How to set up effective project accounting?

Project accounting focuses on how the costs of a project are accounted for and tracked. It provides an accurate measure of a project's financial performance and allows project managers to make informed decisions about what actions to take to stay aligned on budgets. Project accounting can also help identify potential risks and assess risk on the margin of a project. In short, it constitutes an essential component of any good project manager. Before going into detail about the steps to follow, it is important to recall the main concepts.

How does project accounting work?

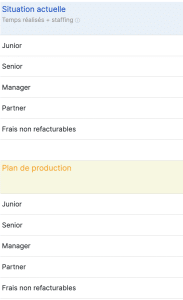

All project accounting involves establishing a provisional budget at the start of each project. This budget must include all costs to be allocated to the project (time spent by employees, purchases, travel expenses, etc.). It must allow for an anticipated margin. Throughout the project, the budget will be regularly reviewed, and the projected margin calculation will be redone to ensure that the project's financial performance is on track.

It is important to keep supporting documents for costs spent on the project (time sheets, expense receipts, invoices, etc.) as well as to be able to justify forecast costs (future project planning, etc.). Indeed, to the extent that these costs are a central element of the accounting calculation (detailed below), it is necessary to be able to explain and justify that the calculations respect the accounting rules.

When a project budget is created, it is important to indicate all cost lines. It is necessary to take into account the time spent using internal resources, purchases of external services (from freelancers for example), travel costs, even those which will be re-invoiced, the possible purchase of products which will be resold during the project .

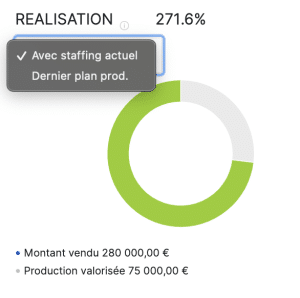

Project accounting – Production plan

💡 See our article on how to create a dashboard adapted for your project management

The steps to follow to set up project accounting

1. Choose the right revenue recognition methodology

There are several methodologies for recognizing revenue in project accounting. To make the right choice, it is necessary to contact your accountant who will be able to explain the ins and outs of the different methodologies and help you choose the right methodologies according to the specificities of your projects. However, here are the main revenue recognition methodologies and the associated rules.

a. Revenue recognition upon completion

In this methodology, revenue is only recognized once the project is completed. All revenue related to the project is recognized in the current period when the project is officially completed. It will not be possible to recognize turnover before this period. For the project to be properly “completed”, the client must confirm that the service for which they ordered has been completed in its entirety. This can for example be done with a delivery note validated by the customer.

b. Recognition of turnover upon advancement

For longer projects, it may be acceptable for accounting purposes to recognize revenue as the project progresses. At the end of each accounting period, a calculation of the progress will be made, and the turnover will be recognized in proportion to this progress. The method of calculating progress must in this case be precise and uniform so that the turnover calculations can be valid. Often, progress is calculated based on costs.

This makes it possible to calculate progress more precisely than a simple calculation based on the work carried out. Indeed, when the project budget includes, in addition to the work carried out by internal collaborators, purchases and external services, it is necessary to be able to include exhaustive monitoring, and the common criterion of cost works well.

c. Recognition of turnover upon invoicing

When project accounting allows it, the method of recognizing turnover upon invoicing implies that turnover is aligned with invoicing. The turnover recognized over the period will be equal to the invoicing generated over the same period. For projects that are billed by time spent, this is often the methodology chosen to simplify the calculations.

Stafiz is an ERP created specifically for professional services and service companies. More than 10,000 users in 10 countries manage their projects in Stafiz.

2. Correctly calculate the progress of a project with a project management software

As seen previously, when the project's turnover is recognized on a progress basis, it is also necessary to choose the correct progress calculation methodology. For progress to be correct, several things are necessary: If the projects are simple, and the progress of the work in time makes it possible to precisely define the percentage of progress of the project, the method can be accepted by the expert -accountant or financial auditor.

On the other hand, when the projects are complex, with different cost lines and product purchases, the cost methodology will surely be preferred. It is therefore necessary to put in place processes which allow at the end of the accounting period to:

- Retrieve precise cost data for each project (human costs, external services, costs, etc.)

- Allow project managers to reassess what remains to be done on the project and therefore the total budget, so that progress can be calculated as a percentage

An ERP or a project management software allows you to easily perform these calculations and simplifies the monitoring of these budgets, updates and accounting closures. Project accounting is more easily deployed with an ERP solution.

To find out, see our article on The Guide to Effective Project Monitoring .

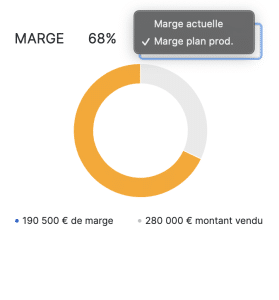

3. How to correctly calculate project margins

In well-conducted project accounting, the calculation of the project margin must be precise and must take into account all the project variables.

Turnover :

First key element in the margin, the calculation of the turnover from which the costs of the project will be deducted. It will not be the same depending on the turnover recognition methodology. Depending on the type of project, your ERP software is normally correctly configured to apply the correct revenue recognition methodology.

Thus, the turnover of a fixed-price project will either be recognized upon completion or progress. Whereas the turnover of a project under management will more often be recognized in the invoice. If costs, purchases or subcontracting are re-invoiced, this must be taken into account because these elements are added to the turnover of the project.

Costs :

3 important criteria: there must be

- completeness of costs

- that these costs are real, that is to say that the amounts are not estimates but real costs

- and that their recording was made during the correct accounting period.

Make sure your tracking software allows you to meet these 3 criteria. For completeness, it is therefore necessary to take into account personnel costs (time spent on the project multiplied by the associated cost), purchases of services (costs invoiced by a freelancer for example), expenses such as travel for example , and purchases of products and materials.

Cost reliability relies on your ERP software or business management software. The more integrated it is, the more reliable it will allow you to make your processes and your costs. Recording in the correct accounting period also implies the implementation of processes which oblige project managers to monitor costs and ensure that they are all recorded on the correct dates.

Learn more about how to boost the margins of your projects and improve your financial performance. All the answers to your questions are in our downloadable white paper.

4. What actions can improve margins

Project accounting allows you to define the rules to properly manage projects. But each company has a certain degree of freedom in the analytical approach. For example, project margins can be divided into two lines to refine the performance analysis. A first level of margin, called the project's gross margin, includes so-called external costs: purchases, expenses, etc. They do not include the company's salary costs.

To move from the gross margin to the net margin, we add to the costs the amount corresponding to the salary cost for the company of the time spent by internal collaborators on the project. A time tracking tool on projects and tasks is necessary for this calculation to be accurate. Here are the actions that can improve margins:

Track margins

And yes, it seems stupid, but you can only improve what you follow. However, too few companies monitor the margins of their projects precisely. By installing precise and regular monitoring of margins, performance will undeniably improve because monitoring will provide visibility on the issues that impact projects.

Empowering project managers

They are the ones who must be responsible for their margins. By giving them the means to automatically know the evolution of their margin and the access to update the rest to be done on the project, you can certainly count on them to keep the budget.

Win in anticipation

Software that allows you to better manage cost forecasting and associate it with monitoring of actual costs gives you a head start. Stafiz, for example, allows you to manage employee workload, future costs and notifies you when margins deviate from projects.

5 – Lack of direction from leaders

- Track the margins : And yes, it seems silly, but you can only improve what you track. However, too few companies monitor the margins of their projects precisely. By installing precise and regular monitoring of margins, performance will undeniably improve because monitoring will provide visibility on the issues that impact projects.

- Empower project managers : they are the ones who must be responsible for their margins. By giving them the means to automatically know the evolution of their margin and the access to update the rest to be done on the project, you can certainly count on them to keep the budget

- Gain anticipation : software that allows you to better manage cost forecasting and associate it with monitoring of actual costs gives you a head start. Stafiz, for example, allows you to manage employee workload, future costs and notifies you when margins deviate from projects.

If you have questions about your project accounting and project financial management more broadly, do not hesitate to contact our experts who can help you lead the right changes in your company. Stafiz is an ERP for service companies and allows you to better manage your projects. Automate your processes and save time. Benefit from global visibility on the performance of your projects!

To learn more about the Stafiz platform, request a demo.