Heures non facturables : enjeux et solutions pour les chefs de projet

La gestion des heures facturables et non facturables est un défi crucial pour les entreprises dont le chiffre d’affaires repose sur la prestation de services, comme les cabinets de conseil, les cabinets juridiques et les agences créatives.

Si les heures facturables génèrent des revenus directs, le temps non facturable reste essentiel mais peut impacter la rentabilité s’il n’est pas bien maîtrisé.

Dans cet article, nous allons explorer ce que sont les heures non facturables, pourquoi elles sont importantes et comment les entreprises peuvent optimiser leurs opérations pour réduire les inefficacités, améliorer la productivité et renforcer leur performance financière.

Qu’est-ce que les heures non facturables ?

Temps et heures non facturables : définition

Les heures non facturables correspondent au temps que les employés consacrent à des tâches qui ne génèrent pas directement de revenus pour l’entreprise.

Contrairement aux heures facturables, qui sont imputées aux clients, les heures non facturables concernent des activités essentielles au bon fonctionnement de l’entreprise, au développement des employés et à l’acquisition de nouveaux clients.

Exemple de tâches non refacturables

Voici quelques exemples d’activités non facturables courantes dans le conseil et d’autres secteurs.

- Tâches administratives : emails, réunions internes, gestion des processus.

- Formation et développement : montée en compétences, partage de connaissances en interne.

- Projets internes : amélioration des processus, documentation, mise à jour des politiques internes.

- Développement commercial : réseautage, marketing, rédaction de propositions commerciales.

Différence entre tâches facturables et non facturables

Le critère principal pour distinguer une heure facturable d’une heure non facturable est la possibilité de la facturer au client.

Cependant, certaines tâches sont souvent mal classifiées, entraînant des erreurs de suivi et une perte de revenus.

| Temps facturable | Temps non facturable |

|---|---|

| Réunion avec un client | Réunion interne d’équipe |

| Élaboration d’une stratégie client | Développement de la stratégie interne de l’entreprise |

| Recherche demandée par un client | Recherche personnelle pour développer ses compétences |

Pour éviter ces erreurs, les entreprises doivent mettre en place des politiques claires en matière de suivi du temps et fournir des directives précises sur la classification des heures facturables.

Pourquoi le suivi des heures non facturables est-il important ?

Le suivi des heures non facturables est essentiel pour comprendre l’impact de la gestion des temps sur la rentabilité, l’allocation des ressources et l’engagement des employés.

Comprendre l’impact financier

Un volume trop important d’heures non facturables affecte directement la rentabilité.

Chaque heure passée en réunions internes, sur des tâches administratives ou au développement commercial est une heure en moins consacrée aux missions client.

Bien que ces activités soient nécessaires, un excès d’heures non facturables peut entraîner une baisse des revenus, un déséquilibre du flux de trésorerie et une difficulté à faire évoluer l’entreprise.

Les coûts cachés des heures non facturables

Beaucoup d’entreprises sous-estiment l’impact des heures non facturables sur leur rentabilité. Elles entraînent notamment :

- une diminution du chiffre d’affaires car moins de temps facturable signifie moins de revenus ;

- des inefficacités opérationnelles en raison d’un mauvais suivi des heures non facturables qui peut entraîner un sous-emploi des ressources et des opportunités de revenus manquées.

Quels sont les défis des heures non facturables ?

La gestion du temps non facturable est un exercice d’équilibre.

Voici les principaux défis auxquels les chefs de projet sont confrontés.

Une allocation inefficace des ressources

Lorsque trop de temps est consacré à des tâches internes non liées aux clients, les équipes peinent à atteindre leurs objectifs d’heures facturables.

Cela est souvent dû à :

- une priorité excessive accordée aux tâches administratives ;

- un manque de visibilité sur l’utilisation du temps, c’est-à-dire une absence de suivi des activités ;

- une mauvaise allocation des ressources entraînant une sous-utilisation des talents facturables.

Un manque de comptabilité et de suivi

De nombreuses entreprises ne suivent pas correctement la distinction entre heures facturables et non facturables, ce qui entraîne :

- une sous-déclaration des heures facturables, réduisant ainsi les revenus ;

- une absence de comptabilité concernant l’excès de travail non facturable ;

- une planification et un budget de projet imprécis.

Un système de suivi du temps permet aux entreprises de mieux contrôler ces heures et d’éviter ces problèmes.

Moins de temps consacré à la croissance stratégique

Lorsque les employés passent trop de temps sur des tâches non facturables à faible valeur ajoutée, ils ont moins de temps pour des activités stratégiques comme :

- le développement commercial, qui renforce les relations clients ;

- la formation et le développement des compétences, qui améliorent la qualité des services ;

- l’innovation et la planification stratégique, qui préparent l’entreprise à la réussite future.

En réduisant le temps non facturable, les entreprises peuvent consacrer plus de ressources à leur croissance stratégique et à leur succès à long terme.

Les stratégies pour optimiser la gestion des temps non facturables

Pour surmonter ces défis, les entreprises doivent mettre en place des systèmes de suivi clairs, optimiser leurs processus et définir des politiques précises.

Les stratégies suivantes vous aideront à minimiser les inefficacités liées aux heures non facturables, à améliorer l’allocation des ressources et à garantir l’engagement des employés tout en maintenant des taux de charges optimaux.

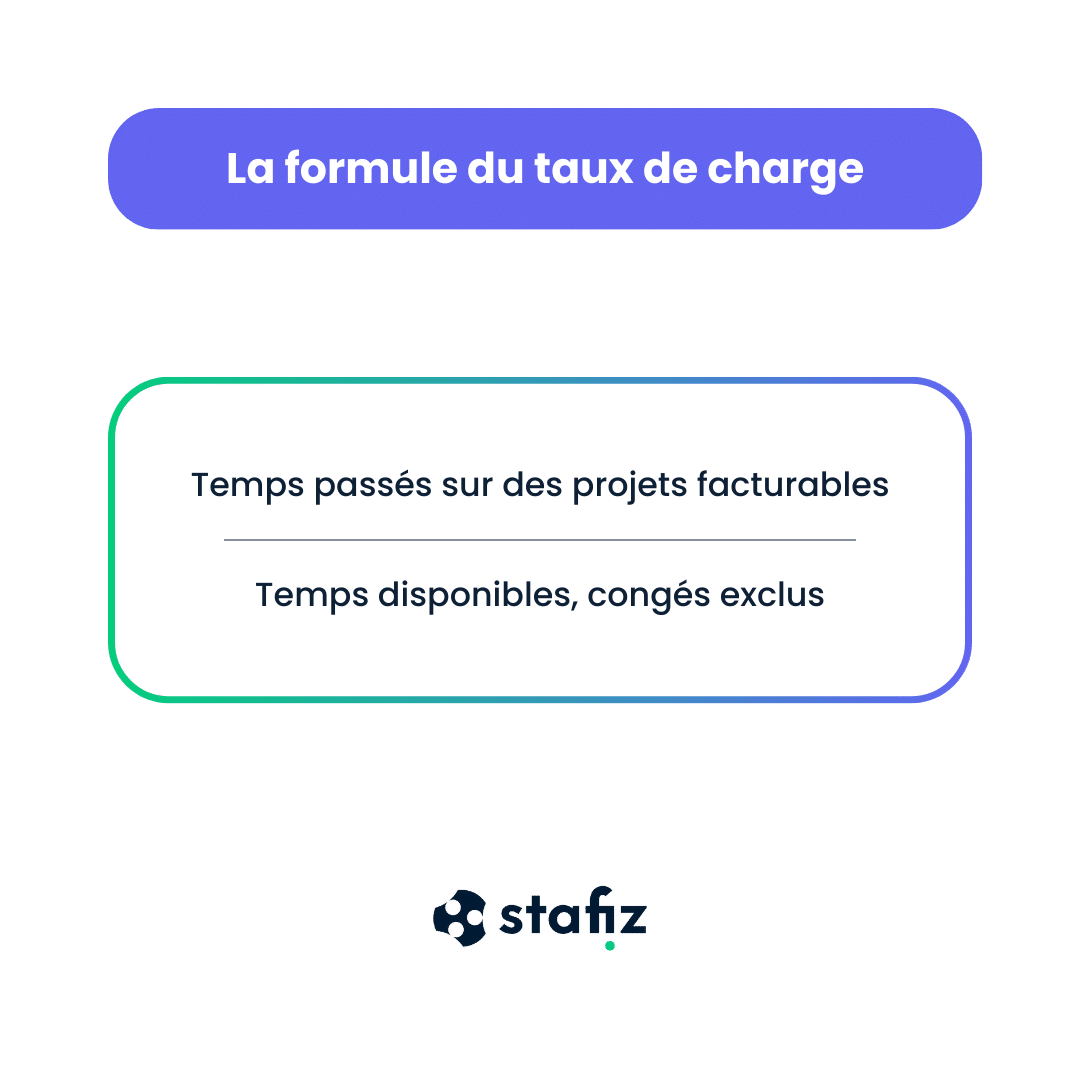

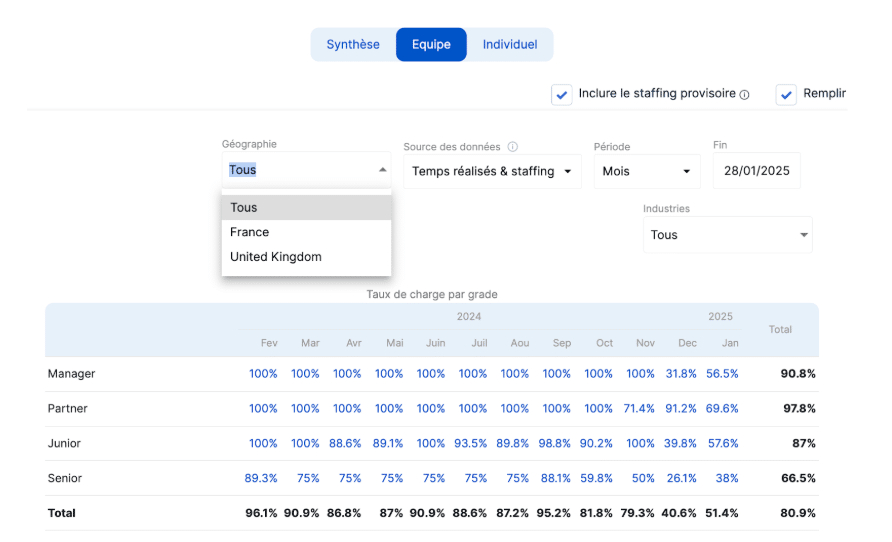

Suivre les taux de staffing avec un outil de gestion du temps

On dit souvent que l’on ne peut améliorer que ce que l’on mesure.

Un suivi précis des heures facturables et non facturables permet aux entreprises de prendre des décisions éclairées en matière de gestion des effectifs, de pilotage des projets et de rentabilité globale.

Sans un suivi rigoureux, elles risquent de souffrir d’une allocation inefficace des ressources, de charges de travail déséquilibrées et de marges bénéficiaires inférieures aux attentes.

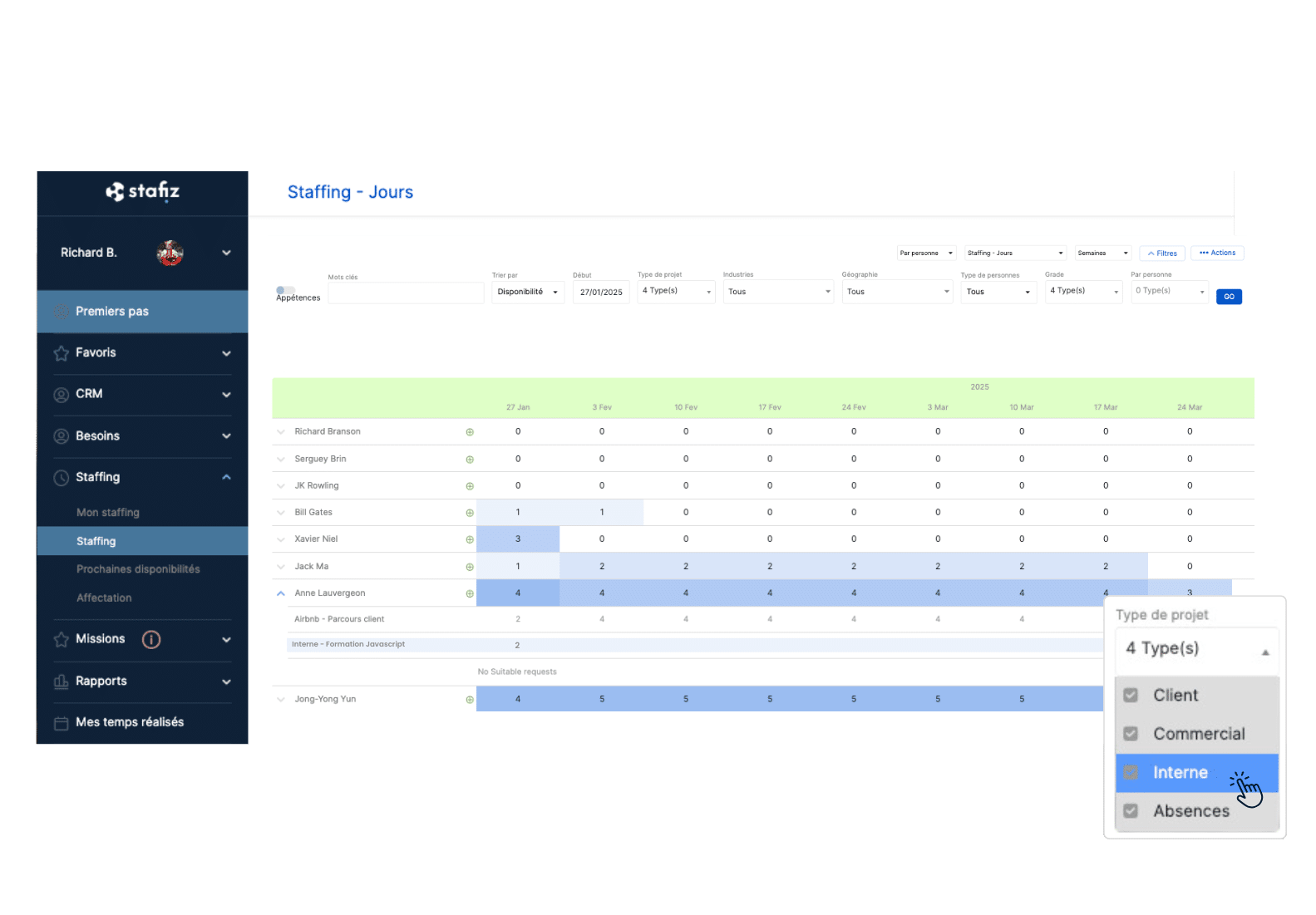

En utilisant un outil de suivi du temps comme Stafiz, les entreprises peuvent :

- optimiser la gestion des effectifs en s’assurant que les employés sont affectés efficacement aux projets facturables ;

- améliorer la prévision des projets en identifiant les tendances liées au travail non facturable et en ajustant la planification des ressources en conséquence ;

- augmenter la rentabilité en minimisant les heures non facturables inutiles et en donnant la priorité aux missions facturables.

Stafiz offre notamment plusieurs fonctionnalités pour simplifier le suivi du temps.

- Le suivi des projets internes et externes pour une vision complète de l’allocation du temps.

- L’enregistrement des heures avec facilité via une application mobile ou une interface desktop, garantissant une saisie rapide et accessible.

- L’exclusion des heures non facturables des rapports d’utilisation pour mesurer avec précision l’efficacité de la charge de travail facturable.

Réduire les tâches non essentielles et optimisation des processus

Réduire le temps non facturable implique d’éliminer les inefficacités dans les opérations internes.

De nombreuses entreprises perdent inconsciemment des heures sur des tâches administratives à faible valeur ajoutée, qui pourraient être optimisées ou automatisées.

Pour réduire ces heures non facturables inutiles, les entreprises devraient :

- automatiser les tâches administratives telles que les e-mails, la planification et la facturation afin de libérer du temps précieux pour le travail facturable ;

- rationaliser les processus internes en supprimant les flux de travail redondants et en améliorant la collaboration ;

- utiliser un logiciel PSA (Professional Services Automation) pour gérer les ressources et optimiser l’exécution des projets.

Stafiz propose des fonctionnalités avancées de planification des ressources pour aider les entreprises à réduire le temps non facturable et à améliorer leur efficacité opérationnelle.

- Gestion des ressources

Profitez de tous les outils pour pré-staffer, sélectionner, allouer et ré-affecter vos ressources. C’est la fin des réunions de staffing à rallonge et des communications multi-canal, réduisant considérablement le risque d’erreurs humaines.

Les taux de charges sont optimisés : les collaborateurs sont toujours occupés, jamais sur-chargés.

Gardez la vue sur les disponibilités de chacun pour une affectation rapide !

- Pilotage de projet

Paramètrez des notifications qui s’activent automatiquement lorsqu’un livrable est prêt. Les responsables et contributeurs des tâches dépendantes pour pouvoir fluidifier la collaboration.

Fini la saisie manuelle de données ! Le suivi des temps s’actualise aux rapports d’avancement et de performance pour suivre le prévisionnel financier et automatiser les clôtures comptables automatiques.

- Facturation

Les livrables déclenchent la facturation automatique d’un client pour améliorer votre trésorerie !

Profitez de fonctions d’envoi de masse, mais aussi des rappels d’impayés automatisés.

Définir clairement les attentes et les objectifs

L’un des plus grands défis auxquels les entreprises sont confrontées avec le travail facturable et non facturable est le manque de clarté.

Si les employés ne sont pas sûrs de ce qui compte comme travail facturable, ils peuvent involontairement mal occuper leur temps, ce qui entraîne une baisse de productivité et une perte de profit.

Pour éviter cela, les entreprises doivent établir des politiques claires qui définissent :

- ce qui est considéré comme temps facturable et non facturable pour garantir un suivi précis du temps et des rapports financiers ;

- comment les employés doivent prioriser les tâches facturables dans leur charge de travail ;

- comment les efforts non facturables seront reconnus et récompensés, garantissant que les employés restent motivés même lorsqu’ils travaillent sur des projets internes.

Bonus : vérifier régulièrement vos finances de projet

Un temps non facturable excessif peut entraîner des dépassements de budget, ce qui entraîne une perte de profits et des problèmes de trésorerie.

Pour prévenir cela, les entreprises doivent surveiller proactivement les finances de leurs projets à l’aide d’outils de gestion de budget de projet et apporter des ajustements avant que les problèmes ne surviennent.

Un suivi financier régulier permet de s’assurer que :

- les projets restent rentables en identifiant où le temps non facturable s’infiltre dans le travail facturable ;

- les budgets sont maintenus en évitant une allocation excessive des ressources internes ;

- les pertes potentielles sont atténuées tôt, permettant aux chefs de projet de prendre des mesures correctives avant que les problèmes financiers ne s’aggravent.

Les heures non facturables sont inévitables, mais une bonne gestion permet d’en limiter l’impact négatif.

En suivant les taux de charge, en optimisant les processus internes et en définissant des objectifs clairs, les entreprises peuvent améliorer leur rentabilité.