Comparatif des meilleurs logiciels de comptabilité de projet en 2026

Pour choisir un logiciel de comptabilité de projet, appuyez-vous sur un critère unique : sa capacité à donner une marge fiable en temps réel. Un bon outil rapproche automatiquement le réalisé, le prévisionnel et la facturation. Si ces données ne convergent pas, votre prise de décision repose sur des chiffres qui se contredisent.

La difficulté consiste à identifier l’outil qui soutient réellement votre pilotage, plutôt qu’un logiciel qui produit des rapports séduisants, mais fournit une photographie inexacte de votre portefeuille de projets. Sans solution adaptée, les écarts se creusent : dépassements non détectés, factures envoyées trop tard et tableurs instables qui multiplient les versions et les erreurs. Au fil des projets, cette incohérence finit par peser sur vos résultats et grignote votre rentabilité.

Ce comparatif de logiciel de comptabilité analyse 12 solutions utilisées dans les cabinets de conseil, les ESN et les structures orientées projet. Objectif : vous aider à sélectionner la plateforme qui sécurise vos marges et accélère votre croissance sans ajouter de complexité.

Qu’est-ce que la comptabilité projet ?

Avant de comparer les logiciels, il faut clarifier de quoi on parle. Il existe 3 types de comptabilité.

- La comptabilité générale : elle produit le bilan et le compte de résultat légaux. Elle répond aux obligations fiscales, mais ne dit pas si tel client ou tel projet est rentable ;

- La comptabilité analytique : elle ventile les coûts par centre de coûts (service, équipe, activité) pour calculer des coûts de revient globaux et des marges par département.

- La comptabilité de projet : c’est le niveau le plus fin. Elle affecte tous les coûts et les revenus à un projet précis pour suivre, en continu, la marge brute et la marge nette par mission, client ou équipe.

Un bon logiciel de comptabilité de projet est donc le pont entre l’exécution opérationnelle (temps, tâches, achats, sous-traitance) et la vérité financière (P&L projet, marge nette, prévisionnel).

Tableau comparatif des meilleurs logiciels de comptabilité projet

Ce tableau vous aide à comparer rapidement les principaux logiciels de comptabilité projet selon :

- leur cible ;

- leurs points forts niveau financier et comptabilité ;

- leur pertinence pour réaliser un pilotage réel/prévisionnel.

🎯 Objectif : identifier l’outil adapté à votre structure sans vous égarer dans des fonctionnalités inutiles.

| Stafiz | ESN, cabinets de conseil, PME orientées projet | – Calcul de la marge à date + atterrissage – Mise à jour du reste à faire – Suivi de la charge & staffing – Synchronisation coûts internes / externes – Reconnaissance du CA selon l’avancement |

Nécessite une intégration comptable si vous souhaitez la compta générale | Le plus complet pour les sociétés de services qui veulent un pilotage financier projet réel/prévisionnel cohérent |

| QuickBooks | TPE / PME | – Comptabilité générale simple – Facturation rapide – Automatisation des paiements |

Très faible sur la gestion de projet et la marge | Pour une petite entreprise qui a besoin de compta + facturation mais pas de pilotage projet |

| ZipBooks | Auto-entrepreneurs / TPE | – Facturation simple – Rapprochement bancaire – Catégorise automatiquement les transactions |

Pas de suivi des temps, pas de marge projet | Pour les indépendants qui veulent une compta basique |

| Teamleader | TPE / PME | – CRM – Gestion des devis et de la facturation – Gestion de projets simple |

Fonctionnalités analytiques limitées | Pour les petites structures qui veulent un outil tout-en-un simple |

| ERPNext | PME / ETI | – ERP global (compta, stocks, RH, achats et projets dans un même système) – Logiciel open source – Multi-activités |

Complexe à paramétrer, reporting projet limité | Pour les entreprises qui veulent réduire les coûts de licence via l’open source |

| Striven | Petites entreprises | – CRM + projets + finances – Produit un reporting basique |

Courbe d’apprentissage élevée | Pour une petite entreprise qui veut centraliser CRM + projets + finances |

| Paymo | TPE / freelances | – Suivi du temps + facturation à partir des heures saisies | Pas d’envoi massif de factures, limité pour les PME | Pour les équipes très petites centrées sur la facturation au temps |

| Replicon | PME / entreprises distribuées | – Suivi du temps avancé – Suivi de la charge réelle – Identifie les disponibilités – Suivi sur mobile |

Ne suit pas les heures non facturables | Pour les équipes hybrides avec forte mobilité |

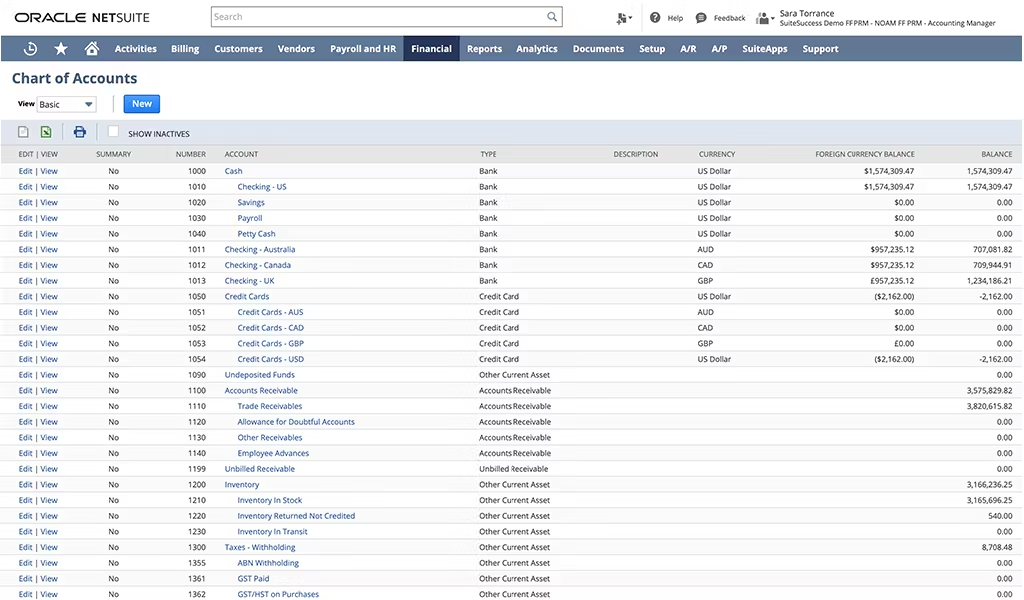

| NetSuite | ETI / grandes entreprises | – ERP + gestion financière + reporting avancé – Multi-devises, multi-pays |

Interface datée, personnalisations limitées | Pour les grandes structures qui veulent un ERP complet |

| Accounting Seed | Entreprises sous Salesforce | – Comptabilité + pilotage financier dans Salesforce – Multi-devises |

Limité aux clients Salesforce | Pour les entreprises déjà équipées de Salesforce |

Stafiz, le logiciel de comptabilité plébiscité par les cabinets de conseil

Les fonctionnalités comptables de Stafiz

Sa force : relier réellement gestion de projet, budget, comptabilité analytique et reconnaissance du chiffre d’affaires, là où la plupart des logiciels se limitent à la facturation.

Les fonctionnalités de suivi budgétaire

Stafiz centralise tous les coûts qui sont associés à chaque projet (directs et indirects) :

- les coûts humains (via les temps saisis) ;

- les achats ;

- les frais ;

- la sous-traitance ;

- etc.

Chaque coût est suivi en consommé et en reste à faire, ce qui permet de comparer en permanence le réel au prévisionnel et de suivre l’avancement en temps réel. Stafiz valorise automatiquement chaque saisie (temps, achats, frais), puis met à jour :

- la production réalisée ;

- les coûts déjà consommés,

- les coûts restant à engager.

La plateforme distingue également la marge brute (coûts directement affectables) de la marge nette (avec allocation des coûts indirects). Cette granularité permet une analyse fine de la rentabilité par client, par projet et par équipe.

En se basant sur l’historique des projets similaires déjà réalisés, Stafiz permet aussi d’établir un budget prévisionnel de projet.

Les fonctionnalités en rapport avec la facturation et les devis

Côté vente, Stafiz assure un contrôle précis du périmètre et des écarts. La plateforme permet un suivi rigoureux entre devis, bons de commande et factures en comparant automatiquement les montants engagés, les quantités prévues et les montants déjà facturés, ce qui permet de détecter immédiatement :

- les écarts entre le bon de commande et la facturation ;

- les écarts entre le facturé et le non-facturé ;

- le reste à facturer (si tous les bons de commandes ont été consommés ou pas).

L’outil calcule aussi automatiquement les FAE (factures à émettre) et PCA (produits constatés d’avance) pour chaque ligne de projet.

• Si la facturation dépasse la production → PCA.

Côté achat, Stafiz récupère les factures fournisseurs pour mettre à jour le consommé réel.

L’outil calcule aussi l’équivalent côté achat des FAE/PCA côté vente pour une symétrie comptable complète, à savoir :

- les CCA (charges constatées d’avance) ;

- les FNP (factures non parvenues) ;

Les fonctionnalités de calcul du chiffre d’affaires

Stafiz s’adapte aux différents modèles contractuels des sociétés de services en intégrant plusieurs méthodes de reconnaissance du chiffre d’affaires.

- Méthode à l’achèvement : CA reconnu une fois le livrable final validé.

- Méthode à l’avancement : CA proportionnel au pourcentage d’avancement.

- Méthode basée sur la facturation : CA aligné sur les factures émises.

- Abonnements : répartition du CA sur la durée du contrat.

- Services managés : combinaison d’une part fixe et d’une part variable.

Ces approches couvrent aussi bien la régie que les forfaits ou les contrats récurrents, offrant une reconnaissance du CA cohérente à chaque fin de période.

Les fonctionnalités de facturation selon le type de contrat

Comme vu précédemment, Stafiz prend en charge toutes les méthodes de facturation utilisées dans les sociétés de services (régie, forfait, services managés, et abonnements.) Chaque modèle suit ses propres règles de calcul, de consommation et de facturation, sans ressaisie ni tableur parallèle.

Les fonctionnalités analytiques et de gestion des clôtures

Stafiz propose un compte de résultat par projet qui reprend l’ensemble des éléments financiers :

- chiffre d’affaires reconnu ;

- coûts humains, achats, frais, sous-traitance ;

- marge brute et marge nette.

Cette lecture détaillée permet de comparer la performance entre projets, clients ou équipes, et d’identifier rapidement les leviers d’amélioration.

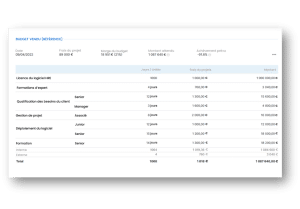

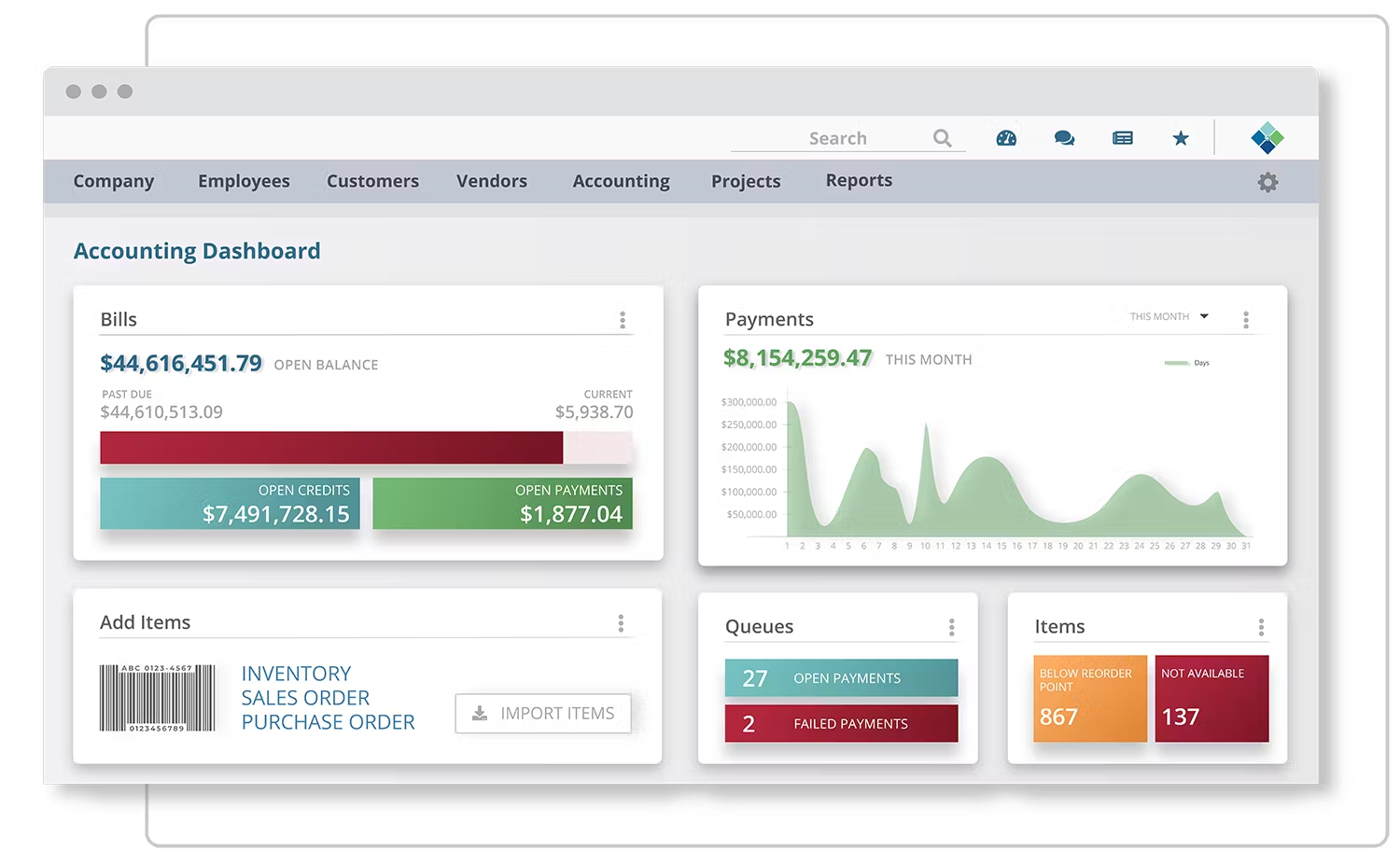

Suivi de la rentabilité des projets par les coûts dans Stafiz

La plateforme permet de comparer le budget avec le prévisionnel, en affichant côte à côte le budget initial, le consommé à date, le reste à faire, l’atterrissage révisé.

Les écarts apparaissent immédiatement, ce qui permet de réagir tôt : ajustement du staffing, renégociation du périmètre ou réévaluation des coûts. De même, le prévisionnel se met à jour automatiquement dès qu’un temps, un coût ou un achat est enregistré.

Enfin, pour garantir la cohérence financière, Stafiz fiabilise la gestion des clôtures comptables, sans risque de modification rétroactive :

- calcul automatique des FAE / PCA / CCA / FNP avant clôture ;

- verrouillage des périodes (mois, trimestre) une fois validées ;

- aucune modification possible des temps, coûts ou frais sur les périodes closes.

Ce mécanisme assure une clôture stable, sans retraitement manuel ni risque que des modifications tardives altèrent les chiffres.

Vous souhaitez améliorer la précision de vos marges, réduire les retraitements et détecter les dérives plus tôt ?

Ce webinar détaille les bonnes pratiques de pilotage financier projet et les approches qui renforcent la rentabilité dans les organisations orientées services.

Pourquoi Stafiz surpasse les autres logiciels de comptabilité projet

Pour le suivi de la probabilité projet, la plupart des logiciels se limitent à la marge à date, c’est-à-dire la performance passée. Stafiz va plus loin et calcule en continu la marge à terminaison et en intégrant un forecast dynamique.

Ce modèle prédictif permet d’identifier tôt les projets en perte (anticipation du provisionnement obligatoire) et d’obtenir une vision stable de l’atterrissage financier. Chaque mise à jour (temps, coût) déclenche un nouveau calcul, évitant les simulations manuelles et tardives sous Excel.

Pourquoi votre logiciel de comptabilité devrait intégrer un forecast automatisé ?

Là où la majorité des solutions demandent d’exporter les données pour reconstruire un prévisionnel, Stafiz produit un forecast dynamique qui se met à jour à chaque action :

- la saisie d’un temps ;

- l’enregistrement d’un achat ;

- la révision du reste à faire.

Ce prévisionnel continu donne une vision stable de l’atterrissage financier et aide les équipes à ajuster plus tôt le staffing, les charges ou le périmètre.

Quelles sont les conséquences si votre logiciel ni calcul de la marge à terminaison, ni forecast automatisé ?

Sans MAT (marge à terminaison) ni forecast automatisé, les dérives ne sont détectées qu’en fin de projet, au moment où les corrections ne sont plus possibles. Cette absence de visibilité fragilise votre marge, rallonge les clôtures mensuelles et crée un risque élevé de décisions basées sur des données incomplètes. Cela revient à découvrir la rentabilité d’un projet une fois terminé : trop tard pour prendre des actions correctives.

Les meilleurs logiciels de comptabilité projet pour petites entreprises

Les très petites structures (freelances, TPE et équipes de 2 à 10 personnes) recherchent un outil simple, rapide à prendre en main et à un coût maîtrisé :

- un logiciel léger, combinant comptabilité générale et facturation ;

- un suivi de projet minimal, pour gérer quelques missions sans process avancés ;

- une interface intuitive, sans paramétrage long ni formation lourde ;

- une solution économique, adaptée aux modèles simples (régie, forfait court, missions unitaires).

Dans ce contexte, des outils basiques sont souvent suffisants et représentent un bon compromis entre simplicité, coût et efficacité.

L’outil QuickBooks pour lier comptabilité et suivi de projet

QuickBooks Online fait partie des logiciels de comptabilité les plus utilisés par les petites entreprises, notamment dans les pays anglophones, grâce à son interface intuitive et son écosystème d’intégrations bancaires automatisées. Sa déclinaison QuickBooks Online offre un accès cloud permanent depuis ordinateur, tablette ou mobile, éliminant les contraintes de licence monoposte des anciennes versions desktop.

QuickBooks remplace avantageusement plusieurs outils séparés, tant que le pilotage projet reste simple. C’est une solution populaire auprès des petites structures qui ont besoin d’un outil simple combinant comptabilité générale, facturation et un suivi projet basique.

Les fonctionnalités de QuickBooks pour la comptabilité

QuickBooks couvre les besoins essentiels d’une petite structure.

- Suivi financier par projet : temps passés, dépenses, revenus et marge simple.

- Facturation et devis : modèles personnalisables, envoi rapide, relances automatiques.

- Encaissements : connexion à des solutions de paiement en ligne (carte bancaire, plateformes comme PayPal ou autres via applications partenaires).

- Dépenses et notes de frais : saisie rapide, catégorisation automatique.

- Rapprochement bancaire : import quotidien des transactions et des suggestions automatiques.

- Reporting simplifié : trésorerie, P&L, suivi des encours.

C’est un outil efficace pour une comptabilité et un suivi de projet très légers.

Pour quel cas d’usage ?

QuickBooks est adapté aux structures qui n’ont pas besoin d’un pilotage projet avancé.

- Freelances et indépendants facturant en régie : consultants, développeurs, graphistes ou formateurs vendant du temps homme avec facturation mensuelle ou par mission ponctuelle.

- Petites agences de services et petites ESN employant peu de collaborateurs et gérant simultanément 5 à 20 projets clients. La visibilité par projet sur les coûts et marges aide à prioriser les clients rentables et identifier les missions déficitaires. Elles vendent principalement du temps homme et n’ont pas besoin de pilotage avancé (ETP, staffing, reste à faire détaillé).

- Artisans et commerçants avec suivi de chantiers nécessitant un suivi des coûts matériaux et une main d’œuvre par chantier, avec une refacturation client des fournitures achetées.

Quickbooks : avantages et inconvénients

➕ Les avantages de Quickbooks

- Prise en main rapide : interface grand public pensée pour les non-comptables, avec un assistant de configuration guidé et des tutoriels vidéo intégrés. Une TPE peut l’utiliser en moins d’une journée sans formation externe coûteuse.

- Rapport qualité-prix compétitif : abonnements d’entrée de gamme démarrant à 10€/mois (selon les pays et les promotions en cours) incluant la comptabilité générale, une facturation illimitée et un suivi projet basique. La tarification est transparente, sans frais cachés d’installation ou de support.

- Écosystème d’intégrations riche : plus de 650 applications tierces connectables (CRM, e-commerce, paie, marketing), permettant d’étendre les fonctionnalités natives sans changer de plateforme comptable.

➖ Les inconvénents de Quickbooks

- Fonctionnalités projet limitées : absence totale de planification des ressources (staffing), de gestion des ETP ou de forecast financier avancé. Le suivi se limite au coût réel versus budget initial, sans capacité de projection du reste à faire.

- Inadapté aux modèles contractuels complexes : impossibilité de gérer proprement un mix régie/forfait/sous-traitance sur un même projet, ni de paramétrer des règles de reconnaissance de revenus différenciées. Les projets mixtes nécessitent des contorsions manuelles ou des logiciels complémentaires.

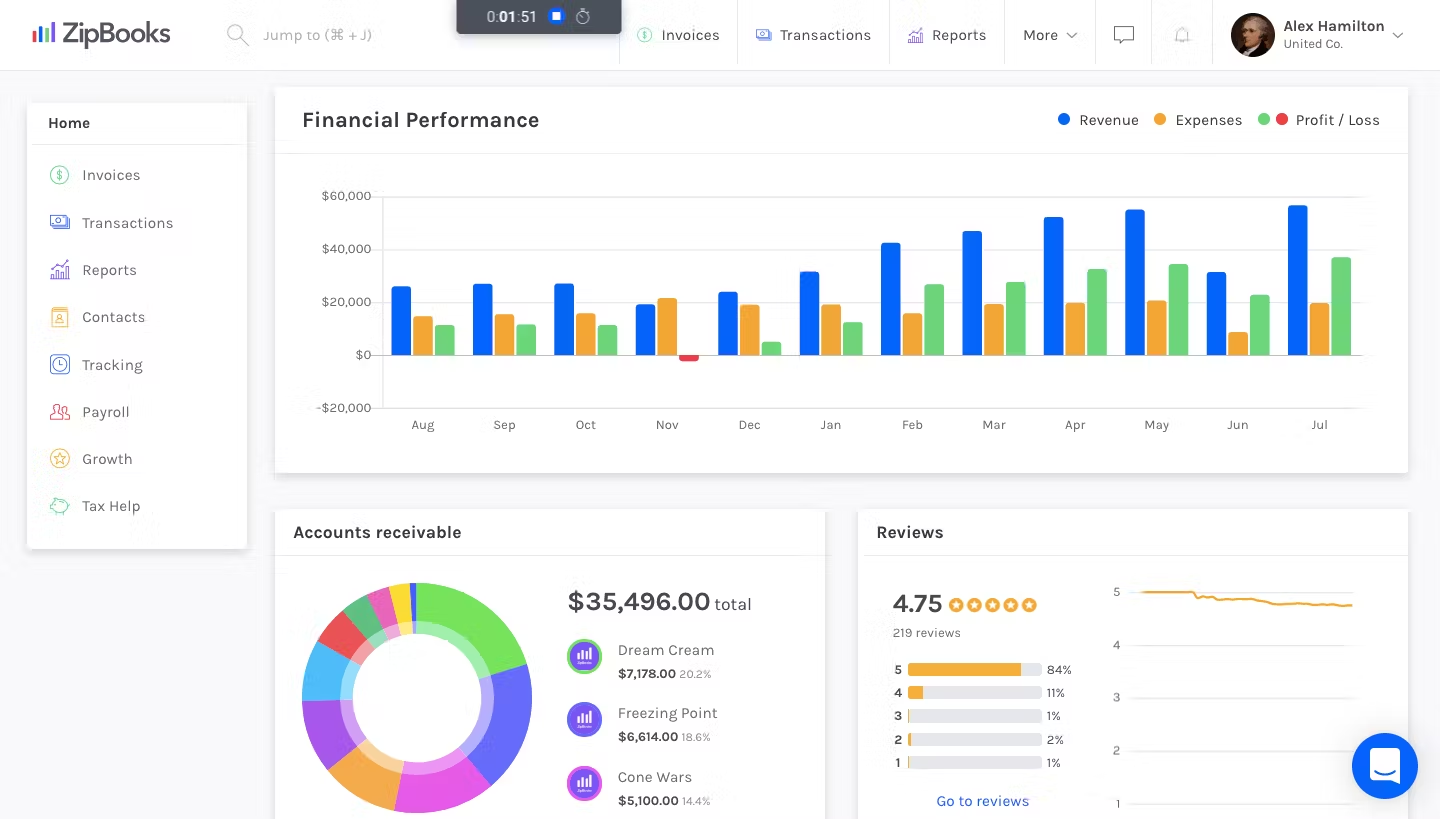

ZipBooks : pour une dimension gestion de projet plus accentuée

ZipBooks se positionne comme une alternative moderne et épurée à QuickBooks, et pensée spécifiquement pour les freelances et TPE qui recherchent une expérience utilisateur fluide sur mobile. Son interface minimaliste cache une capacité de personnalisation avancée, notamment sur la facturation multidevise et les rapports financiers graphiques.

Les fonctionnalités comptables de ZipBooks

ZipBooks propose l’essentiel pour gérer la comptabilité et quelques projets simultanés.

- Comptabilité générale : création de factures, gestion des dépenses, rapprochement bancaire.

- Suivi de projet basique : temps passés, dépenses associées, facturation par projet.

- Devis et paiements en ligne : intégration avec Stripe et PayPal.

- Rapports financiers : profitabilité par projet, cashflow, indicateurs clés simples.

- Automatisations : rappels de paiement, factures récurrentes, catégorisation automatique.

C’est une solution efficace pour ceux qui gèrent peu de projets et recherchent un fonctionnement intuitif plutôt qu’un pilotage avancé.

Pour quel cas d’usage ?

ZipBooks convient idéalement aux profils suivants.

- Freelances et consultants indépendants : développeurs, designers, rédacteurs ou coachs facturant en régie ou au forfait projet. L’interface mobile-first et le time tracking simplifié correspondent parfaitement aux modes de travail nomades.

- Petites agences créatives : studios graphiques, agences social media ou producteurs vidéo, privilégiant l’esthétique de leurs factures et la simplicité d’utilisation sur la profondeur fonctionnelle. Le tagging flexible compense l’absence de module projet structuré.

- Startups en pré-seed ou seed : jeunes pousses technologiques sans DAF dédié, cherchant une comptabilité “quick and dirty” suffisante pour les premiers exercices avant structuration financière complète. La gratuité des forfaits basiques réduit le burn rate.

Cependant, dès que le volume de factures augmente ou que la complexité comptable s’accroît (multi-entités, consolidation), ZipBooks n’est plus adapté.

Zipbooks : avantages et inconvénients

➕ Les avantages de ZipBooks

- Interface très intuitive : design épuré inspiré des applications grand public (Spotify, Netflix), avec un onboarding interactif et des micro-animations rendant la saisie comptable presque ludique. Le taux d’adoption rapide même pour les profils réfractaires à la comptabilité.

- Interconnexion fluide avec paiements : l’intégration native Stripe/PayPal transforme chaque facture en lien de paiement direct, avec réconciliation automatique.

- Tarifs attractifs : forfait gratuit illimité en nombre de factures (rare sur le marché), forfaits payants démarrant à 15$/mois pour fonctionnalités avancées. Absence de frais cachés de setup ou de migration.

➖ Les inconvénients de ZipBooks

- Absence de planification ressources ou prévisionnel : impossible de budgéter les projets futurs, de planifier la charge des collaborateurs ou de simuler des scénarios financiers. La vision reste strictement rétrospective (ce qui s’est passé) sans capacité prospective (ce qui va se passer).

- Fonctionnalités limitées pour structures organisées : pas de gestion des workflows de validation (hiérarchie d’approbation des dépenses), de clôture par période verrouillée, ou de droits utilisateurs granulaires. Inadapté dès que plusieurs personnes manipulent la comptabilité.

- Vision projet assez basique : le système de tags, bien que flexible, ne remplace pas une véritable structure projet hiérarchique (projet > phases > tâches). Impossible de tracker l’avancement technique ou de comparer budget versus réalisé ligne par ligne.

Quickbooks vs Zipbooks pour les petites entreprises, les auto-entrepreneurs et les freelances

| Comptabilité générale | Très complète : factures, dépenses, rapprochement bancaire, P&L détaillé | Essentielle : factures, dépenses, rapprochement bancaire basique, rapports simples |

| Suivi de projet | Module projet basique (temps, dépenses, marge simple) | Suivi projet via tags (temps, dépenses, facturation par projet) |

| Structure projet | Projet → revenus/dépenses → marge | Tags → regroupement flexible mais pas de vraie structure projet |

| Gestion des temps | Timesheet simple pour facturer les heures | Chronomètre et time tracking mobile-first |

| Facturation & devis | Modèles personnalisables, relances, récurrence | Factures simples, multidevise, récurrence |

| Encaissement en ligne | Connexions via apps (PayPal, solutions partenaires) | Intégration native Stripe & PayPal pour paiements immédiats |

| Automatisations | Rappels, factures récurrentes, catégorisation intelligente | Rappels, récurrence, catégorisation automatique |

| Rapprochement bancaire | Robuste : import quotidien + suggestions intelligentes | Basique mais rapide : catégorisation automatique |

| Reporting | Trésorerie, marge projet, P&L complet | Profitabilité simple, cashflow, indicateurs essentiels |

| Pilotage projet avancé | ❌ Non (pas de staffing, pas de prévisionnel) | ❌ Non (pas de forecast, pas de phases/tâches) |

| Personnalisation | Très élevée (650+ apps, écosystème mature) | Moyenne (factures, tags ; reste limité) |

| Tarifs | Entrée de gamme ≈ 10 €/mois (selon pays/promotions) | Plan gratuit + offres payantes ≈ 15 $/mois |

Quel logiciel de comptabilité projet choisir pour une PME ?

Pour une PME ou une startup en croissance, le bon logiciel de comptabilité doit devenir une brique centrale de pilotage qui structure le cycle de vie complet des projets. Les solutions doivent être intégrées, prévisionnelles et capables de suivre des modèles contractuels variés.

Entre 20 et 100 employés (et jusqu’à 300 pour les structures en forte croissance), les besoins évoluent radicalement : la gestion ne peut plus reposer sur des outils TPE ou des fichiers Excel. Les PME doivent orchestrer plusieurs dimensions en même temps : ventes, projets, planning, achats, comptabilité et reporting financier.

À ce stade de maturité, les besoins clés pour un logiciel de comptabilité et de gestion de projet deviennent.

- Un pilotage projet structuré : les équipes gèrent des dizaines de projets en parallèle, souvent multi-clients. Le suivi des coûts projet, du reste à faire, des marges et de l’avancement ne peut plus être manuel : il doit être fiabilisé, centralisé et automatisé.

- Des processus transverses pour aligner les différents workflows de l’entreprise : cycle de vente → projet → facturation → comptabilité, achats → contrôle → imputation projet et staffing → capacité → rentabilité.

- Des fonctionnalités comptables plus avancées comme la reconnaissance du CA, la gestion des encours (FAE/PCA), les rapprochements multi-activités, multi-entités ou multi-devises.

- Une solution modulaire et évolutive : les PME recherchent des outils capables de les accompagner plusieurs années sans re-basculer sur un nouvel ERP à chaque étape.

Deux approches répondent généralement à ce besoin : les ERP unifiés (ERPNext, Striven, Microsoft Dynamics 365) qui regroupent tout dans un seul système et les plateformes PSA spécialisées (Teamleader Orbit, Paymo, Firmbee) associée à un outil externe de comptabilité générale (Sage, Cegid, Xero…), via une intégration API.

Teamleader Orbit : pour combiner finances et comptabilité projet

Teamleader Orbit cible les agences de services (marketing, digital, conseil) et les PME B2B européennes recherchant une plateforme CRM-projet-facturation intégrée, sans la lourdeur d’un ERP complet. Son positionnement “entre QuickBooks et Salesforce” séduit les structures ayant dépassé les outils TPE mais refusant la complexité des grands systèmes.

Les fonctionnalités de Teamleader Orbit

Teamleader Orbit couvre un ensemble de fonctionnalités adaptées aux PME orientées projet.

- Suivi de projet : budget, heures consommées, coûts engagés, marge réalisée.

- Timesheets et gestion de la charge : saisie des temps et charge par collaborateur.

- Facturation automatisée : en régie (temps approuvés) ou au forfait (jalons), plus abonnements récurrents.

- Reporting financier : marge, rentabilité, plan de facturation.

C’est une solution intermédiaire : plus avancée que QuickBooks sur la partie projet, mais sans la profondeur d’un PSA ou d’un ERP complet.

Pour quel cas d’usage ?

Teamleader Orbit convient aux profils suivants.

- Agences de services multiclients : agences digitales, marketing, communication ou consulting employant 10 à 100 collaborateurs et gérant simultanément 30 à 200 projets clients avec mix de modèles contractuels (régie, forfait, retainer mensuel).

- PME B2B avec cycle de vente complexe : éditeurs de logiciels proposant prestations de services (intégration, formation, support), sociétés d’ingénierie technique ou cabinets d’architecture nécessitant un CRM structuré couplé à un suivi financier projet rigoureux.

Avantages et inconvénients Teamleader Orbit

➕ Les avantages de Teamleader Orbit

- Intégration CRM-projet-facturation native : continuité totale depuis l’opportunité commerciale (CRM) jusqu’à la facture client, en passant par le devis, le projet d’exécution et les timesheets, sans quitter l’interface ni resaisir de données.

- Bonne vision financière projet : calcul automatique de la marge et de la rentabilité avec distinction marge brute/nette, plan de facturation prévisionnel, alertes de dépassement budgétaire. Suffisant pour les PME sans contrôleur de gestion dédié.

- Convient aux équipes services structurées : workflows de validation des temps et dépenses, droits d’accès granulaires (commercial, chef de projet, DAF), reporting multi-niveaux (projet, client, type de prestation).

➖ Les inconvénients de Teamleader Orbit

- Pas un logiciel de comptabilité complet : Teamleader Orbit ne gère pas la comptabilité générale (pas de plan comptable complet, pas de grand livre, pas de génération automatique des écritures comptables). Il nécessite l’intégration avec un logiciel comptable externe (Yuki, Exact, Sage) ou le maintien d’un expert-comptable gérant le Grand Livre.

- Vision prévisionnelle limitée : impossibilité de modéliser des scénarios de staffing alternatifs avec impact marge, pas de forecast automatisé du reste à faire, pas de calcul de marge à terminaison anticipant les pertes futures. Le pilotage reste majoritairement rétrospectif.

- Planification des ressources basique : absence de gestion des compétences multiples par collaborateur, pas de planification de capacité à moyen terme (3-6 mois), pas d’optimisation automatique des affectations selon compétences et disponibilités. Convient jusqu’à 50-70 collaborateurs, au-delà nécessite un outil dédié (type Stafiz).

ERPNext : un ERP open source avec comptabilité projet

ERPNext est un ERP open source complet qui couvre l’ensemble des processus d’une PME en croissance. Développé par Frappe Technologies, ce système modulaire couvre l’intégralité des processus d’entreprise : comptabilité générale et analytique, gestion de projet, CRM, achats, stocks, production, RH, helpdesk.

C’est l’une des rares solutions gratuites en licence, tout en proposant une profondeur fonctionnelle comparable à certains ERP propriétaires.

Les fonctionnalités du logiciel ERPNext

ERPNext propose un ensemble riche de modules, utiles pour les organisations qui ont besoin d’une comptabilité projet avancée.

- Comptabilité générale & analytique : ce logiciel de comptabilité analytique de gestion de projet inrègre un plan comptable configurable, des écritures automatiques, le multi-devises et la gestion des clients/fournisseurs. C’est également un logiciel de comptabilité analytique multi-axes (projet, équipe, département), permettant de suivre la rentabilité de chaque activité de manière détaillée.

- Budgets et suivi des dépenses projet : chaque projet peut être associé à un budget et à des règles d’alerte en cas de dépassement. ERPNext consolide automatiquement les coûts (temps, achats, frais), ce qui donne une vision fiable du coût de revient réel et facilite le pilotage budgétaire.

- Suivi de production, achats, stocks : L’ERP gère toute la chaîne opérationnelle : achats, gestion des stocks, éventuelle production interne ou assemblage. Cette profondeur fonctionnelle est utile pour les entreprises hybrides services + produits, ou celles qui doivent gérer des stocks en parallèle de leurs projets.

- Gestion de projet (Gantt, tâches, temps) : ERPNext propose une gestion de projet structurée via des tâches, des dépendances, un diagramme de Gantt, le suivi d’avancement et la saisie des temps. Les heures enregistrées et les achats affectés alimentent automatiquement les coûts du projet, garantissant la cohérence entre l’opérationnel et le financier.

- CRM, RH et facturation sont unifiés au sein d’une même plateforme (suivi commercial, contrats, congés, devis et comptabilité). Cette centralisation réduit les silos et limite les ressaisies entre plusieurs logiciels.

Pour quel cas d’usage ?

ERPNext s’adresse aux entreprises suivantes.

- Les PME et ETI en forte croissance (20-300 personnes) qui ont besoin des fonctionnalités d’un ERP complet, mais à un prix plus compétitif qu’une grosse licence.

- Les structures nécessitant comptabilité analytique projet avancée avec une vision granulaire de la rentabilité par projet, client, type de prestation et zone géographique.

- Les entreprises exigeant une maîtrise totale de leur système d’information, et refusant la dépendance aux éditeurs propriétaires et leurs roadmaps imposées. ERPNext s’héberge sur vos propres serveurs (ou cloud) et se modifie librement pour répondre à vos spécificités métier.

- Les groupes multi-entités ou multi-pays, avec plusieurs filiales, gérant plusieurs devises et référentiels comptables. ERPNext gère nativement le multi-société, et le multi-devise.

Avantages et inconvénients d’ERPNext

➕ Les avantages d’ERPNext

- Très complet et personnalisable : amplitude fonctionnelle rivalisant avec SAP Business One ou Microsoft Dynamics à une fraction du coût. Les modules couvrent 90% des besoins standards d’une PME/ETI, évitant la multiplication des outils spécialisés.

- Excellent niveau analytique projet : comptabilité analytique multidimensionnelle permettant analyses croisées sophistiquées (rentabilité par projet ET par client ET par type de prestation).

- Open source = coût maîtrisé : l’absence de licence logicielle (coût zéro pour le software) permet d’économiser 50 à 70 % des dépenses logicielles sur 5 ans comparé aux solutions propriétaires.

➖ Les inconvénients d’ERPNext

- Mise en œuvre plus lourde : déploiement ERPNext nécessite 3 à 12 mois selon périmètre et niveau de personnalisation, mobilisant ressources internes (chef de projet, key users) et budget conseil externe. Complexité supérieure à un outil SaaS clé-en-main.

- Nécessite partenaire intégrateur : sauf si vous disposez de compétences techniques Python/JavaScript en interne, l’implémentation et la personnalisation exigent un partenaire certifié ERPNext. Le choix de ce partenaire conditionne fortement la réussite du projet.

- Courbe d’apprentissage significative : l’amplitude fonctionnelle se paie par une interface parfois dense et une terminologie technique. Formation utilisateurs indispensable (2-5 jours selon rôles), avec phase d’acculturation de plusieurs semaines pour adoption complète.

Microsoft Dynamics 365 Finance & Project Operations

Microsoft Dynamics 365 Finance & Project Operations s’adresse aux entreprises qui ont besoin d’un ERP cloud robuste, capable de gérer des volumes importants, plusieurs entités juridiques et des processus strictement encadrés. Très intégré à l’écosystème Microsoft (Power BI, Teams, Excel, Azure), il combine comptabilité avancée, pilotage projet et automatisation des workflows dans une plateforme unifiée.

Les fonctionnalités de Microsoft Dynamics 365 Finance

Microsoft Dynamics 365 Finance propose un ensemble de fonctionnalités adaptées aux organisations structurées et multisites.

- Comptabilité financière et analytique complète avec une gestion multi-société, multi-devise et multi-législations fiscales. Le grand livre se structure en dimensions financières illimitées (département, projet, zone géographique, gamme produit), ce qui autorise des analyses extrêmement fines. La solution convient aux entreprises qui doivent produire un reporting consolidé fiable et auditable.

- Gestion projet (budgets, temps, dépenses, billing) : Idéal pour les sociétés de services ayant un grand volume de projets et plusieurs modèles contractuels. Le module Project Operations transforme Dynamics en plateforme PSA (Professional Services Automation) complète. Le suivi financier projet agrège toutes les dimensions de coût, chaque transaction génère une écriture comptable dans le grand livre (traçabilité) et la facturation projet supporte tous les modèles contractuels.

- Workflows, automatisation, multi-devise/pays : un atout essentiel pour les organisations multi-filiales ou opérant dans plusieurs juridictions. Les workflows approuvent automatiquement les budgets, les dépenses, les factures et les paiements. Les automatisations éliminent les tâches répétitives (génération récurrente de factures, alertes budget, clôtures périodiques, etc.)

- Forte intégration Microsoft (Power BI, Teams, Excel) : très intéressant pour les entreprises déjà équipées de Microsoft 365.

Pour quel cas d’usage ?

Dynamics 365 Finance & Project Operations répond aux besoins suivants.

- ETI et grandes entreprises multi-filiales : groupes consolidant 5 à 500 entités juridiques, opérant dans 10+ pays avec devises et réglementations variées (pour justifier l’investissement important dans la solution).

- Entreprises avec de nombreux projets récurrents : ESN, cabinets conseil, ingénierie, R&D gérant 100+ projets actifs simultanément avec mix contractuel complexe (forfait/régie/sous-traitance). La gestion des volumes contractuels demande un système robuste, et une forte capacité d’automatisation.

- Entreprises utilisant beaucoup Office 365, Azure,ou Teams. l’intégration native élimine les coûts et les frictions liés aux intégrations tierces et maximise le ROI de l’écosystème Microsoft.

- Secteurs réglementés exigeant une conformité stricte : les secteurs de la finance, de l’énergie ou de la défense nécessitent des audits rigoureux et une traçabilité complète des transactions.

Avantages et inconvénients de Microsoft Dynamics 365

➕Les avantages de Microsoft Dynamics 365

- Très modulaire et scalable : l’architecture par modules indépendants (Finance, Supply Chain, Project Operations, HR, Commerce) permet une implémentation progressive selon priorités et budget.

- Reporting avancé via Power BI : idéal pour les équipes finances et direction.

- Très bonne gestion de la reconnaissance de revenu compatible avec les normes IFRS 15 et ASC 606. L’automatisation des en-cours (WIP/FAE/PCA) sécurise les clôtures d’exercice et les audits.

➖ Les inconvénients de Microsoft Dynamics 365

- Déploiement long et coûteux : une implémentation typique prend 6 à 24 mois (selon le périmètre), et mobilise une équipe projet interne et un partenaire intégrateur Microsoft. Budget total (licences + services + formation) estimé entre 150k€ et 2M€ pour une PME/ETI, à multiplier par 5-10 pour grands groupes.

- Coût élevé pour petites structures : les licences coûtent 70 à 180€ par mois et par utilisateur selon son rôle (un coût impossible à justifier pour une entreprise de moins de 100 personnes). Le TCO à 5 ans dépasse souvent 500k€ ; cette solution est réservée aux structures disposant d’un budget IT conséquent.

- Expertise nécessaire pour gérer la complexité logicielle : l’administration, la personnalisation et les évolutions de la plateforme nécessitent des compétences techniques pointues (développement X++/Power Platform, administration Azure). L’entreprise qui utilise Microsoft Dynamics 365 dépend fortement de son partenaire Microsoft ou a besoin, en permanence, d’une équipe interne spécialisée.

Firmbee : Gestion complète projet et finances pour PME

Firmbee est une solution SaaS conçue pour les start-ups, agences digitales et petites PME qui veulent un outil centralisant gestion de projet, planification, budgets et facturation, sans la complexité ni le coût d’un ERP. L’interface moderne, l’approche modulaire et le rapport qualité-prix en font un outil intéressant pour les équipes projet multi-clients cherchant une solution légère mais cohérente.

Firmbee se positionne entre un outil de gestion de projet enrichi (type ClickUp) et un mini-PSA, avec suffisamment de briques financières pour piloter la marge sans basculer dans une logique ERP.

Les fonctionnalités de Firmbee

- Budgets, dépenses, marge : Firmbee permet de créer des budgets par projet ou par client, puis de suivre en temps réel les dépenses (temps, achats, frais). Le calcul de la marge est automatique et donne une vision simple, mais fiable de la rentabilité. C’est une approche suffisante pour les PME qui ne disposent pas d’un contrôle de gestion formalisé.

- Planning, tâches, temps, ressources : la gestion des tâches se fait en mode agile via un kanban, des checklists, et des feuilles de route. Chaque collaborateur peut saisir ses temps. La plateforme inclue également le planning des ressources, et offre une visibilité sur la charge des équipes et les disponibilités. En bref, elle permet une gestion opérationnelle fluide pour les équipes multi-clients.

- Facturation par projet : Firmbee est suffisant pour les cycles de facturation standard, sans complexité contractuelle. Les factures peuvent être créées directement depuis les données projets, en mode régie ou au forfait. Le suivi des paiements se fait au sein d’un tableau financier simple.

- Suivi financier global : pensé pour les dirigeants de PME qui veulent une lecture rapide de leur santé financière sans manipuler un ERP. Les tableaux de bord sont simple et présentent la rentabilité et la performance par client ou par projet.

Pour quel cas d’usage ?

Firmbee répond aux besoins des organisations qui recherchent un outil plus complet qu’un simple logiciel de facturation projet mais beaucoup plus léger qu’un ERP.

- Agences digitales ou créatives qui gèrent plusieurs projets et clients simultanément, avec besoin d’un suivi clair de la marge. . Firmbee leur permet de suivre l’avancement, de facturer et de visualiser la rentabilité sans ajouter une couche d’outils supplémentaires.

- Start-ups orientées services ou hybrides (produit + service) : ce type d’entreprise nécessite un outil polyvalent, permettant à la fois d’organiser le travail, de suivre les coûts, d’établir des budgets et de facturer. Firmbee offre une vue cohérente de l’opérationnel et du financier, adaptée aux structures jeunes qui cherchent efficacité et simplicité.

- PME multi-projets (5 à 100 personnes) pour qui la simplicité prime la sophistication comptable. Firmbee leur apporte suffisamment de profondeur pour piloter les projets et leur marge, tout en restant accessible aux équipes non techniques.

Avantages et inconvénients de Firmbee

➕ Les avantages de Firmbee

- Interface moderne, intuitive et agréable, pensée pour la collaboration et l’adoption rapide. Firmbee est conçu comme une application SaaS récente, facile à adopter, avec une ergonomie adaptée aux équipes transverses (chefs de projets, designers, développeurs, responsables financiers).

- Très bon rapport qualité-prix, bien plus abordable qu’un ERP ou un PSA avancé, tout en restant plus puissant qu’un simple outil de facturation.

- Vue unifiée projet + finances, suffisante pour les PME qui veulent piloter leur activité sans complexité technique. Elle permet aux dirigeants et chefs de projet de comprendre rapidement où se situe la rentabilité sans manipuler plusieurs outils ou exporter des tableaux Excel.

➖ Les inconvénients de Firmbee

- Comptabilité limitée : Firmbee n’est pas un logiciel de comptabilité générale. Il nécessite un outil externe ou un expert-comptable pour la gestion du plan comptable, des écritures, de la TVA et des clôtures.

- Prévisionnel financier basique : la plateforme ne propose pas de forecast avancé, d’analyse du reste à faire, ni de projection de marge à terminaison. Elle reste focalisée sur une vision actuelle plutôt que prédictive.

- Analytique restreinte pour les organisations plus matures : si Firmbee convient très bien aux PME, ses capacités analytiques deviennent insuffisantes dès que l’entreprise recherche une analyse multi-axes sophistiquée (marge par profil, scénarios de staffing, prévisions automatisées).

Striven – ERP tout-en-un avec comptabilité projet (PME/ETI)

Striven est un ERP cloud conçu pour les PME et ETI multiservices qui cherchent à unifier l’ensemble de leurs opérations dans un seul système : comptabilité, projets, CRM, facturation, achats, stocks et ressources humaines. Contrairement aux outils spécialisés uniquement projet ou uniquement comptables, Striven offre une vision financière et opérationnelle intégrée, adaptée aux organisations qui gèrent plusieurs processus simultanément.

L’outil se positionne comme une alternative moins coûteuse et plus flexible que les ERP traditionnels (NetSuite, Dynamics), tout en restant suffisamment complet pour remplacer un ensemble de logiciels séparés.

Les fonctionnalités de Striven

- Comptabilité complète : GL, AR/AP, budgets, analytique : Striven inclut un module comptable complet :avec un grand livre, la comptabilité client et fournisseur, le suivi budgétaire et analytique, le rapprochement bancaire, les immobilisations et le multi-devises. Les écritures sont générées automatiquement à partir des opérations (achats, ventes, projets), ce qui réduit les ressaisies.

- Gestion de projet : tâches, planning, coûts, marges : l’ERP propose une gestion projet structurée : tâches, dépendances, planification, saisie des temps, suivi des coûts (salariaux, achats, sous-traitance) et calcul automatique de la marge.

- CRM, facturation, inventaire, RH, achats : Striven centralise les fonctions transverses comme la gestion commerciale (devis, opportunités), la facturation, la gestion des stocks, la gestion des fournisseurs, les achats, l’onboarding RH, etc.

- Automatisations de workflow et reporting avancé (approbation de dépenses, validation des temps, automatisation de factures). Les tableaux de bord financiers sont entièrement configurables et donnent une vision globale de la performance, du cashflow et de la rentabilité.

- Vision unifiée finances + opérations : l’ensemble des modules repose sur une base de données unique. Une mise à jour côté opérationnel met à jour instantanément le financier : utile pour les entreprises souhaitant éviter les incohérences entre outils métiers.

Pour quel cas d’usage ?

- PME multiservices cherchant un ERP complet incluant comptabilité de projet. Grâce à son environnement unique, Striven évite la multiplication d’outils et la perte d’information entre les équipes.

- Entreprises avec plusieurs processus à synchroniser (production, services, facturation récurrente, gestion des stocks et reporting financier consolidé).

- PME et ETI en croissance (20–300 employés) qui ne veulent pas investir immédiatement dans un ERP lourd mais ont besoin de plus qu’un simple outil de facturation.

Striven : avantages et inconvénients

➕Les avantages de Striven

- ERP très complet et unifié qui couvre finance, opérations, projets, RH, CRM et inventaire dans une seule plateforme, réduisant la fragmentation des outils.

- Remplace plusieurs logiciels en un seul comme un CRM, un outil de gestion projet, un logiciel de facturation et comptabilité, un suivi des stocks et un logiciel comptable ; d’où un meilleur contrôle des données et une réduction du coût global.

- Forte capacité de personnalisation des workflows, tableaux de bord, règles d’automatisation et modules, sans recourir à un développement informatique complexe.

➖ Les inconvénients de Striven

- Mise en place plus longue qu’un outil projet classique : comme tout ERP, même “léger”, Striven demande un paramétrage initial conséquent : structure comptable, équipes, processus internes.

- Interface moins intuitive pour les non-initiés : bien que moderne, l’interface reste dense. L’adoption demande un accompagnement ou un temps d’apprentissage.

- Potentiellement trop lourd pour les petites structures (équipes de moins de 10 personnes ou avec des besoins simples) : Striven peut vite devenir disproportionné en termes de périmètre et de charge de configuration.

Paymo – Gestion de projet orientée profitabilité

Paymo est un outil de gestion de projet conçu pour les équipes qui veulent suivre précisément leur charge, leurs coûts et la rentabilité de leurs missions. Très apprécié des agences et sociétés de services, Paymo combine gestion opérationnelle (tâches, ressources, planning) avec un suivi financier simple mais efficace (budgets, marges, facturation).

Il se positionne comme une alternative plus complète que les outils project-only (Trello, Asana, ClickUp) grâce à son excellent time tracking et ses fonctionnalités de suivi de marge (sans toutefois aller jusqu’à la complexité d’un logiciel comptable ou d’un ERP).

Les fonctionnalités de Paymo

- Suivi du temps très complet avec un module de time tracking qui inclue des timesheets, des timers automatiques, un suivi du temps en multitâche, un calendrier de charge et extension desktop/mobile. Idéal pour les équipes dont la facturation dépend directement du temps passé.

- Budgets, coûts et marges par projet : Chaque projet peut être budgété en heures, en coûts ou en montant. Paymo calcule automatiquement la marge projet et alimente un tableau de suivi simple permettant d’identifier les dérives de charge ou les projets en sous-rentabilité.

- Facturation automatisée en fonction du temps ou des forfaits, générée directement depuis les heures approuvées ou selon les forfaits définis au contrat. Les factures sont personnalisables, et Paymo gère également les paiements en ligne via Stripe ou PayPal.

- Gestion des tâches et des ressources via un module complet (Kanban, Gantt, checklists, dépendances), ainsi qu’un planning des ressources pour visualiser la charge par collaborateur.

- Tableaux de bord financiers et opérationnels qui permettent de suivre la performance globale : temps consommé, charge planifiée, budget, marge, retards, projet et état de la facturation.

Pour quel cas d’usage ?

Paymo convient tout particulièrement aux organisations qui ont un volume important de projets et de temps à suivre.

- Agences marketing, studios créatifs, sociétés de production qui vendent majoritairement du temps ou des forfaits liés à la création et ont besoin d’un time tracking fiable, d’un planning clair et d’un suivi de rentabilité projet.

- PME de services multi-projets (10–200 personnes) qui gèrent plusieurs clients à la fois, et apprécient l’unification gestion de tâches + suivi du temps + facturation.

- Entreprises qui veulent un outil projet complet mais pas un ERP.

Paymo : avantages et inconvénients

➕ Les avantages de Paymo

- Excellent time tracking via un minutage précis, des timers multi-appareils, une saisie automatique, et un suivi détaillé par tâche ou projet.

- Vision claire de la marge et de la rentabilité : les tableaux de bord budgets, coûts et marges donnent une visibilité immédiate sur la rentabilité des missions, utile pour des PME qui veulent surveiller leurs marges sans outil comptable avancé.

- Très bon rapport fonctionnalités/prix, car plus abordable que les PSA complets tout en offrant suffisamment de profondeur pour piloter les projets au quotidien.

➖ Les inconvénients de Paymo

- Fonction comptable limitée : Paymo ne gère pas la comptabilité générale ni les écritures comptables. Il doit être couplé à un logiciel comptable externe pour le calcul de la TVA, les clôtures ou la gestion du plan comptable.

- Pas idéal pour les environnements multi-filiales ou multi-pays car l’outil reste pensé pour des équipes centralisées. Le multi-entité, la consolidation ou la gestion multi-devise restent limités.

- Planning prévisionnel simple qui manque de fonctionnalités avancées de staffing ou de simulation de charge (pas de reste à faire, pas de forecast financier détaillé). Il reste opérationnel, pas prédictif.

Comparatif des meilleurs logiciels projet et finance pour PME et ETI

| Comptabilité générale | ❌ Non | ✅ Oui | ✅ Oui | ❌ Non | ✅ Oui | ❌ Non |

| Comptabilité analytique projet | 🟠 Partielle | ✅ Très avancée | ✅ Très avancée | 🟠 Basique | ✅ Oui | ✅ Oui |

| Pilotage projet | ✅ Avancé | ✅ Avancé | ✅ Très avancée | 🟠 Intermédiaire | 🟠 Intermédiaire | ✅ Avancé |

| Gestion des temps | 🟠 Basique | ✅ Oui | ✅ Très avancée | 🟠 Basique | ✅ Oui | ✅ Excellente (trackers, apps, multitâche) |

| Facturation | ✅ Temps, forfait, jalons, récurrence | ✅ Oui (devis, factures ERP) | ✅ Tous modèles (forfait, régie, abonnement) | ✅ Oui (basique projet) | ✅ ERP complet | ✅ Oui (temps/forfait + paiements Stripe/PayPal) |

| CRM intégré | ✅ Oui | ✅ Oui | ✅ Oui | ❌ Non | ✅ Oui | ❌ Non |

| Gestion des stocks / achats | ❌ Non | ✅ Oui | ✅ Oui | ❌ Non | ✅ Oui | ❌ Non |

| RH / gestion interne | 🟠 Basique | ✅ Oui | ✅ Avancé | ❌ Non | ✅ Oui | ❌ Non |

| Prévisionnel / forecast | ❌ Limité | 🟠 Selon modules | ✅ Très avancé | ❌ Non | 🟠 Basique | ❌ Non |

| Analytique & reporting | ✅ Oui | ✅ Fort (tableaux multi-axes) | ✅ Expert via Power BI | 🟠 Basique | ✅ Avancé (dashboards custom) | ✅ Oui |

| Personnalisation | 🟠 Modérée | ✅ Très forte (open source) | ✅ Élevée mais complexe | ❌ Faible | ✅ Forte sans dev complexe | 🟠 Modérée |

| Complexité d’usage | Facile | Complexe | Complexe | Très facile | Complexe | Accessible |

| Adapté pour… | PME services (10–100) | PME/ETI (20–300) | ETI / grands groupes (100–2000) | Start-ups / petites PME (5–100) | PME/ETI multiservice (20–300) | PME services (10–200) |

Les logiciels de comptabilité projet pour les grandes entreprises

Les ETI et les grands groupes internationaux ont des besoins bien plus complexes que les PME. Leur environnement implique généralement :

- une organisation multi-filiales / multi-pays qui demande une consolidation financière et une gestion du multi-devise et de normes comptables multiples (IFRS, GAAP), sans oublier les exigences fiscales locales ;

- des projets complexes : portfolios de plusieurs centaines de projets, collaborations internationales, modèles contractuels variés (forfait, régie, sous-traitance) ;

- des volumes importants de données : des milliers de feuilles de temps, d’achats et de factures à traiter chaque mois ;

- des exigences fortes côté direction financière : contrôle fin des coûts de projet, reconnaissance de revenus avancée, suivi des temps fiable, forecast précis et auditabilité.

Ces entreprises recherchent des solutions robustes et éprouvées, capables de s’intégrer à un ERP existant, d’assurer une haute disponibilité, et de soutenir des workflows complexes avec un niveau de sécurité certifié.

Replicon – un haut niveau de finances projet

Replicon est une plateforme spécialisée dans le time tracking avancé et le pilotage financier des projets. Contrairement aux outils généralistes, Replicon se concentre sur la précision du temps, la conformité internationale et le contrôle des coûts, tout en s’intégrant profondément aux ERP d’entreprise comme SAP ou Oracle.

![]()

C’est un outil utilisé à grande échelle dans les entreprises pour lesquelles la facturation, la marge et la rentabilité dépendent directement d’un suivi du temps irréprochable.

Les fonctionnalités

Replicon propose un ensemble très complet pour les organisations dont la gestion du temps et des coûts est critique.

- Suivi du temps très avancé : saisie d’heures, jours, activités, feuilles de temps multi-niveaux, systèmes d’approbation hiérarchiques, récupération automatique d’activités. Les workflows de validation réduisent les erreurs et sécurisent la facturation.

- Budgets, coûts, taux facturables, marges : Replicon calcule automatiquement les coûts internes et facturables, les marges par projet et les dépassements budgétaires.

- Gestion des projets multi-pays / multi-devises : le système applique automatiquement les taux horaires, règles fiscales et devises correspondant à chaque pays ou filiale.

- Compliance RH et réglementaire : gestion du temps légal, règles de travail propres à chaque juridiction, TVAs locales, conformité audit. Indispensable pour les organisations internationales.

- Intégrations ERP puissantes : connecteurs natifs pour SAP, Oracle, Workday, les outils de paie et les solutions de facturation. Idéal pour un écosystème informatique déjà structuré.

Pour quel cas d’usage ?

Replicon s’adresse aux organisations qui ont besoin de contrôler précisément le temps et les coûts, tout en reliant ces données à un pilotage financier projet solide.

Il est particulièrement utilisé par :

- les ESN, cabinets d’ingénierie et sociétés de conseil (200–10 000 utilisateurs) nécessitant une mesure précise du temps vendu et du coût interne,

- les équipes de R&D, design ou production intellectuelle qui doivent tracer les efforts par activité ou centre de coûts,

- les entreprises internationales ayant des règles RH, légales ou fiscales complexes.

Avantages et inconvénients de Replicon

➕ Les avantages de Replicon

- Très performant sur la mesure du travail : l’un des meilleurs systèmes du marché pour capturer et valider le temps, avec une précision essentielle aux modèles facturables.

- Adapté aux environnements internationaux : multi-pays, multi-devises, règles légales locales et exigences de conformité intégrées.

- Intégrations solides avec les ERP : connecteurs stables et éprouvés pour SAP, Oracle, Workday, facilitant son adoption dans des SI complexes.

➖ Les inconvénients de Replicon

- Pas un outil de planification ou de staffing : Replicon mesure et contrôle, mais ne gère pas la prédiction de charge ou la planification avancée.

- Interface moins moderne que certains concurrents SaaS : l’ergonomie privilégie la profondeur fonctionnelle plutôt que la simplicité.

- Coût élevé pour les petites équipes : pensé pour les grands comptes, il devient rapidement disproportionné pour des structures de moins de 100–150 personnes.

Prophix, le logiciel pour combiner budget, forecast et finances

Prophix est une solution FP&A (Financial Planning & Analysis) conçue pour les directions financières qui doivent piloter budgets, prévisions, cashflow et rentabilité projet dans des environnements complexes. Plus avancé qu’un simple outil de reporting, Prophix permet de modéliser des scénarios financiers, consolider des entités multi-pays et automatiser l’ensemble du cycle budgétaire.

C’est un outil particulièrement apprécié des ETI et grands groupes qui cherchent à sécuriser leur processus de planification financière tout en obtenant une vision fiable de la performance projet.

Les fonctionnalités du logiciel Prophix

Prophix offre un ensemble de fonctionnalités clairement orientées contrôle de gestion et finances avancées.

- Budgets multi-pays / multi-projets : construction de budgets collaboratifs, gestion des versions, workflow d’approbation, consolidation automatique.

- Modélisation financière avancée : création de modèles CAPEX/OPEX, scénarios what-if, simulation de variations (taux, charges, ressources).

- Consolidation, cashflow et prévisions projet : projections automatisées, analyse des écarts, prévisions glissantes, calcul du cashflow prévisionnel par entité ou par projet.

- Intégration ERP (SAP, Oracle, MS Dynamics) : synchronisation des données comptables, analytiques et RH pour fiabiliser les modèles financiers.

Pour quel cas d’usage ?

Prophix s’adresse aux organisations dont le pilotage financier nécessite une vision budgétaire structurée et des prévisions fiables, notamment :

- les directions financières cherchant un outil spécialisé pour le cost control, la planification et la rentabilité projet,

- les entreprises multi-filiales ou multi-pays de 200 à 5 000 employés devant consolider rapidement des données hétérogènes,

- les groupes de 200 à 5 000 employés qui gèrent de nombreux projets CAPEX/OPEX et doivent anticiper leurs impacts financiers.

Prophix : avantages et inconvénients

➕ Les avantages de Prophix

- Très avancé en contrôle de gestion : idéal pour les équipes FP&A qui doivent piloter les budgets, les écarts et les scénarios financiers.

- Automatisation des processus financiers : accélère les cycles budgétaires, réduit les erreurs et centralise la donnée financière.

- Particulièrement adapté aux projets CAPEX/OPEX : offre une vision claire des investissements, amortissements, coûts opérationnels et impacts prévisionnels.

➖ Les inconvénients de Prophix

- Pas un outil de gestion de projet opérationnel : Prophix pilote la performance financière, mais ne gère ni tâches, ni planning, ni ressources.

- Déploiement conséquent : nécessite un cadrage, une modélisation et un accompagnement importants, plus proche d’un projet ERP que d’un simple outil SaaS.

Oracle NetSuite pour la comptabilité projet

Oracle NetSuite est l’un des ERP cloud les plus utilisés au monde pour gérer la finance, les opérations et les projets dans les organisations multi-filiales. Pensé pour les entreprises à forte complexité (internationalisation, intercontrats, contrats long terme), il offre un niveau de robustesse comparable aux grands ERP on-premise, tout en conservant la flexibilité d’une solution cloud.

NetSuite excelle particulièrement dans la comptabilité projet, avec une gestion fine du revenu, du WIP (Work In Progress), des coûts, de la marge et du forecast, indispensable pour les entreprises de services structurées et les projets internationaux.

Les fonctionnalités

NetSuite propose un périmètre complet pour les directions financières et les équipes projet.

- Comptabilité complète multi-pays, multi-normes : gestion du grand livre, multi-sociétés, IFRS/GAAP, taxes locales, consolidation automatique.

- Logiciel de gestion financière projet : suivi du WIP, recognition revenue conforme ASC 606 / IFRS 15, marge réelle, coûts engagés, prévisions financières.

- Gestion multi-filiales, multi-devises : conversion automatique des devises, reporting consolidé, transactions intercompany fluides.

- Planning, ressources et facturation projet : allocation des ressources, feuille de temps, coûts salariaux, facturation en régie, forfait, jalons, abonnements.

- Automatisation avancée : workflows sur mesure, règles comptables automatiques, API ouvertes, intégrations via SuiteTalk et SuiteFlow.

Pour quel cas d’usage ?

Oracle NetSuite répond aux besoins des organisations qui ont une structure financière et opérationnelle complexe.

- ETI et grands groupes (100 à 5 000 utilisateurs) avec projets internationaux, contrats long terme, règles de reconnaissance de revenus complexes.

- Groupes multi-filiales (100 à 5 000 utilisateurs) avec refacturations internes, consolidation automatisée et reporting multi-pays.

- ESN, cabinets d’ingénierie, sociétés de services globaux ayant besoin d’un ERP cloud robuste et unifié.

NetSuite : avantages et inconvénients

➕ Les avantages d’Oracle NetSuite

- Très puissant, robuste et scalable : cet ERP supporte des milliers d’utilisateurs, des volumes comptables élevés, et des structures multi-pays sans perte de performance. Sa robustesse en fait un choix privilégié pour les organisations en croissance ou déjà complexes.

- Vision financière et opérationnelle unifiée : tous les processus (comptabilité, projets, facturation, achats, stocks, trésorerie, RH) reposent sur une base de données unique. Cela garantit une cohérence totale entre l’opérationnel et la finance : chaque temps, coût ou achat impacte instantanément les résultats et la marge projet.

- Conformité pour les groupes intégrés et les projets complexes : NetSuite gère nativement la consolidation multi-sociétés, la reconnaissance de revenu avancée (ASC 606 / IFRS 15), les transactions intercompany, les devises multiples et les réglementations locales. C’est un outil parfaitement adapté aux groupes internationaux et aux contrats long terme.

➖ Les inconvénients d’Oracle NetSuite

- Coût élevé : les licences, les modules additionnels et les services d’intégration représentent un investissement conséquent. NetSuite est rarement rentable pour des entreprises de moins de 100 collaborateurs ou celles ayant des besoins simples.

- Déploiement long et nécessitant un partenaire : comme tout ERP d’envergure, NetSuite requiert une implémentation encadrée : paramétrage des filiales, règles comptables, workflows, revenue recognition, formation des équipes. Un intégrateur spécialisé est indispensable pour réussir le projet.

Accounting Seed : la comptabilité dans l’environnement Salesforce

Accounting Seed est une solution de comptabilité et de gestion financière native sur Salesforce. Conçu pour les entreprises qui utilisent déjà l’écosystème Salesforce au cœur de leurs opérations, il permet d’unifier CRM, delivery et finances dans une seule plateforme. Grâce à sa flexibilité et à son architecture orientée objets Salesforce, Accounting Seed devient un véritable module comptable intégré, adapté aux organisations qui veulent renforcer la cohérence entre ventes, projets et performance financière.

Les fonctionnalités d’Accounting Seed

- Comptabilité complète (GL, AP, AR, reporting) : Accounting Seed gère le grand livre, les comptes clients et fournisseurs, les écritures automatiques, la TVA et un reporting financier configurable. Il offre le même niveau de profondeur que les logiciels comptables avancés du marché.

- Comptabilité analytique et suivi financier projet : les dépenses, revenus, temps et achats peuvent être affectés à des projets, départements ou objets Salesforce personnalisés. Le module analytique permet de suivre la marge, le coût de revient et la performance financière par projet.

- Reconnaissance de revenu avancée : le système est compatible avec les modèles de régie, de forfait, d’abonnement et les contrats multi-composants. Le système gère les obligations de performance et la reconnaissance du revenu conforme ASC 606 / IFRS 15.

- Gestion des achats, dépenses et immobilisations : suivi des bons de commande, workflow d’approbation, gestion des dépenses collaborateurs et module d’immobilisations avec amortissements automatisés.

- Intégration native Salesforce : toutes les données CRM (opportunités, devis, projets, ressources) se synchronisent automatiquement avec la comptabilité, supprimant les doubles saisies et améliorant la cohérence des données.

Pour quel cas d’usage ?

Accounting Seed convient particulièrement aux organisations qui souhaitent unifier vente, delivery et finance dans un environnement unique.

- Les entreprises déjà équipées de Salesforce, cherchant à ajouter une brique comptable et financière parfaitement intégrée.

- Les entreprises orientées sales + delivery, pour lesquelles la cohérence entre pipeline commercial, gestion projet et facturation est stratégique.

- Les PME et ETI (50–500 collaborateurs), notamment les structures 100 % Salesforce qui veulent éviter de multiplier les outils externes.

Avantages et inconvénients d’Accounting Seed

➕ Les avantages d’Accounting Seed

- Intégration native avec Salesforce : toutes les données (clients, deals, projets, temps, facturation) sont centralisées dans le même environnement, garantissant une cohérence totale entre ventes et finance.

- Très flexible et personnalisable : comme il repose sur la plateforme Salesforce, Accounting Seed bénéficie de sa puissance : objets personnalisés, workflows, automatisations, Apex/Flow, tableaux de bord.

- Excellente granularité analytique projet : attribution fine des coûts et revenus, vision précise de la marge projet et analyses multi-axes pour les organisations exigeantes en suivi financier.

➖ Les inconvénients d’Accounting Seed

- Dépendance forte à Salesforce, et donc un coût élevé : l’outil nécessite des licences Salesforce + les licences Accounting Seed, ce qui augmente rapidement le coût total.

- Mise en œuvre technique nécessitant un intégrateur : la flexibilité de Salesforce implique souvent un déploiement configuré par un partenaire certifié, avec un projet d’intégration complet.

- Pas adapté aux petites structures : l’ensemble Salesforce + Accounting Seed est trop coûteux et trop complexe pour des organisations de moins de 20–30 personnes.

Comparatif des meilleurs logiciels projet et finance pour ETI et grands groupes

| Comptabilité générale | ❌ Non | ❌ Non | ✅ Oui | ✅ Oui |

| Comptabilité analytique projet | 🟢 Avancée | 🟢 Financière uniquement | 🟢 Très avancée | 🟢 Très fine |

| Pilotage projet | 🟢 Financier uniquement | ❌ Non (pas opérationnel) | 🟢 Très avancé (WIP, revenue, marge) | 🟢 Financier + marge |

| Gestion des temps | 🟢 Excellent | ❌ Non | 🟢 Oui | 🟠 Basique |

| Budget / Forecast | 🟢 Budgets + coûts | 🟢 Très avancé | 🟢 Très avancé | 🟠 Prévisionnel limité |

| Reconnaissance de revenu | 🟠 Basique (via ERP) | 🟠 Indirecte | 🟢 Conforme ASC 606 / IFRS 15 | 🟢 Avancée (forfait, régie, abonnements) |

| Multi-pays / multi-filiales | 🟢 Très bon (règles locales) | 🟢 Oui | 🟢 Excellent (interco, consolidation) | 🟠 Dépend des modules Salesforce |

| Facturation projet | 🟢 Via ERP | ❌ Non | 🟢 Tous modèles (régie, forfait, jalons, abonnements) | 🟢 Oui |

| Intégration ERP | 🟢 Native (SAP, Oracle, Workday) | 🟢 Forte (SAP, Oracle, Dynamics) | 🟢 ERP complet | 🟢 Très bonne (Salesforce natif) |

| Compliance / audit | 🟢 Oui | 🟢 Oui | 🟢 Oui | 🟢 Oui (Salesforce security) |

| Analytique & reporting | 🟢 Avancé | 🟢 Très avancé | 🟢 Très avancé | 🟢 Avancé |

| Personnalisation | 🟠 Modérée | 🟢 Structurée (modèles) | 🟢 Élevée mais complexe | 🟢 Très forte (flows, objets, automatisations) |

| Complexité d’usage | Intermédiaire | Complexe (orienté finance) | Élevée (ERP complet) | Intermédiaire à complexe |

| Adapté pour… | ESN, ingénierie, consulting (200–10 000) | Directions financières ETI (200–5000) | Groupes multi-pays (100–5000) | Organisations Salesforce (50–500) |

Checklist : une matrice pour vous aider à choisir un logiciel de comptabilité projet

Pour accélérer votre sélection, voici une série de questions essentielles. Elles vous permettent d’identifier rapidement la catégorie de logiciels qui correspond à votre niveau de maturité, à la complexité de vos projets et à vos besoins financiers.

Avez-vous besoin de calculer la marge à terminaison et d’anticiper les pertes ?

✅ Oui → Si votre priorité est d’obtenir une vision prospective fiable — indispensable pour provisionner, anticiper les dérapages et sécuriser vos marges — tournez-vous vers des solutions capables de produire un forecast dynamique comme Stafiz, Oracle NetSuite ou Prophix.

❌ Non → Si votre activité reste simple et que vous n’avez pas besoin d’un modèle prédictif, des outils de suivi réalisé/budget comme QuickBooks, ZipBooks, Firmbee ou Paymo suffisent largement.

Vos clôtures mensuelles sont-elles alourdies par les FAE/PCA et CCA/FNP ?

✅ Oui → Si le traitement des encours rallonge vos clôtures ou génère des incohérences, privilégiez des outils capables d’automatiser ces écritures et de verrouiller les périodes : Stafiz, Striven, Replicon ou Oracle NetSuite.

❌ Non → Si ces enjeux concernent peu votre activité, l’utilisation d’outils simples de suivi réalisé/budget suffit largement.

Travaillez-vous en multi-pays, multi-filiales ou multi-devises ?

✅ Oui → Les organisations internationales ont besoin d’une gestion avancée des normes comptables, des devises et de la consolidation. Dans ce cas, privilégiez Stafiz, Oracle NetSuite, ERPNext, Dynamics 365 ou Accounting Seed.

❌ Non → Si votre activité reste centrée sur un seul pays ou une seule entité, des solutions orientées services comme Teamleader Orbit, Paymo, Firmbee ou Striven seront plus rapides, plus légères et plus économiques.

Souhaitez-vous remplacer plusieurs outils par une plateforme unique ?

✅ Oui → Si votre objectif est de réduire la fragmentation de votre SI, un ERP ou un outil “tout-en-un” comme Striven, ERPNext, NetSuite ou Dynamics 365 est le meilleur choix.

❌ Non → Si au contraire, vous préférez garder votre comptabilité séparée et ajouter un module projet performant, un PSA spécialisé comme Stafiz, Teamleader Orbit, Replicon ou Paymo sera plus adapté.

Votre volume de projets et d’utilisateurs est-il élevé (plus de 50 personnes ou 30 projets actifs) ?

✅ Oui → Au-delà d’un certain seuil, les outils TPE sont rapidement dépassés. Pour absorber du volume sans perte de contrôle, privilégiez Stafiz, Dynamics 365, NetSuite ou Replicon.

❌ Non → En dessous de ce volume, des solutions plus simples comme Teamleader Orbit, Firmbee ou Paymo offrent un excellent compromis.

Avez-vous besoin d’une analytique avancée (multi-axes : client, projet, équipe, type de prestation, géographie) ?

✅ Oui → Pour une lecture financière précise et multi-dimensionnelle, orientez-vous vers Stafiz, ERPNext, NetSuite ou Accounting Seed.

❌ Non → Si vous visez surtout un suivi de rentabilité global, des outils comme QuickBooks, ZipBooks ou Firmbee répondront à vos besoins.

Le staffing (planification des ressources) est-il critique pour votre rentabilité ?

✅ Oui → Si la capacité, la charge et les compétences impactent directement votre marge, optez pour des outils intégrant un vrai module de staffing comme Stafiz, Dynamics 365 ou NetSuite.

❌ Non → Si la planification est secondaire ou gérée ailleurs, Paymo, Teamleader Orbit ou Firmbee sont largement suffisants.

Disclaimer

Ce comparatif de logiciels de budget prévisionnel résulte d’une étude réalisée en interne en décembre 2025, et croise différentes sources, telles que les sites officiels des logiciels, ainsi que leur documentation. Les informations seront régulièrement revues pour conserver un contenu le plus à jour possible. Notre but est de vous aider à déterminer vos critères de choix et à orienter votre recherche au plus près de vos besoins. Cependant, veuillez prendre en compte la possible non-exhaustivité du comparatif, en raison de changements potentiels à prévoir, et d’un périmètre de recherche délimité.

Questions fréquentes :

Oui, notamment via la comptabilité de projet, qui constitue son volet financier. Elle est essentielle pour assurer le suivi de la performance financière, garantir la rentabilité du projet et permettre une facturation précise et conforme.

La comptabilité générale enregistre toutes les transactions financières pour produire les états légaux (bilan, compte de résultat). La comptabilité analytique calcule les coûts réels et la performance par activité ou centre de coût. La comptabilité de projet, forme spécifique d’analytique, suit précisément les coûts, dépenses et revenus par projet afin d’en mesurer la rentabilité individuelle.

Le comptable enregistre et valide toutes les transactions financières liées au projet (dépenses, notes de frais, bons de commande). Il applique les règles comptables (amortissements, cut-off) et assure la conformité fiscale des factures. En collaboration avec le chef de projet, il produit les rapports de rentabilité et contribue aux audits.

Pour un pilotage efficace des budgets et prévisions, un logiciel PSA (Professional Services Automation) ou un ERP avec module de comptabilité de projet est idéal. Ces outils centralisent les données prévisionnelles (heures, dépenses) et les comparent en temps réel aux données réelles imputées, offrant un suivi fiable et continu.