Electronic invoicing 2024 for service activities

Facilitating the digital transition on the French territory implies the implementation of new habits. These include electronic invoicingmade mandatory for all companies from 2024. However, even if you already generate and send your invoices by e-mail, this is not considered electronic invoicing in the eyes of the government.

As we shall see, this practice requires more than just PDF format format, and requires the use of specific tools. In this article, we'll explain all the implications of electronic invoicing to help you to compliance.

What is electronic invoicing?

Electronic invoicing, also known as e-billrefers to the fact of generating, sending and receiving invoices in electronic electronically in specific specific formats. This means dematerialize invoices previously sent in paper format.

However, electronic invoicing is not just about sending e-mails or PDFs, but refers to theexchange of data flows. These are subject to specific standards governed by the DGFIP.

In addition, the latter offers a set of information sheets to help companies make the transition to electronic invoicing.

Why did you decide to reform electronic invoicing in 2024?

- The benefits of electronic invoicing

Electronic invoicing enables companies to become more competitive. In fact, some of our European neighbors are already subject to this obligation, such as Italy since 2019. Electronic invoicing offers many advantages.

-

- Time savings Administrative tasks are reduced, and cash flow management is optimized. Certain information, such as VAT, can be pre-filled.

- Reliability : Automation reduces the risk of errors

- Financial : Reduced printing costs, shorter payment times and easier cash management

- Customer satisfaction Reduced payment terms will strengthen customer-supplier relations and improve customer satisfaction.

- Traceability Electronic invoicing software provides access to the complete invoicing history, improving traceability and limiting the risk of fraud.

- The compliance schedule

Billing will become compulsory for all companies from July 1, 2024. The government's timetable

-

- July 1, 2024 All companies must be able to receive electronic invoices. Large companies will also have to be able to generate them.

- January 1, 2025 The obligation to generate electronic invoices will also apply to intermediary companies.

- January 1, 2026 This obligation will also apply to small, medium-sized and micro businesses.

How to prepare?

For service companies, switching to electronic invoicing means making a few adjustments. We strongly recommend that youanticipate this transition and and think about the right tool that will enable you to invoice electronically in full compliance. Fortunately, there are several solutions available.

- Public Billing Portal (PPF)

The Public Billing Portal set up by the French government gives all French companiesfree access to electronic invoicing. Although the functionalities are basic, the platform fulfills its primary functions: facilitating companies' financial management, simplifying VAT declarations and combating tax fraud.

- Private Partner Dematerialization Platforms (PDP)

These platforms deployed by private companies must be registered with the tax authorities for a renewable 3-year renewable term. They perform the same functions as the public invoicing portal, but often offer additional additional functionalities features. Depending on the tool, this may include :

-

- Invoice conversion

- Send to recipients directly from the platform

- Payment

- Automation: expense reports, supplier invoices

- Reporting services to optimize budget monitoring

- Integration with various tools, such as your billing software, time and activity management software...

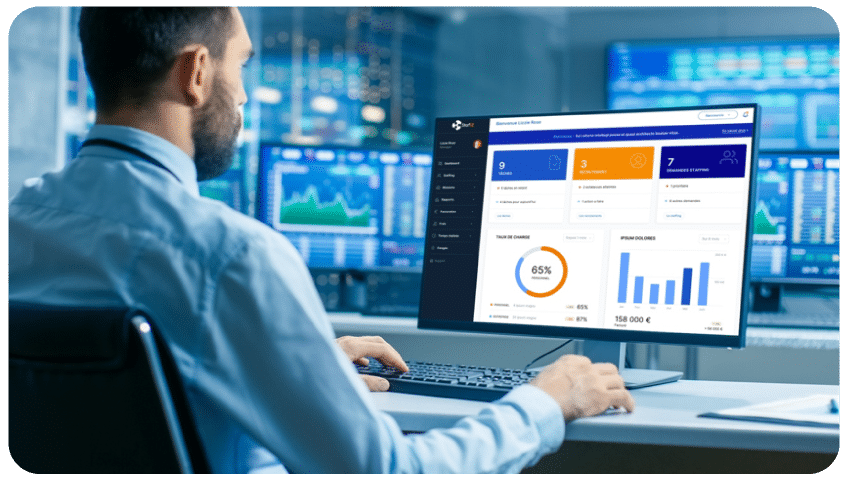

As a dematerialization platform, invoicing in Stafiz is tailored to your service business: management for project management and fixed-price projects (triggers, automatic time filling, etc.), reminders, mass invoicing...

- A complementary solution: dematerialization operators (OP)

We should also mention the existence of dematerialization operators. These simplify the the implementation of electronic invoicing within a company. While these tools can offer similar functionalities to partner dematerialization platforms, they have not been accredited. They should therefore be used as a complement of the two solutions presented above: PPF or PDP.

That said, this software can make a major contribution to facilitate electronic invoicing and can be used upstream. In fact, they offer advanced functionalities conversion of invoices into an approved approved dematerialized format :

-

- UBL (Universal Business Language)

- Factur-X

- CII (Cross Industry Invoice)

Please note that these are the only formats authorized for the transmission of electronic invoices.

How can Stafiz help service companies make the transition to electronic invoicing?

Stafiz will be a dematerialization operator, which means that we will have a direct connection to the aforementioned Public Billing Portal (PPF).

In addition, we will offer one or more of the new billing formats:

- "UBL (Universal Business Language)

- "Factur-X

- or "CII (Cross Industry Invoice)".

👇And beyond these aspects, Stafiz is the perfect ally for your service business.👇

Stafiz introduces an invoicing module tailored to your service business

Discover our special invoicing file with answers to all your questions:

- How can you estimate your costs accurately?

- How to manage your overrun risks

- How can you get paid faster by your customers?

- And much more

If we haven't answered all your questions, don't hesitate to contact us by following this link.