DOSSIER - EVERYTHING YOU NEED TO KNOW ABOUT INVOICING FOR SERVICE COMPANIES

5. How do I account for tax billing and multi-currency billing?

In this article, we explore how to present taxes in invoices: VAT or other types of taxes. Discover the links to all the articles in the dossier below:

1. How do you estimate costs, prices, and billing type for a billable project?

2. How to manage the risks of project overruns?

3. How can I get paid faster by customers?

4. How to manage complex billing arrangements

5. How do I take into account the invoicing of taxes? What about multi-currency billing?

6. How to manage invoicing between different entities of the same company (intercompany flows)

7. How can we simplify communication with customers?

8. How can I modify certain parameters that will impact invoicing during projects?

9. How to set up a project quoting and invoicing tool?

The invoicing of taxes depends on many criteria

Taxes vary depending on the countries of the customers who are being charged. It also varies according to the types of products or services that are invoiced.

For example, when a French company invoices a customer in another country of the European Union, there is no VAT to apply. However, the invoice must include the following information:

– The amount excluding tax

– The VAT rate at 0%

– The words "reverse charge of VAT"

The project invoicing software chosen should be able to easily manage all these types of taxes to generate invoices that comply with the regulations of each country.

Multi-currency invoicing

It is common for projects to be invoiced in foreign currencies. Two issues arise:

-

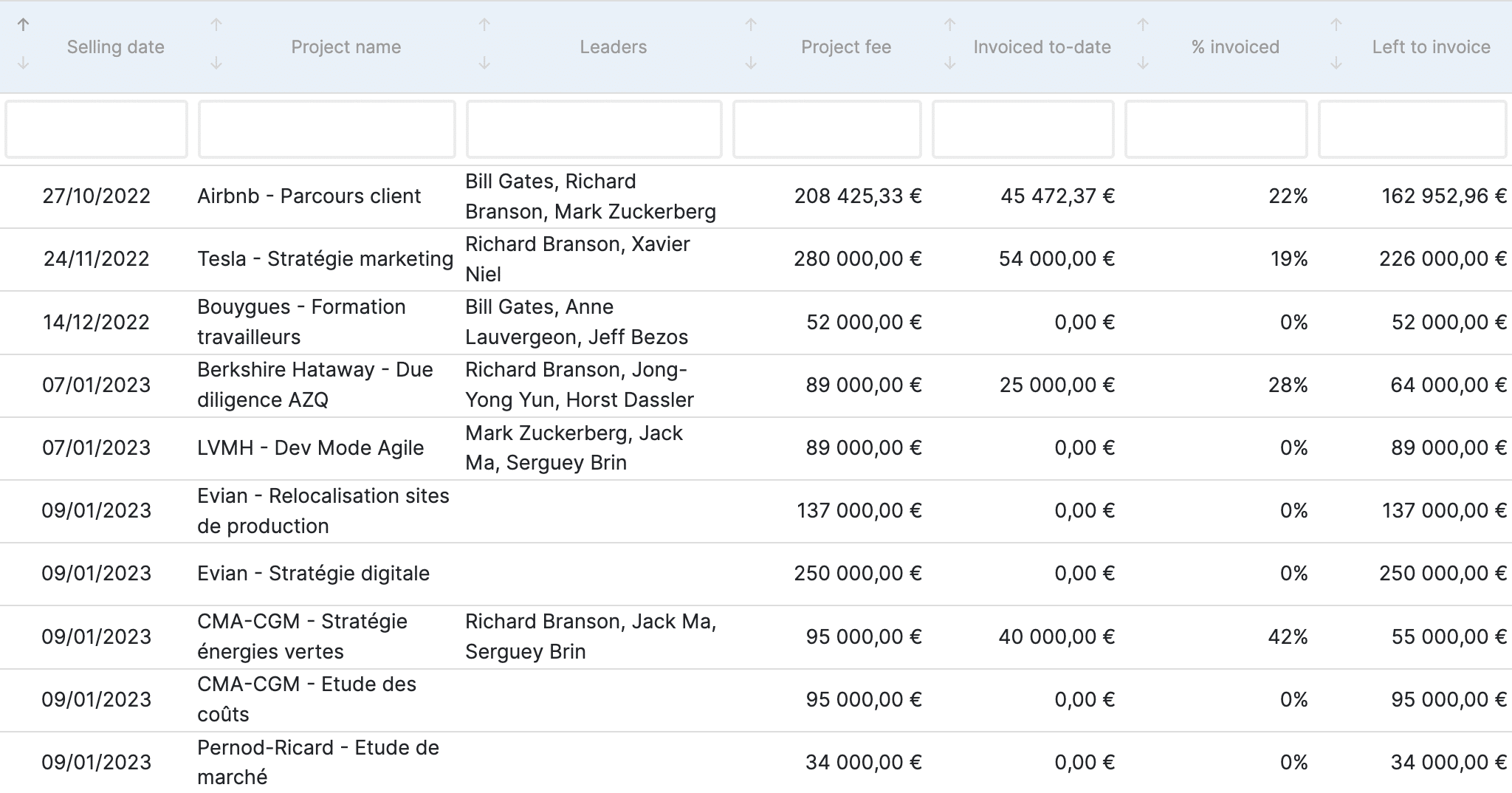

- The software must allow invoicing in several currencies. At the time of project creation, the software must be able to specify the currency in which the project is to be invoiced.

- Convert billing data to the right conversion rates to provide reliable reporting. The analyses must be carried out in a single currency so that they provide the right level of information. The invoicing software must therefore take into account the rates of all currencies over each period. Conversion rates vary from one period to another. For example, $1000 billed in January 2023 doesn't have the same value in EUR as $1000 billed in February 2023. The conversion rate is different between the two periods.

Stafiz allows you to generate invoices in all currencies. Each project is billable in a specified currency, but on the same project, it is possible to invoice in several different currencies.

When the project is set up, the associated taxes are determined based on the services. This then automates the addition of taxes at the time of invoice generation.

In addition, the reports are calculated in a consolidation currency that converts all the amounts invoiced at the right rates according to the period of issuance.

The 9 problems of project invoicing and how does Stafiz help you solve them?

1. How do I estimate the costs, prices, and billing type for a billable project?

2. How to manage the risks of project overruns ?

3. How to get paid faster by customers?

4. How to manage complex billing arrangements

5. How do I account for tax invoicing and multi-currency invoicing?

6. How to manage invoicing between different entities of the same company (intercompany flows)

7. How to simplify communication with customers?

8. How can I modify certain parameters that will impact invoicing during projects?

9. How do I set up a project quoting and invoicing tool?