automatic mandatory information.

In November 2025, only Stafiz, Shine and Tiime are fully ready for this reform.

Security and Hosting

Financial and customer data is highly sensitive. Secure hosting is essential to guarantee their confidentiality and integrity:

- Hosting in France or Europe, GDPR compliant.

- Management of access rights by user profile.

How to choose your project invoicing software?

A project invoicing tool is not limited to issuing invoices: it connects your financial data and your production data, makes turnover more reliable, and makes the margin manageable on a daily basis.

Here is our 5-step process for choosing the right software.

Define your goals

First of all, clarify which problem(s) your tool must address.

- How to save time on the creation and follow-up of invoices?

- How to automate quotes, reminders and payments?

- How can you monitor your cash flow and link it to your accounting data?

- How to analyze your profitability by mission or by client?

The more specific your objectives, the easier it will be to identify the right solution for your priorities (ease of use, process automation, data analysis, regulatory compliance, etc.).

Identify your friction points

These are the stages in which your current processes generate the most time wasted or errors.

- Manual timesheet entry.

- Employee forgetfulness.

- Validation too slow by managers or HR.

- Delay in validating deliverables.

- Delays in invoicing milestones.

- Forgetting expenses that can be rebilled.

- Non-billable time not properly integrated into the invoice.

- Etc.

These irritants determine the priority features: validation workflow, milestone automation, expense tracking, accounting integration, etc.

Select the right performance indicators (KPIs)

A good invoicing tool should help you measure and improve the profitability of your assignments. Prioritize tools that offer dashboards with these KPIs:

- Margin to date and margin to complete to track financial performance;

- All that remains is to invoice in order to anticipate future revenues;

- Cashflow per project to monitor operating cash flow;

- DSO (Days Sales Outstanding) to track payment terms.

These indicators allow you to transform your invoicing data into financial management levers, alerting you as soon as a project deviates from its objectives.

Compare and test multiple solutions

Compare the tools with your real data:

- Test 2 to 3 software programs on a sample of projects;

- Check software integrations (accounting, CRM, time management);

- Ensure compliance with the 2026 reform;

- Evaluate the overall cost of the tool for your use: license, training, support, add-ons or free/paid options as needed.

Involve your teams in the choice

Successful deployment depends on adoption by your users:

- Involve project managers, controllers and the accounting department from the test phase.

- Ask for feedback on ease of use, workflow logic, and data visibility.

Questions:

Project invoicing software is much more than just a document editor: it integrates into the entire project cycle. It makes it possible to manage time and costs by comparing the actual with the forecast and to automate invoicing according to different contract models.

Technically, it is possible to use Excel to generate invoices, but this is strongly discouraged and carries legal risks. In France, the law requires that the billing system guarantee the inalterability, security and archiving of data. Excel doesn't meet these requirements: certified software is required to ensure tax compliance and avoid penalties. With the reform of electronic invoicing, this practice will soon be banned.

The invoicing software tracks profitability by comparing the revenue generated from invoicing to the actual costs charged to the project. It provides dashboards and metrics like gross margin and resource billing rate. This real-time monitoring makes it possible to quickly identify budget drifts and optimize profitability.

To reduce errors, the software should automate the conversion of posted timesheets and expenses into invoices, eliminating manual re-entry. To prevent non-payment, it is essential to activate automatic reminders as soon as payment deadlines are exceeded. Fast and transparent invoicing, based on validated data, also limits disputes with customers.

Professional Services Management (PSA) tools or service-oriented ERP are the most suitable. They manage transactions between subsidiaries (intercos) or between departments (intracos), track the time spent for another entity, apply internal rates and automate internal re-invoicing.

PSA software and advanced project management systems support milestone invoicing. When a milestone is reached and validated by the customer, the system automatically generates an invoice corresponding to the predefined amount, simplifying contract monitoring and cash flow.

These are mainly the timesheet software integrated with project invoicing systems. Once validated by the project manager, the hours are converted into billable positions according to the hourly rates of the contract.

PSA software and project management solutions are designed to do just that. For fixed-price projects, they allow you to establish an overall fixed amount at the outset and to track internal costs against the budget to guarantee the expected margin.

Yes, modern PSA software like Stafiz offers this flexibility. They allow you to configure mixed invoicing lines in the same project: one part as a fixed fee (for deliverables) and another as a direct part (for adjustments or extensions).

Yes, most PSA software and advanced project invoicing solutions allow this. They offer the possibility of grouping together on a single invoice the billable items (time, expenses, milestones) of several projects of the same client, thus simplifying administrative management and accounting.