DOSSIER - TOUT SAVOIR SUR LA FACTURATION POUR LES SOCIÉTÉS DE SERVICES

5. Comment prendre en compte la facturation des taxes et la facturation multi-devises ?

Dans cet article, on explore la manière de présenter les taxes dans les factures : TVA ou autres types de taxes. Découvrez les liens vers tous les articles du dossier ci-après :

1. Comment estimer les coûts, les prix et le type de facturation pour un projet facturable ?

2. Comment gérer les risques de dépassement de projet ?

3. Comment être payé plus rapidement par les clients ?

4. Comment gérer des modalités de facturation complexes

5. Comment prendre en compte la facturation des taxes ? et la facturation multi-devises ?

6. Comment gérer la facturation entre différentes entités d’une même société (flux intercos)

7. Comment simplifier la communication avec les clients ?

8. Comment modifier en cours de projets certains paramètres qui vont impacter la facturation ?

9. Comment mettre en place un outil de devis et de facturation de projets ?

La facturation des taxes dépend de nombreux critères

Les factures comportent de nombreuses mentions légales et le montant des taxes facturées en fait partie.

Les taxes varient en fonction des pays des clients qui sont facturés. Elle varie aussi en fonction des types de produits ou des prestations qui sont facturées.

Par exemple, lorsqu’une entreprise française facture un client dans un autre pays de l’Union Européenne, il n’y a pas de TVA à appliquer. Mais la facture doit comporter les mentions suivantes :

– Le montant hors taxe

– Le taux de TVA à 0%

– La mention « Auto-liquidation de la TVA »

Le logiciel de facturation de projets choisi doit permettre de gérer facilement tous ces types de taxes pour générer des factures conformes à la réglementation de chaque pays.

La facturation multi-devises

Il est fréquent que les projets soient facturés dans des devises étrangères. Deux problématiques se posent :

-

- Le logiciel doit permettre de facturer dans plusieurs devises. Au moment de la création du projet, le logiciel doit permettre d’indiquer la devise dans laquelle le projet doit être facturé.

- Convertir les données de facturation aux bons taux de conversion pour offrir un reporting fiable. Les analyses doivent être réalisés dans une devise unique pour qu’ils apportent le bon niveau d’information. Le logiciel de facturation doit donc tenir compte des taux de l’ensemble des devises sur chacune des périodes. Les taux de conversion varient en effet d’une période à une autre. Par exemple, 1000 USD facturés en janvier 2023 n’a pas la même valeur en EUR que 1000 USD facturés en février 2023. Le taux de conversion est en effet différent entre les deux périodes.

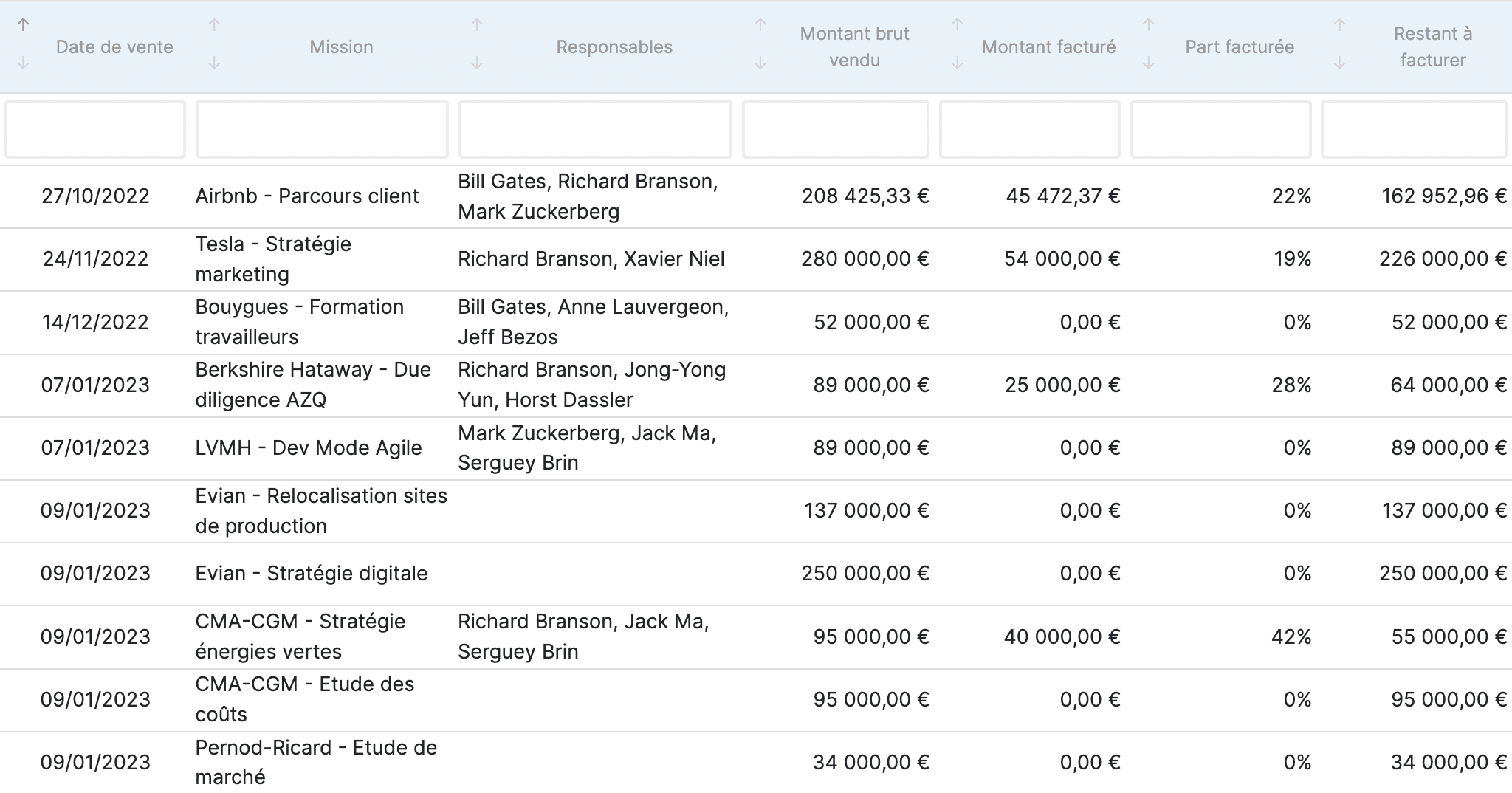

Stafiz permet de générer des factures dans l’ensemble des devises. Chaque projet est facturable dans une devise précisée, mais sur un même projet, il est possible de facturer dans plusieurs devises différentes.

Au moment du paramétrage du projet, les taxes associées sont déterminées en fonction des prestations. Cela permet ensuite d’automatiser l’ajout des taxes au moment de la génération des factures.

Par ailleurs, les reportings sont calculés dans une devise de consolidation qui vient convertir tous les montants facturés aux bons taux en fonction de la période d’émission.

Les 9 problèmes de la facturation de projets et comment Stafiz vous aide à les résoudre ?

1. Comment estimer les coûts, les prix et le type de facturation pour un projet facturable ?

2. Comment gérer les risques de dépassement de projet ?

3. Comment être payé plus rapidement par les clients ?

4. Comment gérer des modalités de facturation complexes

5. Comment prendre en compte la facturation des taxes ? et la facturation multi-devises ?

6. Comment gérer la facturation entre différentes entités d’une même société (flux intercos)

7. Comment simplifier la communication avec les clients ?

8. Comment modifier en cours de projets certains paramètres qui vont impacter la facturation ?

9. Comment mettre en place un outil de devis et de facturation de projets ?