Invoicing: How To Get Paid Faster For Your Projects?

The longer it takes for a receivable to be settled, the greater the risk of non-payment .

You then understand why it is essential to closely monitor your invoicing in order to avoid unpaid bills, but also delays. Indeed, a simple delay in payments can jeopardize the company as a whole.

Fortunately, there are several methods to get paid faster by your customers. In this article, we will see why cash flow management, i.e. the difference between the inflows and outflows of money at a given time, is essential, and we will offer you concrete solutions to speed up invoicing.

1. How do you estimate costs, prices, and billing type for a billable project?

2. How to manage the risks of project overruns?

3. How can I get paid faster by customers?

4. How to manage complex billing arrangements

5. How do I take into account the invoicing of taxes? What about multi-currency billing?

6. How to manage invoicing between different entities of the same company (intercompany flows)

7. How can we simplify communication with customers?

8. How can I modify certain parameters that will impact invoicing during projects?

9. How to set up a project quoting and invoicing tool?

What Are the Challenges of Cashflow In Project Management?

For fixed-price billing

- Segment billing

Flat-rate billing involves a price defined in advance, regardless of the time spent. To limit any risk of non-payment, it is preferable to segment invoicing, and this can be done in several forms:

- Fixed-price billing based on a deadline of dates

In this case, we recommend that you clearly define the deadlines, amounts and invoice dates in a project schedule at the beginning of the project. This will avoid any misunderstandings with the customer but will also help them to organize themselves so that they pay you on time.

- Fixed price billing based on the achievement of deliverables.

Invoicing is triggered upon delivery of the deliverable or milestone, defined in advance.

In addition, it is possible to ask for a deposit in certain fields such as construction or events. This allows the customer to be hired and to have the funds available to advance the costs necessary for production.

- Promote fast collection

Improving cash flow also requires quick collection of invoices. Indeed, it makes it possible to cover expenses in good time, especially for the remuneration of service providers.

Optimized expense management is therefore essential, in order to avoid too large a gap between the recognized revenue, based on actual progress, and invoicing. Otherwise, the risk is that you will have to call on unlocked funds, thus threatening profitability.

In addition, a quick collection ensures that all the work already done is well paid.

For time-based invoicing

In the case of time-spent billing, the worked time is invoiced. Thus, the smoother the time tracking and its management, the less time is taken. The faster invoicing and collection can be. It should be noted that projects under direct management are generally invoiced monthly.

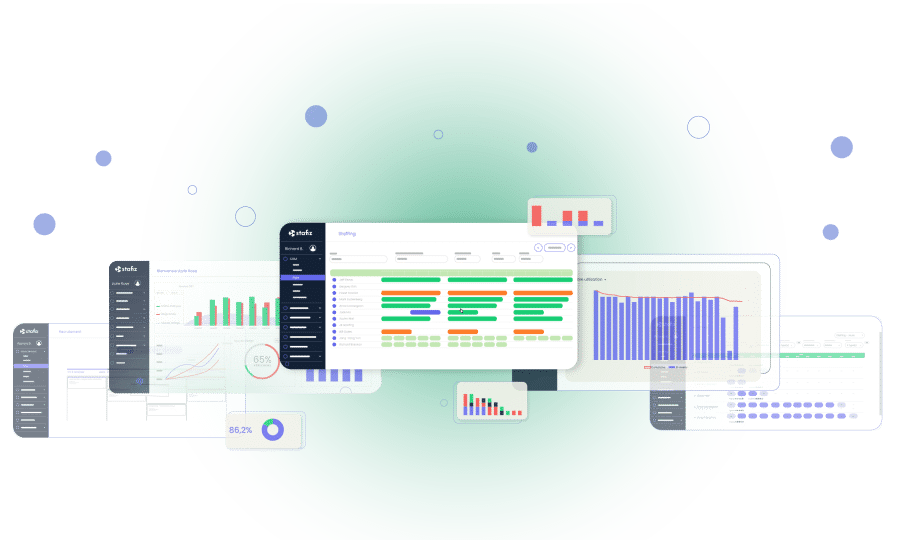

Time management can be optimized through the use of time tracking software like Stafiz. This type of tool helps to avoid billing errors, which can lead to discounts in order to maintain an optimal customer relationship. However, discounts impact profitability and also generate additional time for project management and conflict management.

For a subscription billing model

Subscription billing applies to regular, long-term projects, such as maintenance or licensing.

These types of projects are billed on a per-period basis, usually per month. Recurring and predictable, this invoicing format can be automated using invoicing software.

Stafiz supports these different billing models!

Why Is Billing Fast Crucial?

An invoice awaiting payment is likely to be forgotten. Thus, the faster an invoice is sent, the more likely it is to be processed, and the customer payment will be quick.

In addition, it is a question of context: the closer an invoice is sent to the end of the assignment, the higher the perceived value . Also, a late invoice can send the message that there is no emergency.

The earlier the invoice is sent, the more you can start the first phases of the reminder. Several features offered by billing management tools allow you to obtain visibility in order to implement a dunning strategy :

- an automatic reminder system,

- updating paid/unpaid statuses,

- the connection between the bank account and the invoicing solution.

What Actions Can Be Taken to Speed Up Invoicing?

Using an invoicing software

One solution to improve cash flow and promote a short payment term is to speed up invoicing with dedicated software. Indeed, it allows data to be centralized in one place and to be quickly inserted on invoicing documents.

- Take advantage of the alert and notification system

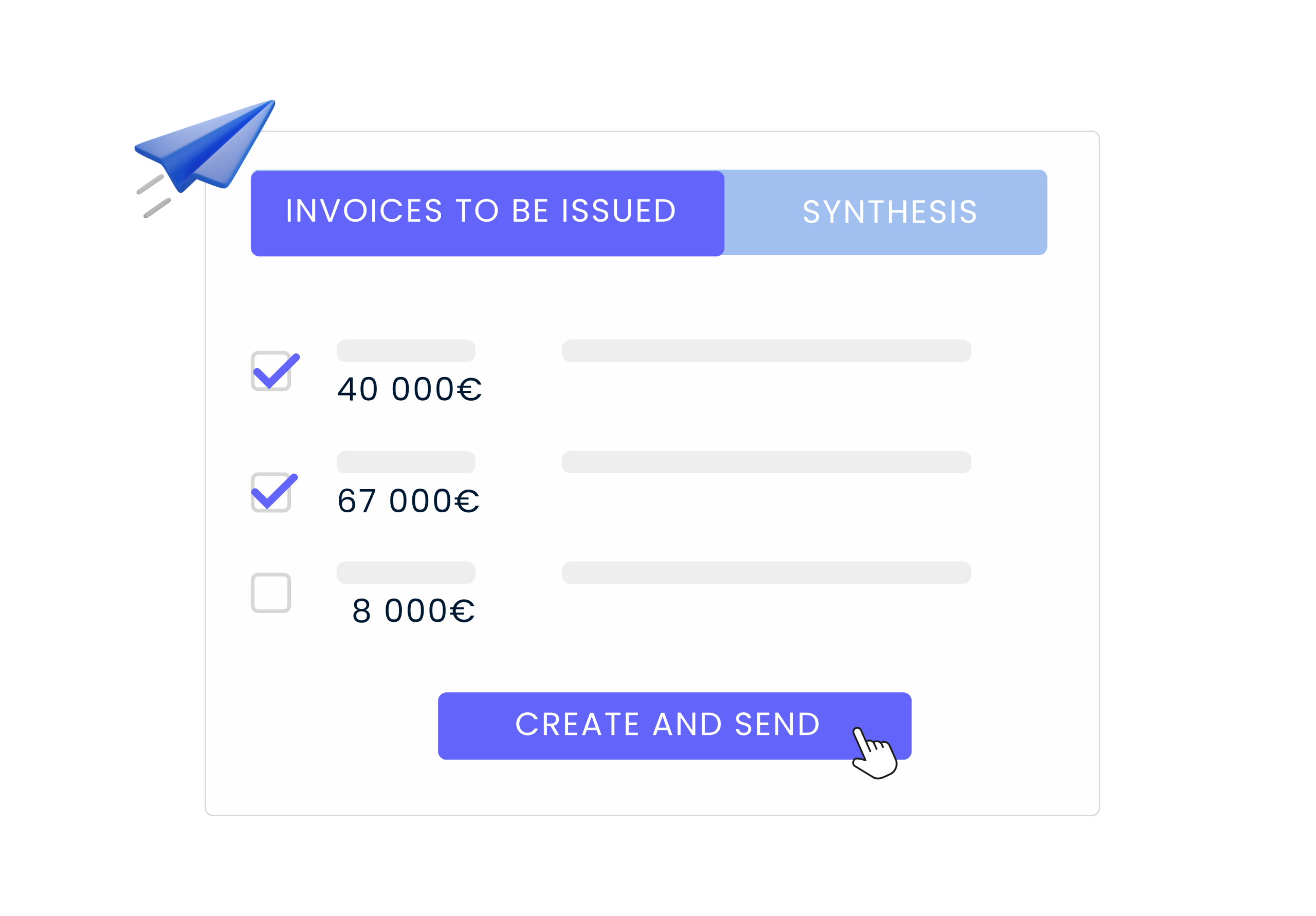

Invoicing software like Stafiz allows you to set up alerts, for example to receive a notification when a deliverable or the project is completed.

With one click, you can activate the automatic triggering of invoices once a deliverable is completed.

- Automate

Other features help speed up invoicing, such as automatic invoice generation.

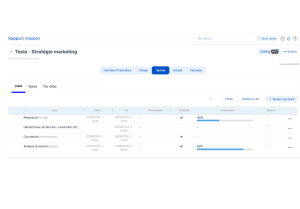

Tracking billing

To get paid faster by customers, it is essential to follow up on your invoices as soon as they are issued. This involves setting up a rigorous invoicing follow-up, where each invoice is assigned a status.

By sorting your invoices by it, you quickly gain visibility into which due invoices need to enter the dunning process.

Implementing a chargeback strategy

Contrary to popular belief, following up with a customer for a late invoice is not necessarily badly perceived because it demonstrates your professionalism and rigor.

In addition, this follow-up can represent an opportunity to strengthen your relationship. By better understanding the reasons for the delay, you can consider accommodating solutions such as discounting or installment.

The management of reminders benefits from being automated in order to save time and mental load. Thus, a strategy for managing chargebacks includes, among other things:

- the implementation of automatic notifications to be alerted in the event of non-payment,

- the designation of the persons responsible for each task (follow-up of invoices, customer reminders),

- the definition of recovery scenarios.

These should be tailored to your business, your customers, and your industry. Consistent, gradual, they must take into account various criteria such as the amount due and the time of delay.

How To Get Your Customers To Pay Projects Faster?

Edit complete and clear invoices

To speed up customer payments, it is essential to minimize the action required of your customers. By sharing clear, complete, and error-free invoices, you increase the chances that your invoice will be processed quickly. If you make a mistake, you may extend the processing time.

Here is the information that should appear:

- the invoice number with the reference of the quote or order,

- the invoice date and the date of service,

- the identity of your company, that of your buyer and your contact: you must be easy to reach in case of questions,

- the individual VAT identification number, the applicable rate, where applicable,

- the price, detailed in a precise manner in order to limit any questioning,

- Payment information : payment terms, accepted payment methods, payment deadlines, late payment penalties and bank details.

Clearly state the conditions for late payment

The conditions of late payment penalties must be clearly stated on your invoices. Not only is this mandatory mention, but it also encourages the customer not to pay late.

Digitize invoicing

An invoice generated and sent online, by email or via invoicing software is more likely to be paid quickly. Indeed, it prevents it from being lost and allows you to keep a written record.

In addition, the dematerialization of invoices is underway and the obligation of electronic invoicing will become mandatory for the majority of companies in 2026.

Building and maintaining a good customer relationship

Finally, our most effective recommendation to get paid faster by customers is to maintain a good relationship with your customers. The happier a customer is, the faster they pay.

Thus, we encourage you to identify the right contact person and to contact him or her at the right time to send your invoices. In addition, certain practices help to promote good exchanges, such as thanking when an invoice is paid, or attaching a personalized message when sending the invoice.

Finally, offering a discount for customers who pay in advance can be an effective strategy if you want to get paid as quickly as possible.

An optimized cash flow is largely dependent on efficient billing management. Thus, it is essential not to let late payments set in. One way to get paid faster is to invoice as quickly as possible and to be as clear and precise as possible in the editing of your invoices. Otherwise, other solutions exist, such as focusing on customer relations.

In any case, it is essential to rigorously monitor your invoicing and to consider a follow-up strategy, both systematic and gradual. An invoicing management tool will help you save time, as well as accuracy.

Questions:

Fill in all the essential information (contact details, number, date, details, payment terms) and add the references required by the customer. The clearer and faster the invoice is sent, the more likely it is to be paid without delay.

Yes, their mention is mandatory and dissuasive. They remind the customer of the importance of meeting deadlines and secure your cash flow, even if they are not always applied.